As of late any bad economic news has been the "siren's song" for a "crack addicted" market begging the "dealer" for another hit of liquidity injected euphoria. After all, the worse the economy gets for mainstream America, the better off Wall Street is. Talk about a wrong allocation of resources - but hey, we have to save the banks, right?

However, as we discussed in this past weekend's missive: "Bernanke, and the other members of the FOMC, have been able to achieve the effects of QE (driving asset prices higher) through 'talk' rather than 'action.' This is the nirvana of monetary policy for the Fed – to achieve the effect of intervention without intervening." Therefore, today's two major economic reports bring up the question of whether "bad economic news" is just that or if "hope" can continue to keep the markets afloat for a while longer.

The two important economic releases today were the Institute of Supply Management's Manufacturing Index and Construction Spending reports. Both reports broadly missed economists' expectations of 50 and 0.4% respectively by showing prints of 49.6 and -0.9% for August. (I know - it's a shocker economists were wrong.)

ISM Manufacturing Index

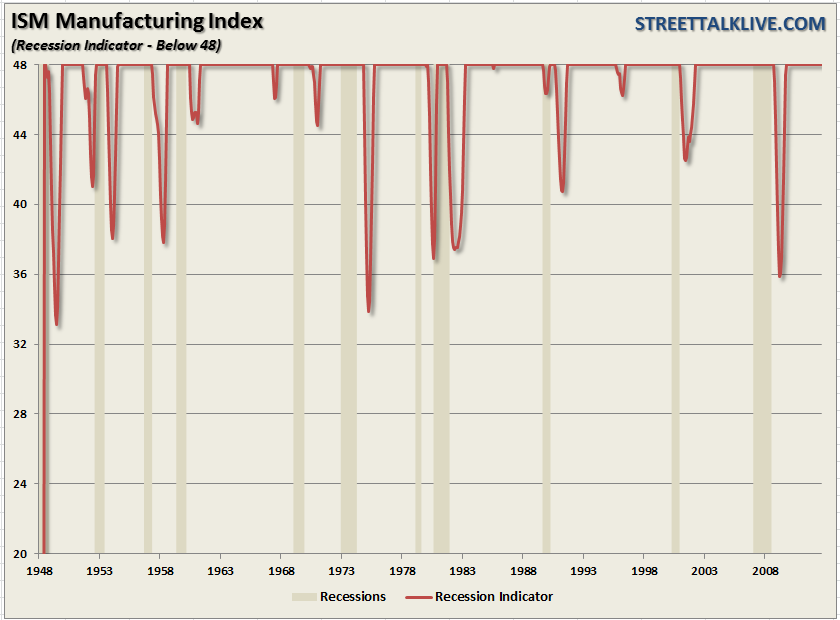

The ISM report fell again in the latest month declining from 49.8 to 49.6 in August. It is the lowest reading of the index since July of 2009, however, at that time manufacturing was on the mend, not falling. More importantly, weakness was broadspread accross the most important sub-indexes. The chart above shows the ISM manufacturing index turned into a recession indicator - index readings below 48 are marked against recessions. What we find is that the overall index a lagging rather than coincident or leading indicator in regards to recessions. This is logical considering that businesses, and primarily manufacturers, are reactive to the economic environment rather than proactive.

The economy is likely weaker than it is currently appearing meaning manufacturers are likely to curtail production in the months ahead. This defensive posture will further impact an already weak employment environment.

One of the major concerns that we have discussed repeatedly in the past (most recently here) is that the weakness in the eurozone economy will impact the domestic economy. With export orders now making up more than 13% of the GDP the slow down in Europe will inevitably come home to roost.

New export orders clocked in at 47.0 which is a third straight month of contraction. The decline in export orders, as well as new orders as we will discuss momentarily, is pushing manufacturers to draw down their backlogs, slipping to 42.5 from 43 in July, for the fifth straight month of contraction. When backlog levels get low enough - the next move by manufacturers will be to start cutting employment.

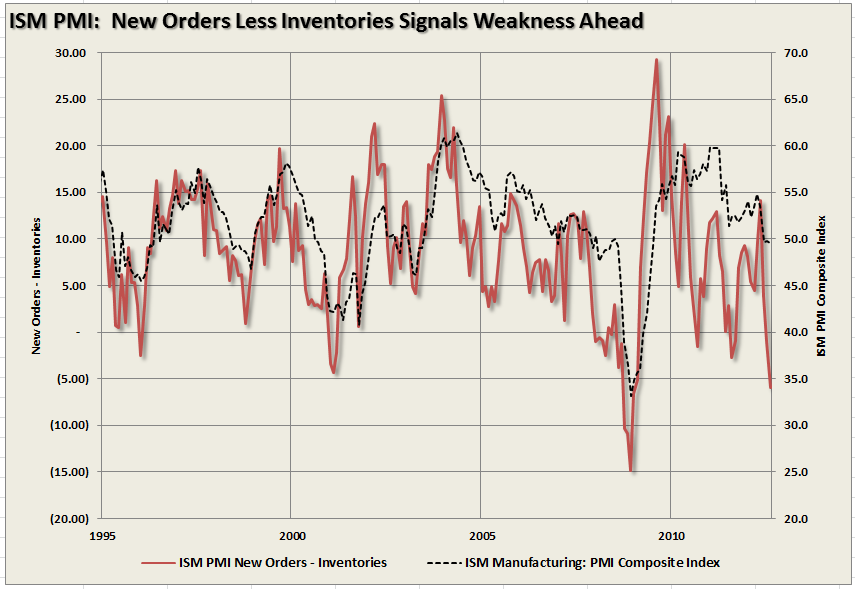

As I stated, it is not just New Export Orders that are waning, but also New Orders in general. New Orders, which is a key driver of forward expectations, capital expenditure plans and employment, declined in the latest month to 47.1 from 48 in June. The lack of new orders is starting to hit production which fell a very steep 4.1 points in the month to 47.1 and is the first sub-50 reading since May 2009.

Declines in New and Export Orders show that end demand is weak, and leading to an unwanted build in inventories, which is the first such build since September 2011. Also, relating back to the end consumer, was the decline in import orders which also declined as delivery times shrank.

The rise in input prices causes much bigger concerns in a weak demand environment because it becomes much more difficult to pass those price increases along. This has already been seen in the latest earnings reports for the 2nd quarter and will likley be a much bigger problem in the 3rd quarter earnings season. Estimates are currently still very high by most analysts so it will be prudent to watch for rapid negative revisions to estimates in the months ahead.

The comments from the various industries were all cautious or negative, supporting the overall content of the report.

- "Internal indicators and feedback from sales channels are indicating a slowdown in demand for capital equipment." (Machinery)

- "Business continues to be very solid, but there is now a slowing of incoming orders." (Fabricated Metal Products)

- "Incoming orders have slowed somewhat, but indications are that there will be a stronger fourth quarter." (Plastics and Rubber Products)

- "Business is slow right now. Companies seem to be holding onto their money." (Computer and Electronic Products)

- "We can sense, feel and see headwinds with customer orders, especially Europe related." (Apparel, Leather and Allied Products)

- "New orders and backlog remain flat." (Miscellaneous Manufacturing)

- "Auto industry slowing a bit in the second half [of the year]." (Transportation Equipment)

- "U.S. drought severely impacting raw materials prices." (Food, Beverage and Tobacco Products)

- "Lackluster demand continues in all regions of the world, and is supporting much lower raw materials prices in the second half of 2012." (Chemical Products)

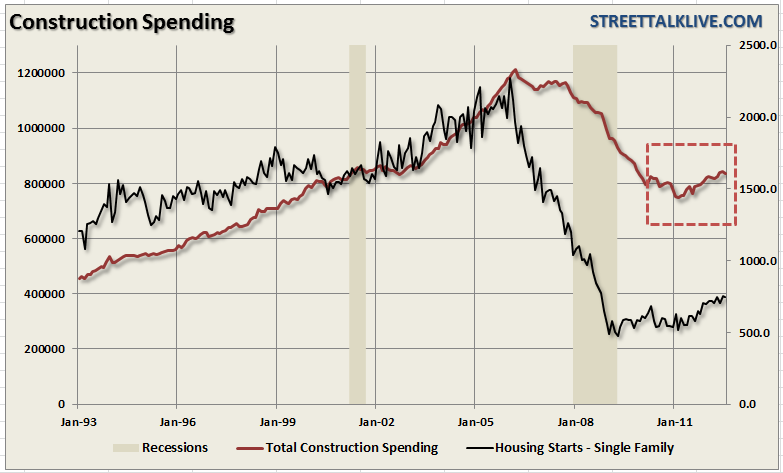

If the ISM report was not bad enough - construction spending dropped sharply in July as was very broad based. The weakness in July is concerning because summer months are the strongest construction months of the year and show a deterioration in economic activity.

Construction spending fell back 0.9 percent in July, following a 0.4 percent gain in June. The drop was led by private residential outlays which declined 1.6 percent after a 2.4 percent boost in June. The nascent recovery in home building continues with new one-family structures up 1.5 percent. The chart shows that new single family home starts are still at very depressed levels due to employment and financing problems.

However, new multifamily structures advanced 2.8 percent as more people need to rent because they can not afford, or qualify, to buy. One caveat here, as is always the case, just because homes are being started it does not mean that they are finished or sold. An increase in interest rates, or another economic downturn, will quickly leave inventory sitting empty on the ground and drive prices substantially lower as inventories are liquidated.

In a sign of bad news for "Do It Yourself Stores" - spending on existing structures plunged 5.5 percent. This is also not a great sign for the consumer as a whole. Also concerning were the sharp declines in private nonresidential spending, and public outlays, which were clearly negative. The next couple of months will give us much more clarity with regard to the direction and strength of construction spending.

It is my best guess that the weakness that has been slowly invading the domestic economy, due to the recession in the eurozone, is more pervasive that the current economic indicators reveal. In the next couple of months the impact of the slowdown in China and the continued recession in Europe will become much more quantifiable. While it is unlikely that the Fed will act with further stimulative measures in the next two weeks - I do think it is highly likely that they will be pushed into action by the year's end.