There is a vast part of the market that many investors know very little about... if anything at all.

But as you will see in a moment, you need to get familiar with it. That’s because it currently holds the largest share of transactions. In fact, it dwarfs the conventional exchanges.

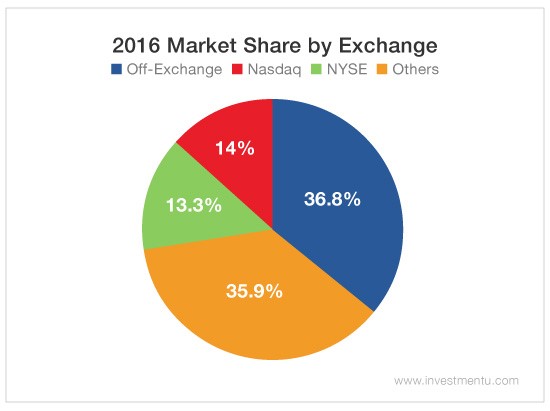

This week’s chart shows each exchange’s share of our financial markets in 2016.

The first thing you should notice is that the NASDAQ and New York Stock Exchange do not have the largest market shares. Even if you combined the two, they still wouldn’t have the largest share.

Instead, that title is held by off-exchange trading.

Last year, we saw off-exchange volume tip over 36% (up from 35.5% in 2015), and it continues to make up the largest chunk of volume in the U.S.

So what is this market?

Off-exchange trading, also known as over-the-counter (OTC) or “dark pool” trading, is done directly between two parties, without the supervision of an exchange.

Here’s the big difference... Exchanges facilitate liquidity, provide transparency and maintain the current market price. But off-exchange trading information is not necessarily published.

Off-exchange orders are dark, meaning the size and the price of the orders are not revealed. They’re mostly used by sophisticated professional traders and large institutions.

So how do the trades work?

OTC Stocks

One part of the off-exchange market is made up of OTC securities, which are unlisted. These are generally accessible to ordinary investors, but the trading process is a little different from buying or selling a conventional stock.

First, an investor places a market order for an OTC security with his or her broker. The broker must then contact the security’s respective market maker. The market maker will then quote the broker the ask price at which the market maker is willing to sell the security.

Since the order is a market order, the broker must accept the price quoted. The broker will then transfer the necessary funds to the market maker’s account and is subsequently credited with the respective securities.

It sounds simple, and for the most part, it is. But the nature of these investments is the tricky part. You see, these types of securities are riskier than stocks listed on exchanges are.

Why?

OTC stocks typically belong to smaller companies with small market caps. They’re typically more difficult to research than exchange-listed stocks are. And they tend to be extremely illiquid, which can make it hard to find a buyer.

It is also important to note that not all brokers will allow you to invest in these types of securities. You will want to check with them before looking for opportunities to invest in OTC stocks.

But if you can, there is great potential for some really big gains on these securities.

Institutional Orders

What’s more, OTC stocks are only one component of the off-exchange market. It’s also where investment banks and other institutions go to quietly buy and sell big quantities of conventional stocks.

As we mentioned earlier, this type of trading is mostly used by sophisticated professional traders. But that doesn’t mean you have to miss out on the big returns offered by these huge but secretive transactions.

Our Chief Investment Strategist Alexander Green has found a way to leverage institutional buying and selling.

He recently introduced “dark trades” to subscribers of The Momentum Alert. And his subscribers are already seeing great results with a recent return of 25% on Zillow (NASDAQ:Z). And that was the return on just the stock itself. His option recommendation had an average return of more than 260%.

So what are these dark trades?

They are MASSIVE anonymous trades that have a predictable impact on the stock market. And with knowledge of these dark trades, you can predict which stocks are about to soar.