The trend, which has been supporting the S&P 500 for the past three years, was invalidated earlier this week as panic selling took hold. The index found some buyers at the beginning of yesterday’s session, but a late sell off proved to be a dead cat bounce. Is this the bubble bursting?

The fear is palatable. Chinese stock markets, where it all began, have fallen 8.4% and 7.6% on Monday and Tuesday this week. This has come on concern the slowdown in the world’s manufacturer is deeper than many had anticipated. The fear quickly spread to all markets across the globe, with the S&P shedding almost 4% on Monday, invalidating the bullish trend. It will be some time before we know how deep the Chinese slowdown will be, but the Chinese equity markets will be a good indicator.

This brings us to the US. The Federal Reserve will have a tough decision to make when they meet on September 17th. The market’s prediction of a rate rise has all but evaporated, and this latest collapse in global equities will make that decision even tougher. The rout in Chinese equities and the devaluation of the yuan are only confounding the problem for the Fed, as these events will undoubtedly put pressure on US economic metrics.

A decision to keep interest rates steady would, under normal circumstances, be bullish for equities, but I suspect this may not be the case if that is the outcome in September. The market may very well take a decision to hold rates as a sign that things are going to get worse and the Fed is acknowledging it. The intention may be to support financial markets, but it may end up having the opposite effect.

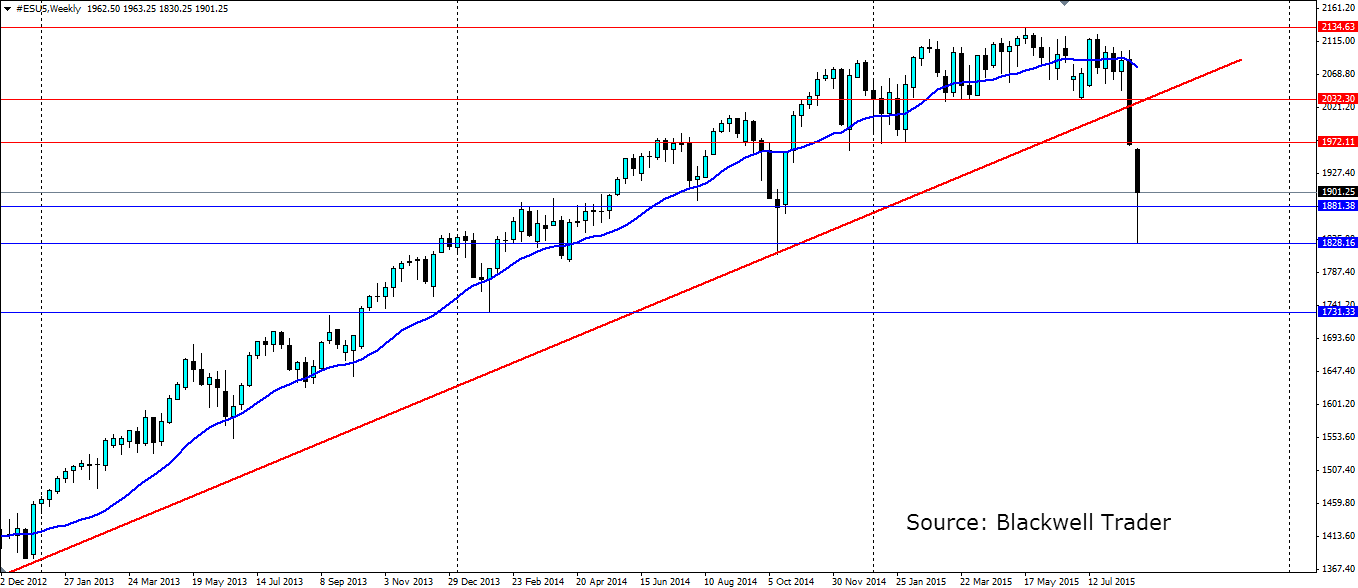

The push through the bullish trend line may be the trigger than Equity traders have been looking for (or trying to avoid). The S&P 500 September Futures (above graph) found support just above a previous swing point found back in October last year at 1,828.16. From there it bounced, but the bounce was met with more selling. This level may come under pressure again with the next solid level at 1,731.33.

It is very likely that we will see plenty of traders “buying the dip,” but the fact we have seen lower highs since May, and the calamitous breakdown of the trend line suggests the bull run is over. If we see a solid bounce (as happens with most crashes), look for resistance at 1,972.11 and 2,032.30, with the trend line also likely to act as dynamic resistance. If we fail to break the high at 2,134.63, this will be a very bearish indication and sign the bull market is over.