Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Did you notice that the Atlanta Fed GDPNow is now tracking fourth quarter growth at 2.3%, up from 2.1% on December 20. The next reading won’t come until January 3. Still, that is not a bad growth rate for an economy that is supposed to be in a recession at this point. Sorry, I forgot the recession is coming in 2020 now, right. I most certainly think not.

It really must have been tough to have been a bear 2019. There was no recession, and even worse the equity market has rallied by more than 30%.

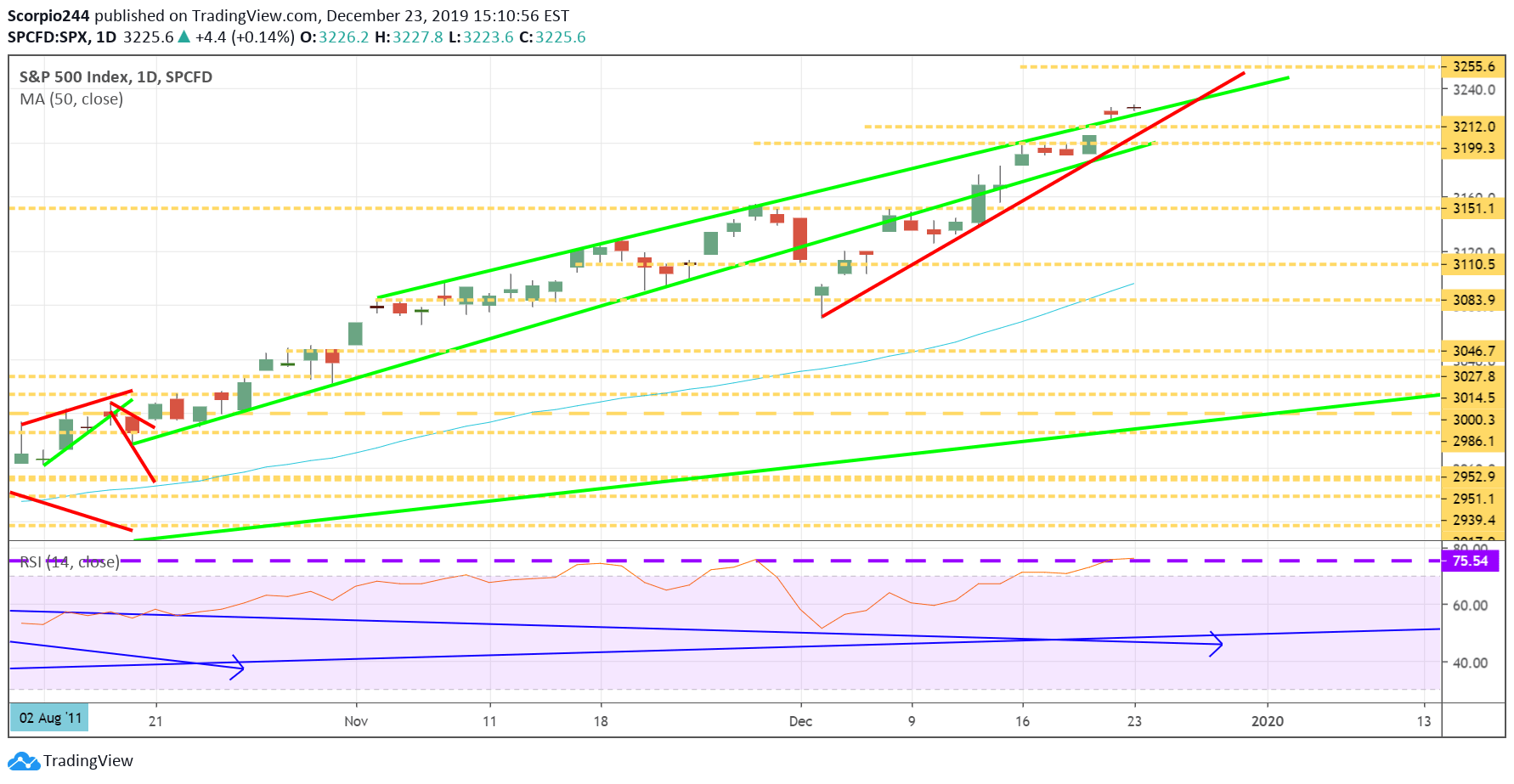

S&P 500 (SPY)

Stocks finished flat with the S&P 500 closing around close at 3,223. The path of least resistance for the index is up. There is nothing to suggest that the trend will change. Maybe it turns when the new decade begins, but between now and then, newsflow should continue to trickledown. It means that the no reason for the trend to change.

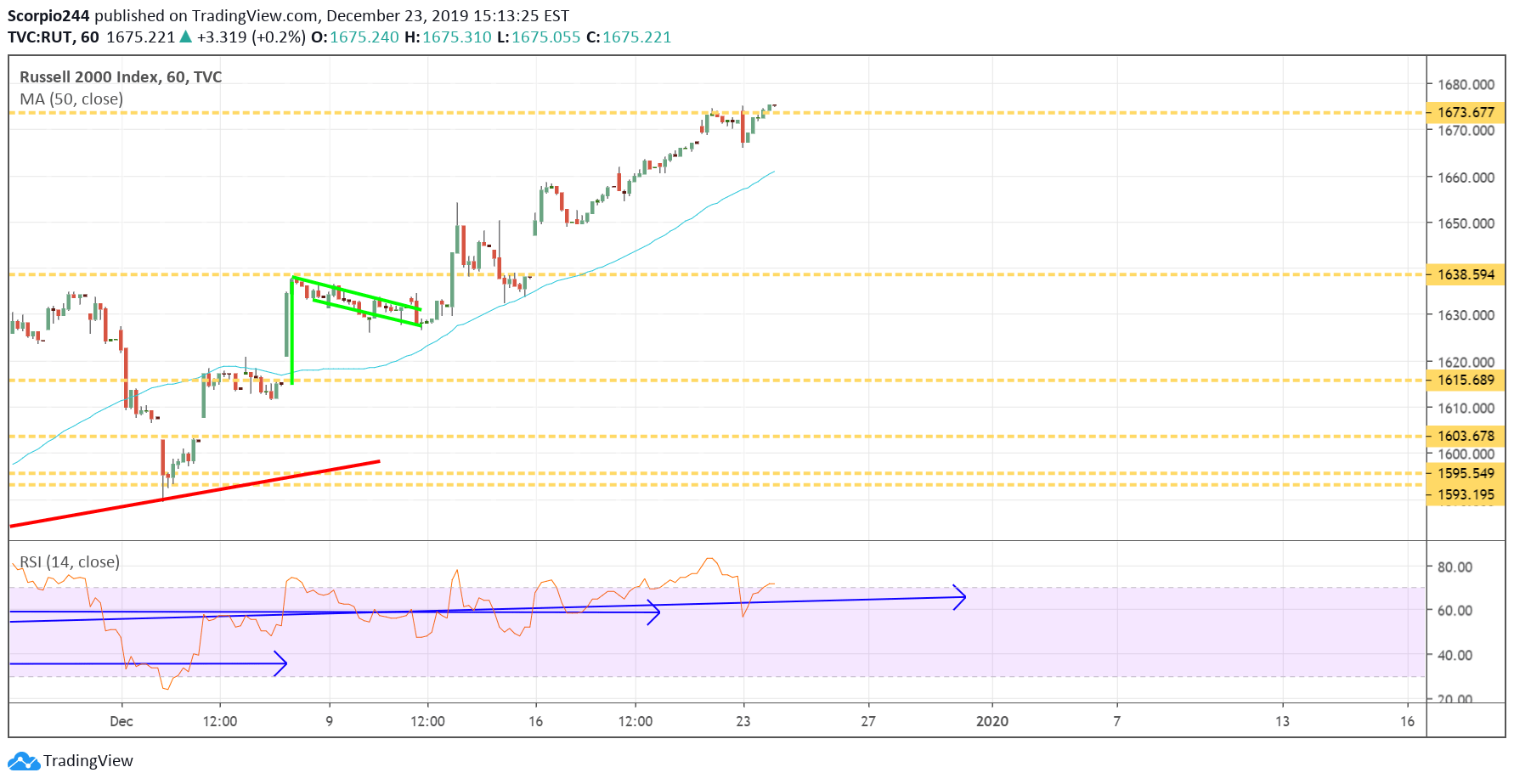

Russell (IWM)

The Russell also continues to push higher, and it managed to rise to around 1,674 and is now trying to breaking free of resistance in that 1,673 to 1,675 region. I continue to believe that the upside in this index is to approximately 1,710. It is why I still hold my IWM calls for January expiration.

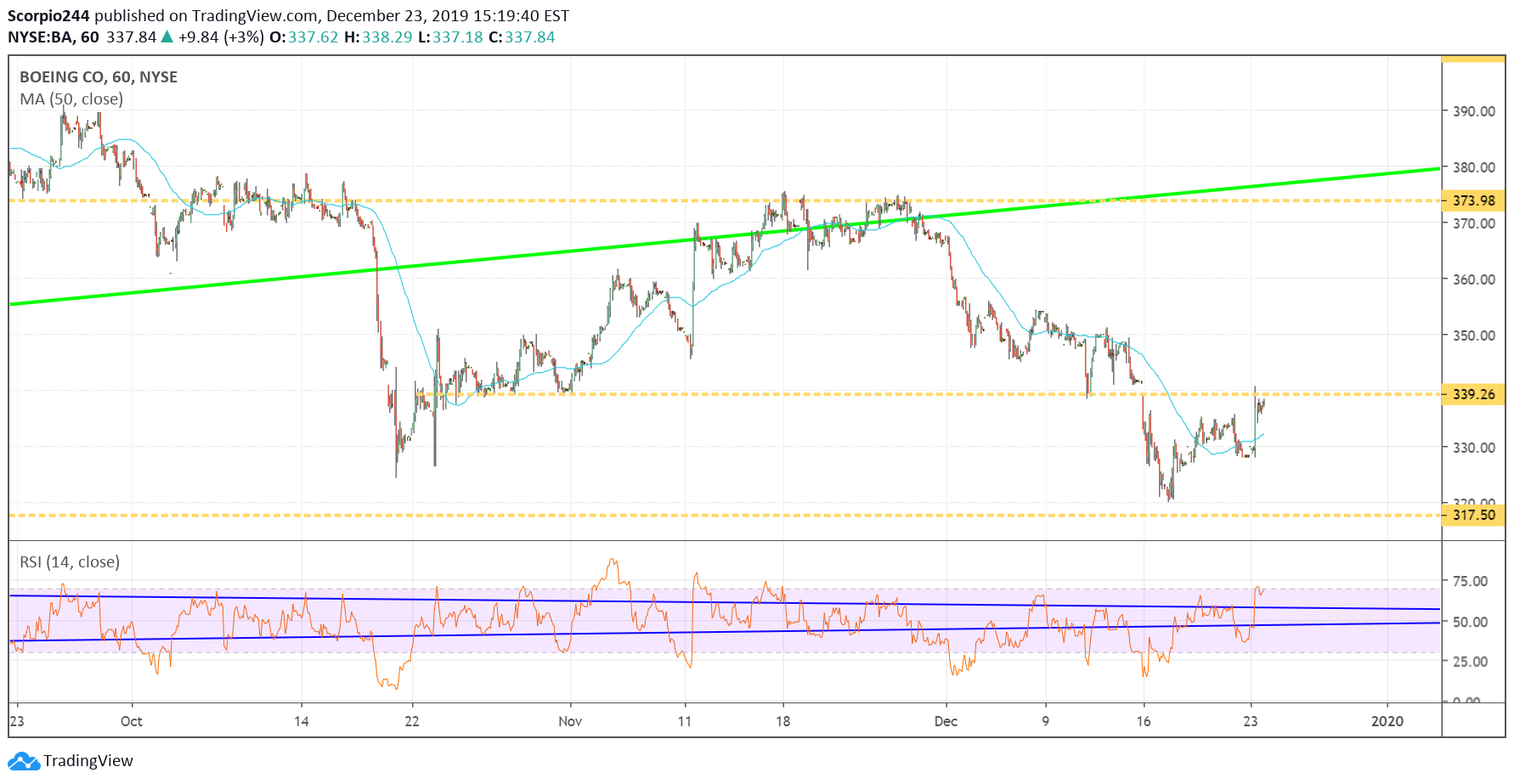

Boeing (BA)

Boeing (NYSE:BA) surged by 3% yesterday on the news a new CEO will be taking over. I’m not sure that should make anyone feel better at this point. Typically what follows when a new CEO takes over a company is a reset of expectations, which means guidance gets cut and whole a slew of operational change. I’m not sure it will be any different for Boeing. It stands the chance things could get worse for Boeing, especially if the MAX delays carry on for longer than anyone was expecting. $339 to $340 is short-term resistance, be careful.

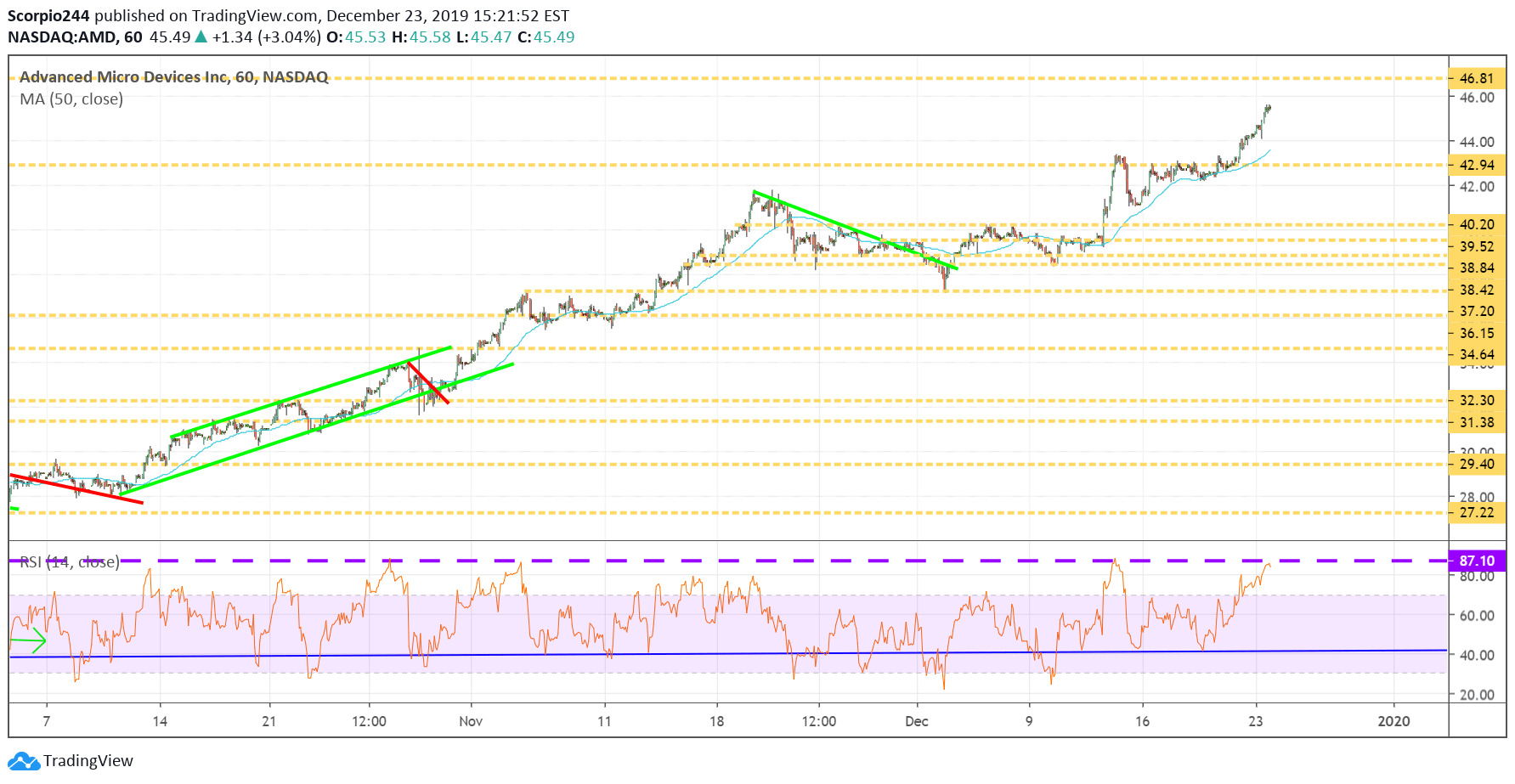

AMD (AMD)

AMD was up again yesterday and shall likely continue to climb until it reaches $46.80. At least that is what the chart suggests.

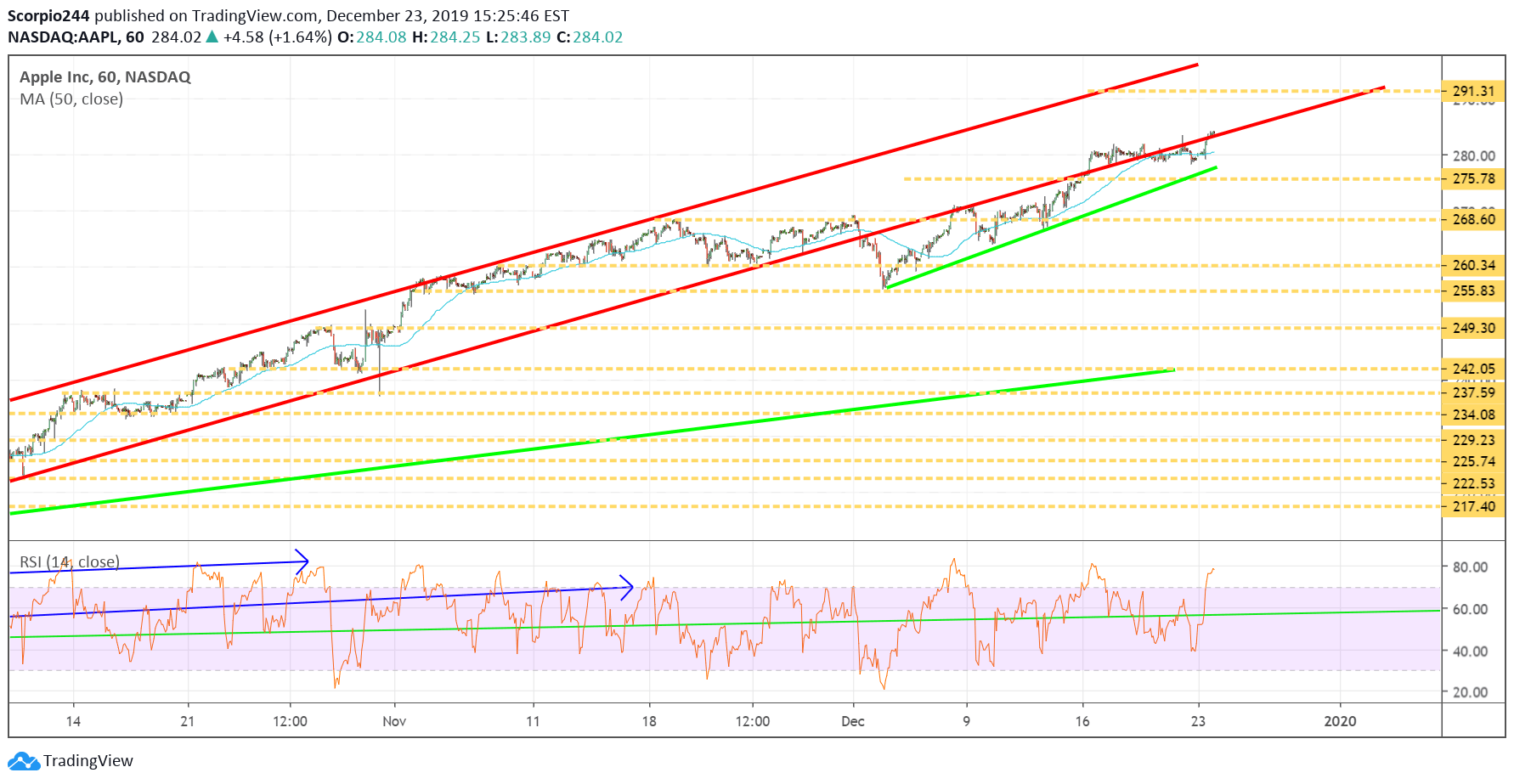

Apple (AAPL)

Apple (NASDAQ:AAPL) is driving higher following an upgrade out of Wedbush, which gave the stock a $350 price target. I’m guessing $291 is the next level to look for.

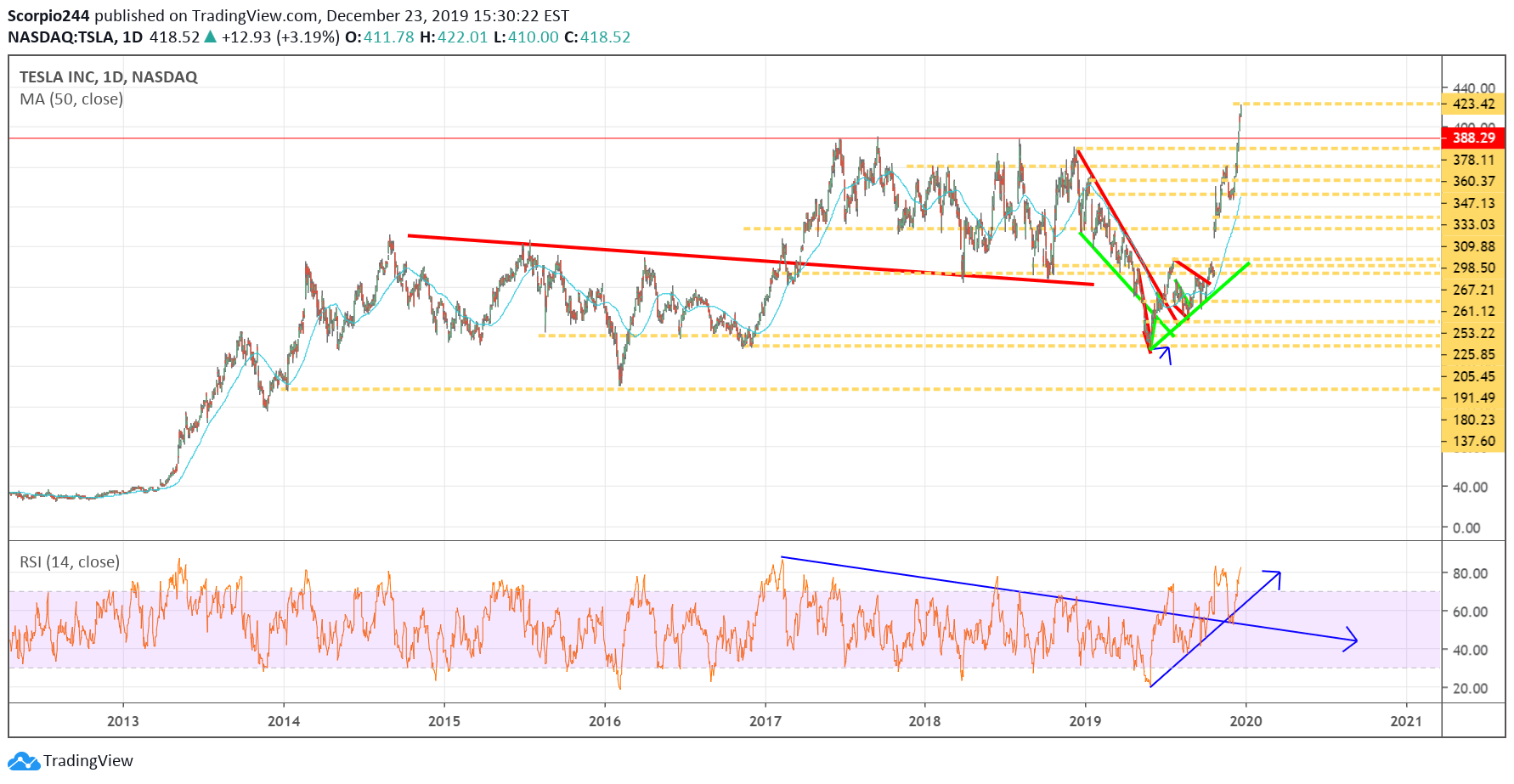

Tesla (TSLA)

Tesla (NASDAQ:TSLA) got to $420, reaching $422. I’m not sure how much more juice is left in the battery pack for this stock, but support at $390 should be strong. The stock can consolidate around $420, then there is likely further to rise.

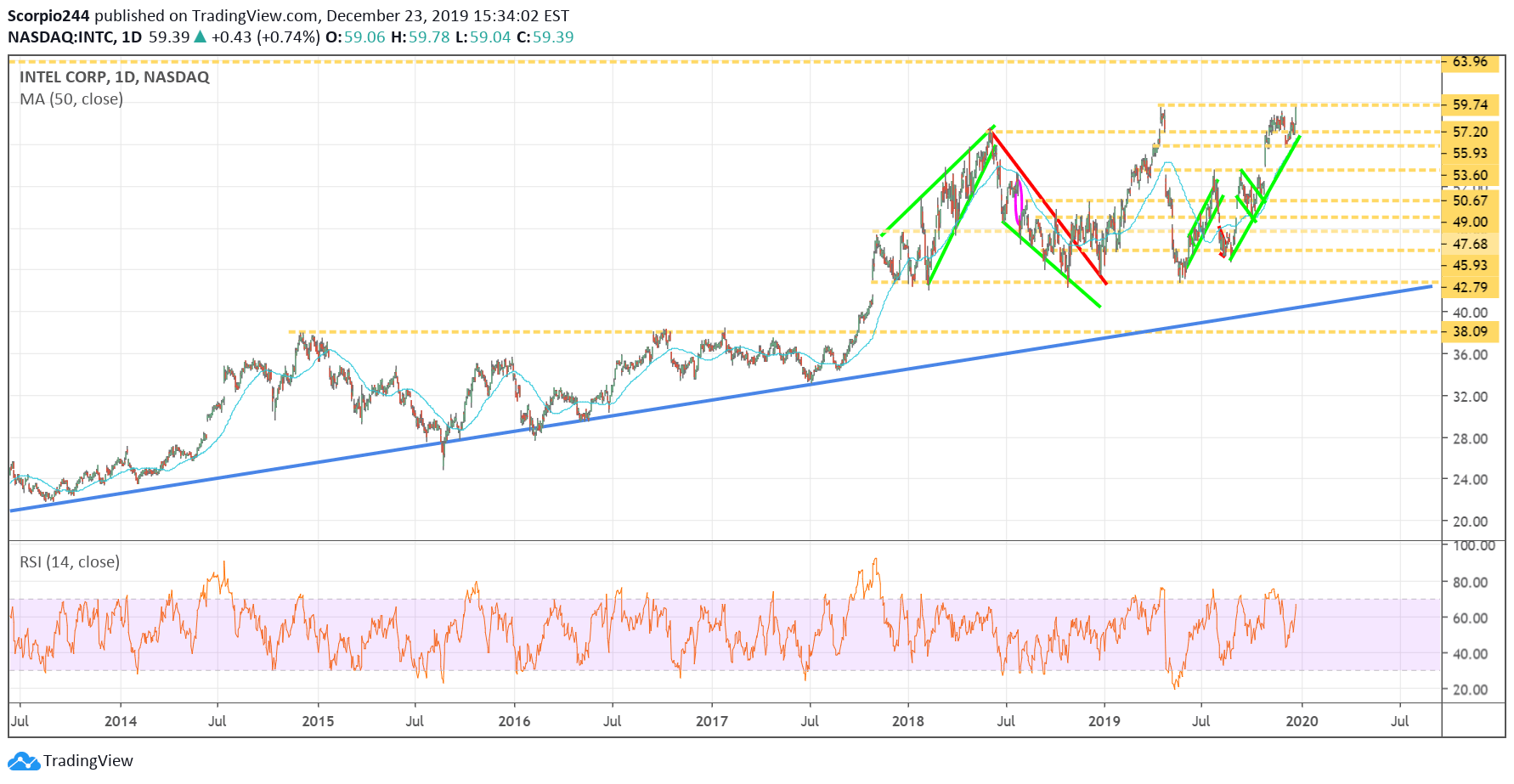

Intel (INTC)

It looks like Intel (NASDAQ:INTC) is going to try and make that push to $64 after all this time.