This week: monthly charts, bullish euphoria, double 20's, stocks vs bonds, global stocks, index membership, and the golden 60-40.

Learnings and conclusions from this week’s charts:

-

The S&P 500 closed up +5.73% in November (+26.47% YTD).

-

Numerous indicators point to bullish euphoria.

-

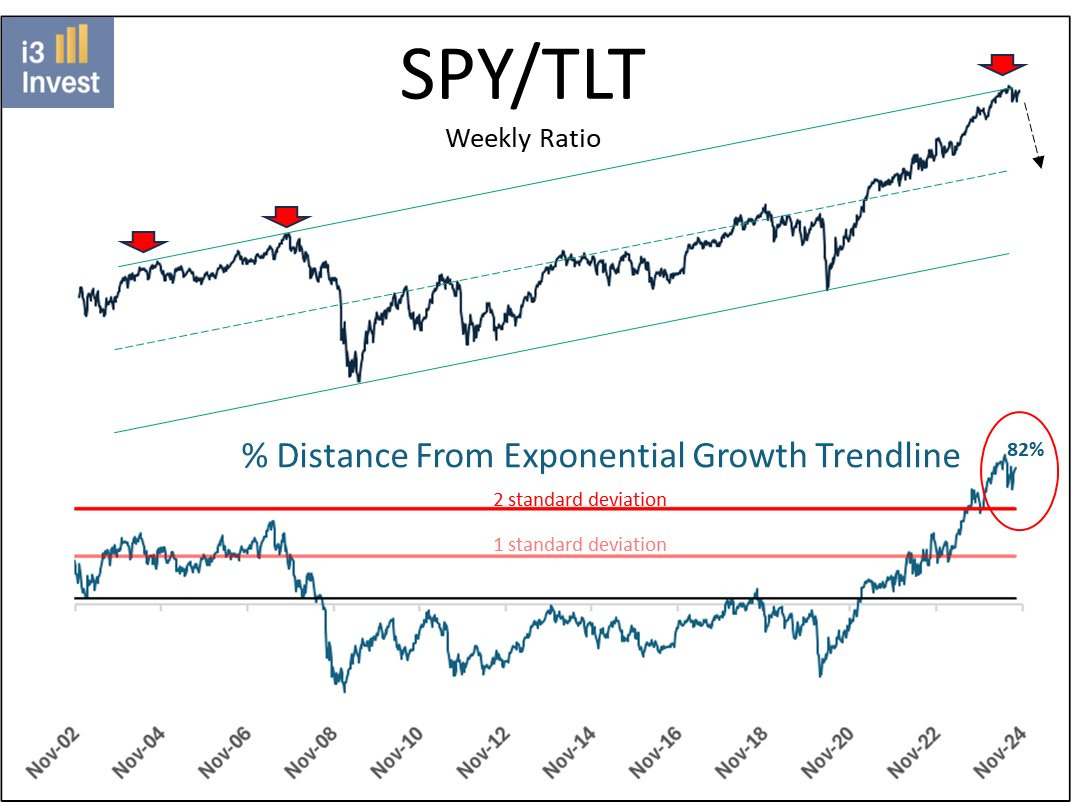

The stock/bond ratio looks stretched, divergent.

-

US stocks account for ~75% of Developed Markets.

-

About 1/3 of the stocks in the S&P 500 get replaced each decade.

Overall, the market continues to exhibit strong bullish momentum in an uptrend. This has enchanted investors with a sense of euphoria, and as highlighted in this week’s charts, one of the most contrarian moves right now would be switch stocks for bonds and maybe it’s not the right time just yet, but it sure is contrarian, and the time will come eventually come sooner or later to make that move.

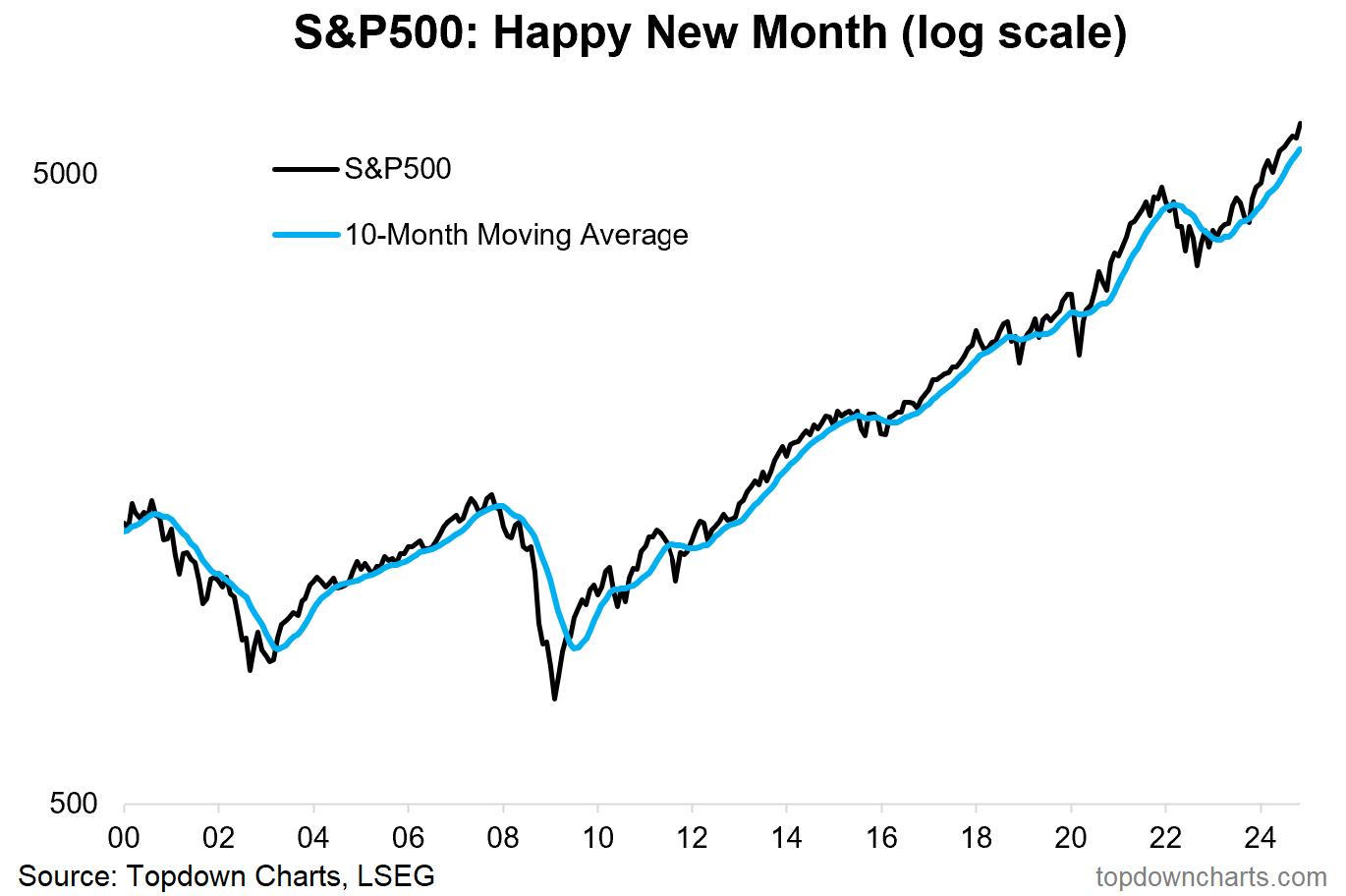

1. Happy New Month: November saw the S&P 500 up +5.73% on the month (and 6.24% for the equal-weighted S&P 500), placing it up now 26.47% YTD (28.07% including dividends). November marks the 13th month in a row of the S&P 500 closing above its 10-month moving average (i.e. ~200-day; which is rough indicator of up vs down trend). So yeah, clear picture of strength here.

Source: Topdown Charts

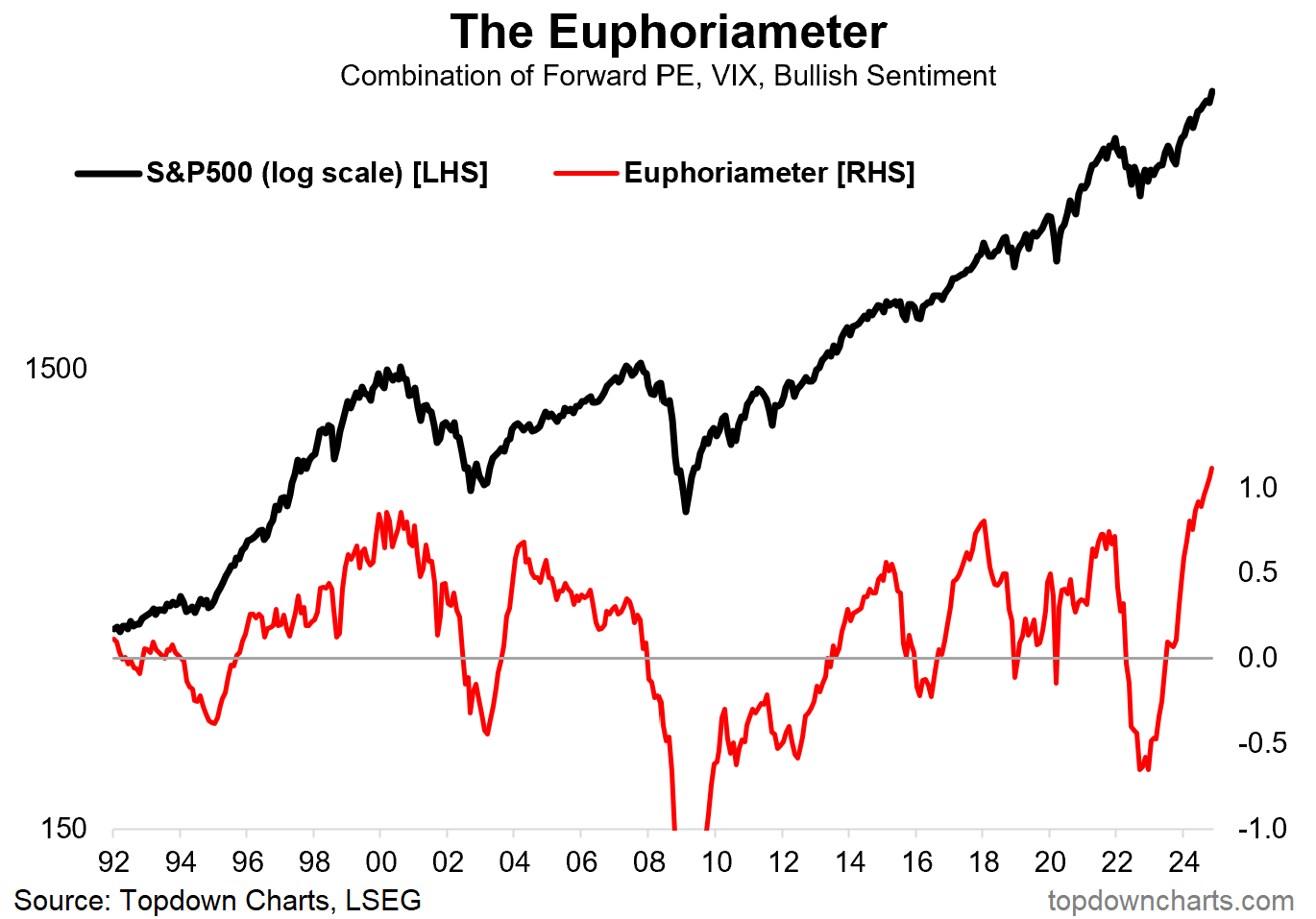

2. Bullish Trumphoria: Along with the S&P 500, the Euphoriameter made another new all-time high in November (and it’s not a trending indicator, it is supposed to be bounded; mean reverting!) — contrast that to November 2016 when it was basically neutral. Again, as noted a couple of weeks back, it’s problematic to use the bullish template of the 2016 election because that was early cycle, this is late cycle.

To put it simply, and probably no one wants to hear it, but this is not a good set up — investors and speculators alike have been lulled into permabull paradise.

As I talked about in an forthcoming podcast (will link when it goes live), we are in for some some challenging times ahead, interesting times, but definitely not a time to be asleep at your portfolio steering wheel that’s for sure.

Source: The Euphoriameter explained

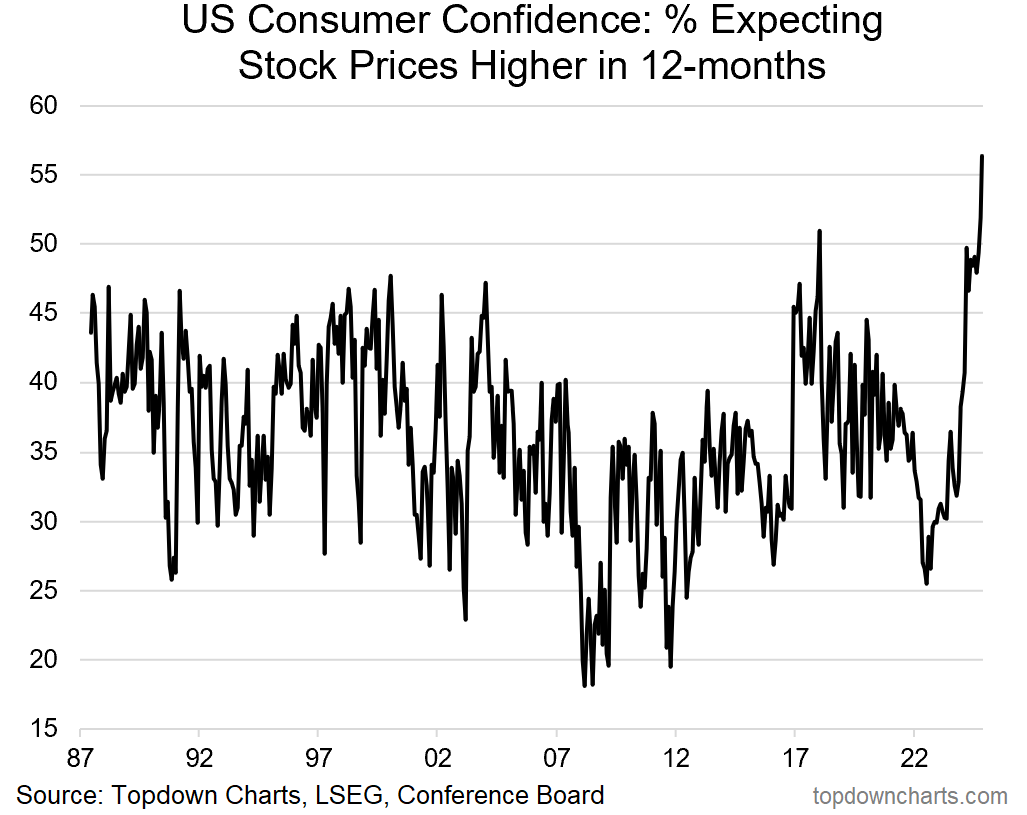

3. Don’t Believe Me: Ask the consumer, which is exactly what the Conference Board did and has done for many decades and their findings? US consumer expectations on the stock market made a fresh all-time high in November. So it’s not just my weird indicators, multiple data points confirm the bullish fervor that has taken hold. This is entirely unprecedented.

Source: Topdown Charts Professional

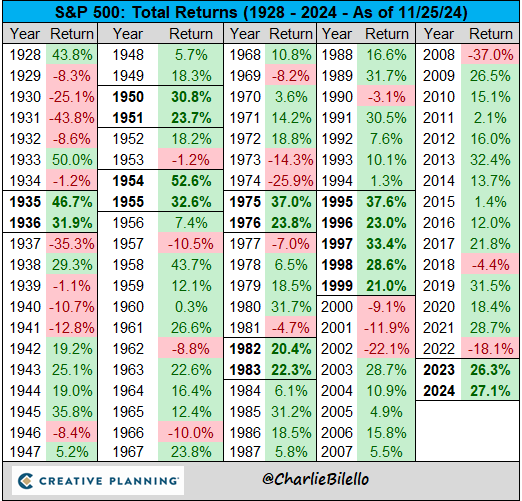

4. Justified? The table below highlights instances when the market closed up more than 20% at least 2 years in a row. Some observations: over this 96-year period it happened 7 times, of which 4 times were followed by positive returns (p.s. I am treating the 95-96 instance as 1, rather than double or triple counting the 90’s dream run), and 2 were followed by negative returns. So no strong conclusion to draw except that it represents decent momentum, and the momentum can continue (until it becomes unsustainable).

Source: @charliebilello

5. Stocks vs Bonds: One to make one think about asset allocation — at a time when sentiment sees stocks only going higher, and also at a time where I would say most people are negative on treasuries (given fears of inflation resurgence risk and concerns around the US fiscal path) — arguably very few would be thinking about the stock/bond ratio rolling over. Indeed, it would be deeply contrarian to overweight bonds vs stocks at this point, but maybe something to think about as a possible next move as and when things start to turn.

Source: @i3_invest

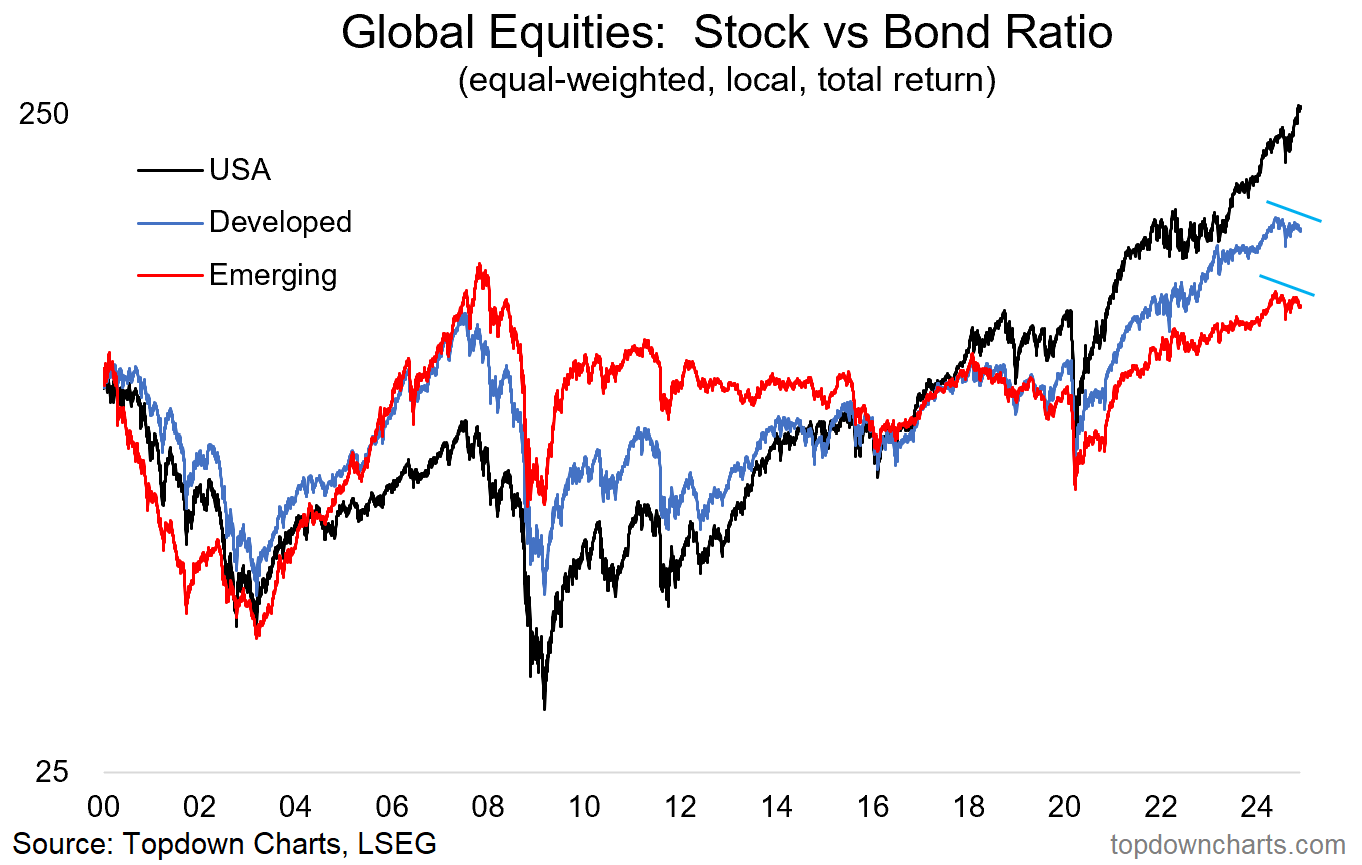

6. Global Stock/Bond Ratios: At the global level, while developed and emerging markets saw their stock/bond ratios peak back in May, the US stock/bond ratio has gone on to new highs making it an odd one out and a presenting a bearish divergence.

Source: Global Cross Asset Market Monitor

7. Stock/Bond Strategy: On my metrics stocks are expensive vs bonds (and stocks are outright expensive, while bonds are cheap), but this by itself is rarely enough to take a strong position — you need the technicals to turn, but you also need the macro to turn. The unemployment rate (shown inverted) is the last ingredient; for bonds to outperform stocks you need to see the unemployment rate go up (aka recession) — which is why bonds have traditionally been used as a diversifier; more on that soon.