The massive rise of companies such as Amazon (NASDAQ:AMZN) helps highlight the rapid expansion of growth-obsessed investing. Yet, at a time when many investors target lofty growth—sometimes in favor of most other metrics—value investing can still be just as powerful as ever.

Value investors tend to target stocks that can be purchased at a discount relative to many of the company’s industry peers. United Rentals, Inc. (NYSE:URI) is a company currently positioned in this value-focused category.

United Rentals is currently the largest equipment rental provider in North America. The company has almost 1,000 branches, where it rents its often-large equipment to construction companies, industrial firms, utilities companies, government agencies, municipalities, and other entities. The equipment rental giant currently boasts about 11% market share in North America.

Shares of United Rentals have skyrocketed almost 85% in the last year and currently rest just below their all-time high. On top of that, United Rentals is currently a Zacks Rank #1 (Buy) and sports an overall VGM grade of “A.”

In terms of valuation, United Rentals also rocks an “A” for Value in our Style Scores system.

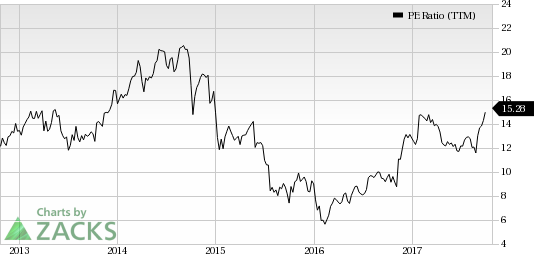

One of the first things that many value minded investors look at is a company’s price to earnings ratio. United Rentals is currently trading at just 13.64x earnings, which marks a big discount compared to its industry’s 19.87 P/E ratio, as well as the S&P 500 average. URI’s 1.92 P/S ratio is also solid, although it falls below its industry’s average.

Along with these traditional valuation metrics, United Rentals has an earnings yield of 7.34%, which tops the industry’s 4.98% average. What’s more, URI’s price to cash flow ratio of 6.14 is far better than the “Building Products – Miscellaneous” industry’s 11.95 average.

It seems clear that United Rentals presents strong value for investors. When coupled with its current Zacks Rank #1 (Strong Buy) and its “A” VGM grade, URI might be a stock that value-minded investors should consider.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation. See Them Free>>

United Rentals, Inc. (URI): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Original post

Zacks Investment Research