Starbucks Corporation's (NASDAQ:SBUX) biggest threat to global coffee dominance might be an Israeli based, barebones coffee chain intent on bringing ultra-cheap java to the masses.

Starbucks already counts some 23,000 locations around the world and plans to add another 12,000 over the next five years alone. A new chain called Cofix (TA:CFX), run by wealthy entrepreneur Avi Katz, is tiny by comparison but that might not be the case for long.

Under Katz’s management, Cofix has quickly become Israel’s largest coffee-stand operator, with under 160 branches. And it did so in just three years.

Now, Cofix is turning its attention internationally. With stands already in place in Moscow, the low-price coffee chain is expanding soon to Turkey and the United Kingdom. Other countries will likely follow quickly.

All About Price

Although both sell essentially the same items — coffee, cappuccino and baked goods — Cofix’s business model couldn’t be more different from Starbucks. Cofix eschews all the pomp and circumstance of modern coffee houses and instead focuses on a single important variable: price.

At around $1 per cup (or less, depending on the country), its gourmet coffee undercuts competitors like SBUX by 75% or more. The trade-off is that there’s no seating, no table service and no room — most of Cofix’s locations look like streetcars parked in busy areas. So while its no-frills approach won’t appeal to everyone, the company has made huge progress in targeting cost-conscious consumers.

According to Bloomberg, “[Traditional] coffeehouses charge six to nine times more for a medium cappuccino than the $0.40 the ingredients cost consumers, according to data from Allegra.” Cofix is willing to settle for much lower margins but much higher volume — like McDonald’s (NYSE:MCD) did when it revolutionized the fast-food industry.

So the next time you take a sip of that $5 latte, imagine a future where a nearly identical product costs 80% less. It might be coming sooner than you think.

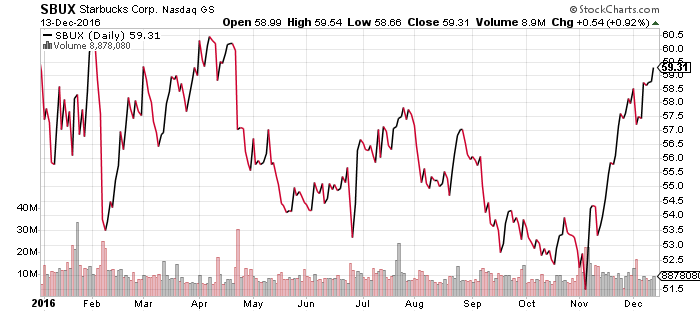

Starbucks shares fell $0.26 (-0.44%) to $59.05 per share in premarket trading Wednesday. Year-to-date, SBUX has fallen -1.2%, badly trailing the +11.72% return of the benchmark S&P 500 during the same period.