After reaching the important $50 per barrel mark, speculation about a potential recovery for oil prices is once again in full swing. Whilst a long term recovery is harder to gauge, the short to medium term could see oil remain somewhat higher than it has been in previous months. Primarily, a temporary increase in demand for oil could alleviate some of the depressing effects of the global supply glut. However, the recent U.S. job data and a potential rate hike could prove to be a major hurdle to a real recovery in oil prices.

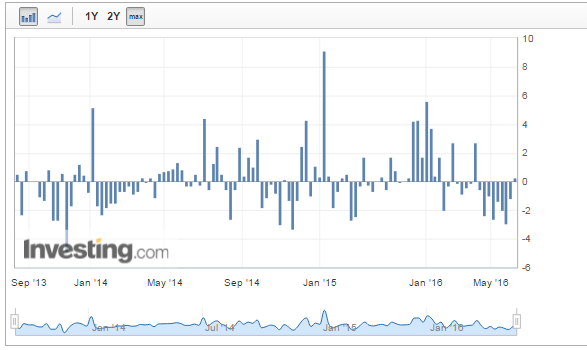

As summer approaches, oil demand in the U.S. will once again be expecting an uptick as the “driving months” begin in earnest. In fact, for the first time in eight weeks, there has been a build in gasoline and distillates of 760K and 270K respectively. The build comes as refineries move to accommodate the excess demand which is generated as U.S. drivers begin their yearly spate of road trips. Therefore, it comes as little surprise that the last three U.S. crude inventories results have posted drawings. These drawings have seen oil prices steadily recover and the impending release is likely to follow the recent trend.

In the event that the U.S. posts another reduction to crude oil inventories, there is almost certainly going to be a resulting spike in oil prices. Ordinarily, such a spike would be relatively short lived given the recent uptick in the U.S. rig count to 408. However, this time around, the seasonal increase in demand for oil could limit the downside potential of increasing rig counts significantly. Furthermore, the driving months’ effect on demand comes on the heels of the massive 0.56 mb/d y/y demand growth which was seen in February. As demonstrated in the May OPEC Monthly Oil Market Report, increasing demand over this period was supported largely by a low oil price environment and bullish vehicle sales.

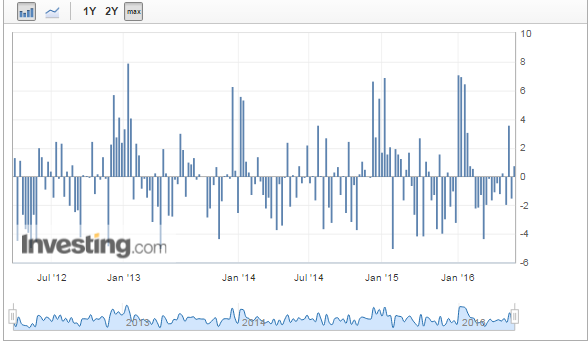

Whilst oil prices will probably stay buoyant in the short to medium term, oil will also be unlikely to push far beyond the $50 mark. Primarily, a slowdown in the U.S. jobs results is hinting that demand could be somewhat muted going forward. Specifically, a shocking Non-Farm Employment Change result of just 38K could signal that U.S. economic growth is not going as well as originally thought. Furthermore, a slowdown in U.S. vehicle purchases means that one of the contributing factors to recent upticks in oil demand is no longer in play.

Additionally, the looming spectre of a Fed rate hike brings further doubts that oil can survive above $50 for long. In fact, the relative bearishness of the USD in past weeks has provided an opportunity for non-U/S. based speculators to enter the oil market as the commodity was relatively cheaper. This becomes evident when looking at the increasing volume of trade over the last month for oil. In contrast, if a rate hike does occur, the resulting rally of the USD could severely limit the competitiveness of U.S. oil. Consequently, the commodity could see itself struggling to extend recent bullishness if the Fed follows through with a hike.

Ultimately, oil is by no means out of the woods just yet and a low oil price environment is set to be the new norm for the commodity. However, as forces begin to balance out supply and demand for oil, we might finally see a degree of stability in the coming months. As a result, oil might be able to stay afloat around the $50 handle as the driving months are underway. However, looking abroad could be prudent as domestic factors can only prop up prices for so long.