This morning we received the second estimate of 2012's second-quarter GDP. The good news is that the original 1.5% estimate was revised up to 1.7%, which is only slightly lower than the Federal Reserve's estimated 2% growth rate for 2012. The bad news is that, for the time being, the increase puts the final nail in the QE3 coffin.

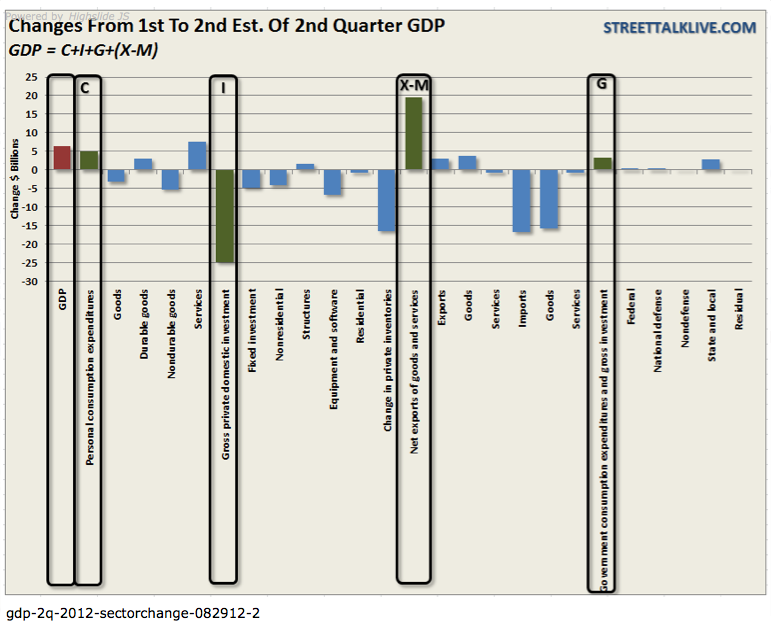

While the media quickly glossed over the surface of the report, there were very important underlying variables that tell us much about the economy ahead. The first chart below shows the differences between the first and second estimates of the second-quarter GDP.

I have put the basic formula of the GDP calculation at the top of the chart and labeled the relevant green bars. The revisions to the first estimate of GDP show that personal-consumption expenditures were $4.9 billion stronger than originally thought with the revision primarily driven by a surge in spending on services, which was increased by $7.7 billion. Exports also continue to save corporate-profit margins (exports have made up roughly 40% of corporate profits since the end of the last recession) with exports being revised up by $3.1 billion.

However, big negative revisions came to the Private Investment segment, which was revised lower by a whopping $24.8 billion dollars. Furthermore, equipment and software spending -- in a sign that businesses are pulling back on capital investment -- was revised down $6.6 billion tacking on additional declines to the first-quarter report. Adding continued pressure to China and other emerging-market exporters, the weak U.S. consumer continues to shun buying non-necessities as imports came in much weaker than originally estimated, revised down $16.7 billion, primarily in the produced goods.

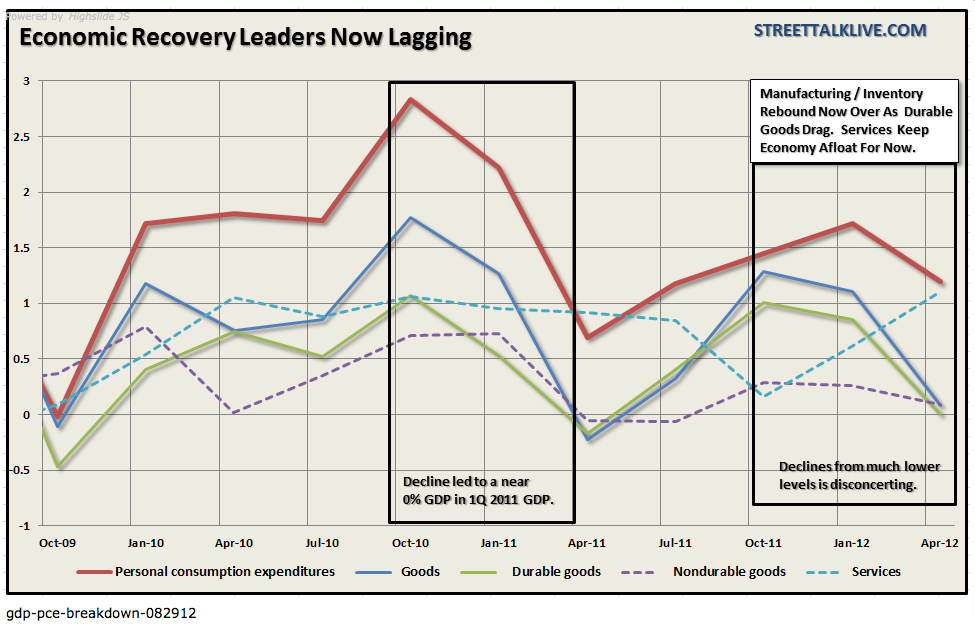

These are not small details. The next chart shows a clear trend change for the consumer as measured by Personal Consumption Expenditures (PCE). When the recovery began in 2009 it was led primarily by consumption and production (inventory restocking). Given that consumption is currently making up more than 70% of GDP, an understanding of where consumption is occurring is relevant to the direction of future economic growth.

Fading Tailwinds

The decline in PCE, Goods and Durable Goods beginning in the third quarter of 2010 led to a near ZERO growth rate of the economy in the first quarter of 2011. Fortunately, the economy was saved from a recession with a manufacturing restart and inventory restocking process, post the Japanese tsunami/earthquake in March of 2011. That boost, combined with the warmest winter in 65 years and sharply falling oil prices, lifted the economy into the first quarter of 2012. Those tailwinds now appear to again be fading.

With GDP currently at 1.7% as of the latest estimate, the decline in overall PCE, Goods, and Durable Goods, is very concerning relative to the next couple of quarters. While the pick-up in services spending (haircuts, accounting, legal, etc.) is currently keeping the current quarters GDP afloat, service-related spending does not lead to substantially stronger economic output in the future. The driver for that is in the manufacture of goods and, unfortunately, that is where weakness is developing.

Equipment And Software -- A Notable Concern

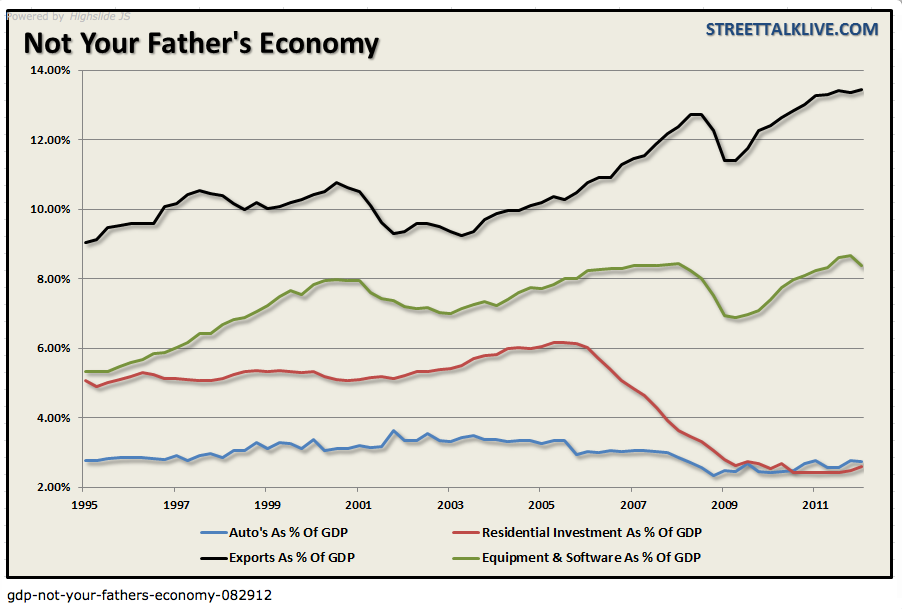

In the quest to keep employment as low as possible in recent years while maximizing the return of each employee, (the highest costs for businesses are employee related -- payroll, benefits, healthcare), the expenditures on equipment and software has boomed since the end of the technology bust. This spending has become a much larger share of GDP and downturns in spending imply that businesses are not only not hiring but also becoming extremely conscious of overall spending. The chart below shows four very important items.

First, I want to dispel the myth about the importance of a housing recovery relative to the economy. At one point, housing was a very important component of economic growth. Today, it represents a mere 2.6% of GDP. So while we spend billions upon billions of taxpayer dollars trying to bailout homeowners, forgiving bankers of their criminal misdeeds and not dealing with defunct-government agencies -- all in the name of saving the economy -- in reality it has very little effect. Ditto for automobile manufacturing and the billions of taxpayer dollars wasted on GM under the lie that without a bailout American auto manufacturing would have been lost.

Reading The Corporate Cutbacks

The important focus here, however, is watching equipment, software spending and exports. As stated above, with exports now making up 40% of corporate profits and more than 13% of GDP, a decline in exports due to the recession in Europe and a slow down in China, will quickly resonate in the domestic economy. Furthermore, the directional trend of equipment and software spending is indicative of corporate forecasts about the economy ahead. Cut backs in spending occur as forecasts for economic growth weakens and concerns about profitability heighten. The chart above clearly shows that both exports and equipment and software spending as a percentage of GDP declined just prior to the onset of the last two recessions. The recent decline in equipment and software spending may be telling us something.

The Recovery That Wasn't

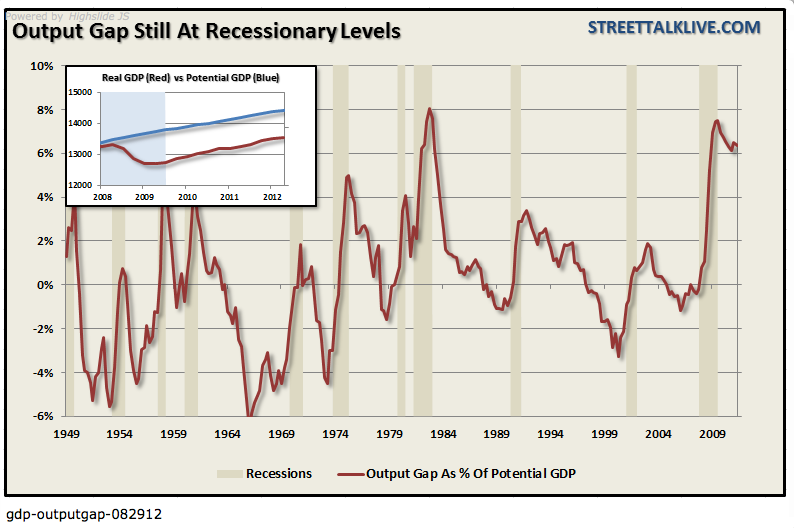

This has by far been the weakest economic recovery of any post-WWII period. Employment remains elevated but lower only due to the massive number of unemployed who have either giving up looking for work or moved onto some sort of welfare program, which excludes them from being counted. Economic growth, such as it has been, can be primarily attributed to continued rounds of artificial intervention and stimulus programs designed to pull forward future economic activity. Of course, that begs the question of what will happen when we reach the future? Wages have remained stagnant, household net worth has declined for the longest period since the depression era and consumers are again being forced into debt to make ends meet. This all leads to a sub-par economic growth rate as shown by the output gap between the real economy and what the economy should be producing.

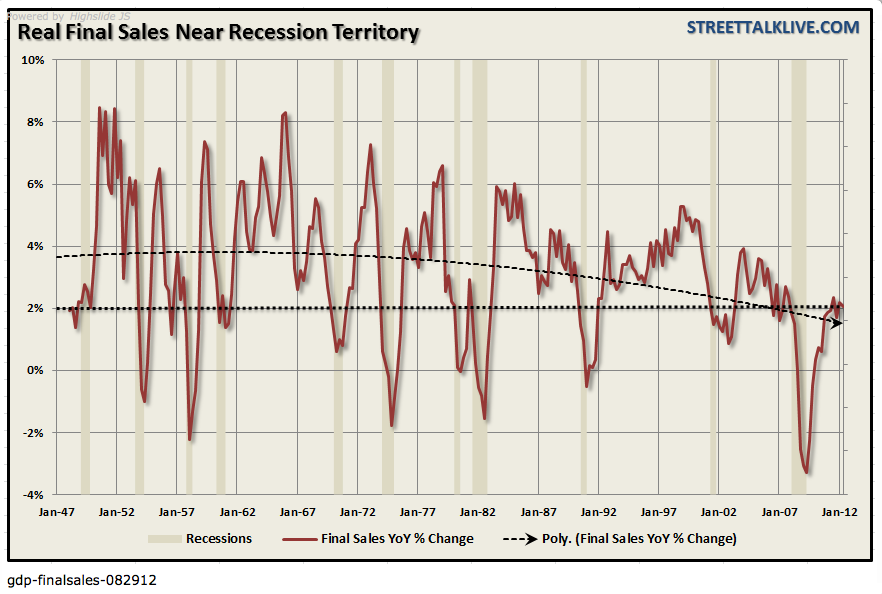

Clearly the economy, while not technically in a recession, is operating at levels that are normally associated with one. Without artificial intervention, suppressed interest rates and housing support, it is likely that the economy would be reading far lower levels of activity than it is. This is also evident if we look at real final sales for the economy.

Real final sales -- GDP less the change in private inventories -- is a better measure of what's happening within the economy. The recent builds in inventories are likely unwanted as product sits on the shelves collecting dust and consumer demand wanes. The final sales number is a better indication of actual activity. Real final sales declined from a quarterly change of .59% in the first quarter to .49% in the second quarter. This brings the year-over-year growth rate of real final sales to 2.06%, down from 2.17% in the first quarter.

Final sales continue to flirt with the 2% annual change level, which has historically always equated to a recessionary spat in the economy. With the current decline in PCE, it is likely that we will see real final sales decline to recessionary territory in the next two quarters.

No QE 3 For Now -- But Later For Sure

Today's release is likely to keep the Fed sidelined through the election for further rounds of stimulative action. As stated recently, with the markets near highs for the year and the economy not falling off the ledge, there is very little benefit to another round of stimulative action. At least for now. The Fed knows it's running low on ammunition so it is likely to wait until either the economy is threatening a recession or a more systemic event occurs. Both are likely in the future.

For investors, this is not a time to be taking on tremendous amounts of risk with their portfolios. While markets can sometimes do irrational things in the short term, it is the underlying economics and fundamentals that drive long-term returns. Taking on risk at the wrong time while chasing returns can lead to devastating losses that take the entire next upswing to recover. That's happened twice already since the turn of the century and it will happen again -- it's just a matter of time. The important point here is that, for investors who have a limited amount of time to plan and save for retirement, "hope" and "getting back to even" are not successful investment strategies.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Q2 GDP: Not Good

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.