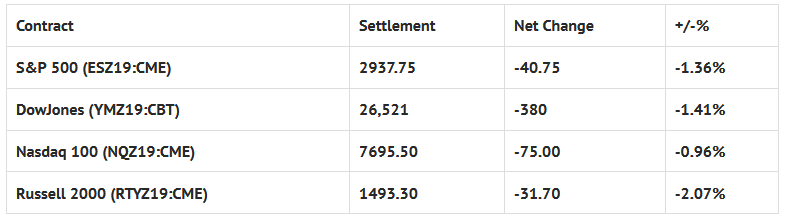

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes Motor Vehicle Sales, MBA Mortgage Applications 7:00 AM ET, ADP (NASDAQ:ADP) Employment Report 8:15 AM ET, Patrick Harker Speaks 9:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, and John Williams (NYSE:WMB) Speaks 10:50 AM ET.

S&P 500 Futures: Early Pop Leads To Larger Drop, ISM Falls To A 10 Year Low

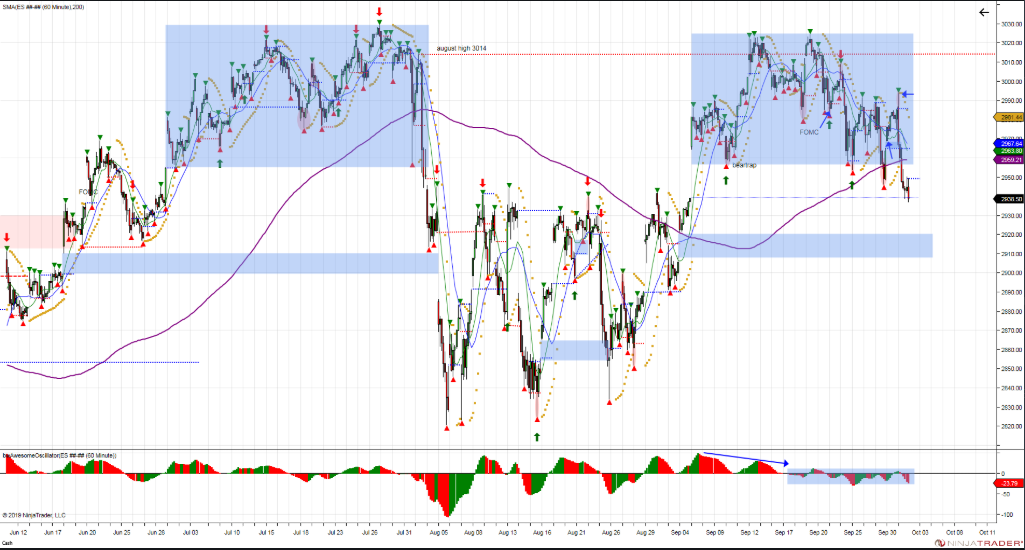

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F Looking a lot like the 1st trading day of August. Buyers dropped the ball. Aug 1- lost July low, left July longs trapped. Now – retesting gap @ 2940 where buyers came in above after Sep 1 short squeeze. September stopped out shorts from August, now Sep longs on hook.

Like on many other occasions lately, the S&P 500 futures (ESZ19:CME) were acting OK during yesterday’s early rally, trading up to 2994.00. It was when the ISM number was released, showing a drop to a 10 year low, that the ES puked all the way down to 2957.75, a 36.25 handle drop in less than 45 minutes.

This seems to be the theme lately. Whether it’s a Trump tweet or negative economic headline, it’s all about failed rallies.

After the drop, the futures short covered up to 2965.75 at 10:30, then got hit by another wave of sell programs that helped pull the ES down to a new low at 2939.25, just after 12:30, 54.75 handles off the high.

It really was a continuous sell program. There was another small bounce, and then another new low at 2938.25 printed. The @HFTAlert software that I’ve been using started showing some small buy programs after that, and the ES did rally, trading up to 2950.50 at 1:48.

The next move was back down to 2945.75, then back up to the previous high at 2950.50, before heading straight down to 2943.25. From there, the futures chopped around in a 4 handle range, as the MiM went from $275 million to buy to $76 million to buy, and then sold off back down to the 2941.00 area.

On the 2:45 cash imbalance reveal, the futures traded 2944.00, as the final MiM showed $1.4 billion to sell.The ES then went on to print 2941.75 on the 3:00 cash close, and settled the day on the lows at 2938.50, down -46 handles, or -1.54%.

In the end, the price action was all about the failed rallies. In terms of the days overall tone, the ES acted horrible, but closed at a big discount to the S&P 500 cash. In terms of the days overall trade, 1.59 million mini S&P futures contracts traded, which is high for what we have been seeing.