Investing.com’s stocks of the week

S&P 500 went nowhere yesterday. Just like the previous Monday, there was heavy buying into Friday's close but no follow-up the day after.

After almost touching 16 to close the week, CBOE Volatility Index peeked higher yesterday only to reverse back down. Nice try but if you look at the put/call ratio turning down simultaneously, the alarm bells are far from ringing.

The S&P 500 rise of late isn't without its good share of non-confirmations though. The ones seen in Russell 2000 and emerging markets got a fresh company in the corporate credit markets. No denying that the stock market is in a strong uptrend, but it got a bit too stretched vs. its 50-day moving average – a consolidation in short order would be a healthy move, but the CPI readings above expectations don‘t favor one today.

If you look at the put/call ratio again, its lows throughout March and April haven‘t been reaching the really exuberant levels of prior months, hinting at a less steep path of S&P 500 gains.

And what about the volume print as stocks went about making new highs?

That is not encouraging either. It's not that rising yields would be causing trouble:

(…) The retreat in rising yields is running into headwinds, much sooner than the 10-year one could reach the low 1.50% figure at least. Value stocks and cyclicals such as financials appear calling it out, and both rose on Friday.

And financials had a good day yesterday too. Technology welcomed the reprieve, and the heavyweights joined in increasingly more. Again though, more than a little stretched, these FANG generals are rising while the troops (broader tech) are hesitating, which makes a down day/consolidation quite likely, especially should the TLT retreat again. As I wrote

yesterday:

(…) The rotation simply isn‘t much there, and the TINA trade isn't letting much air to come out of the S&P 500 sectors that would be expected to sell off in a more relaxed monetary policy.

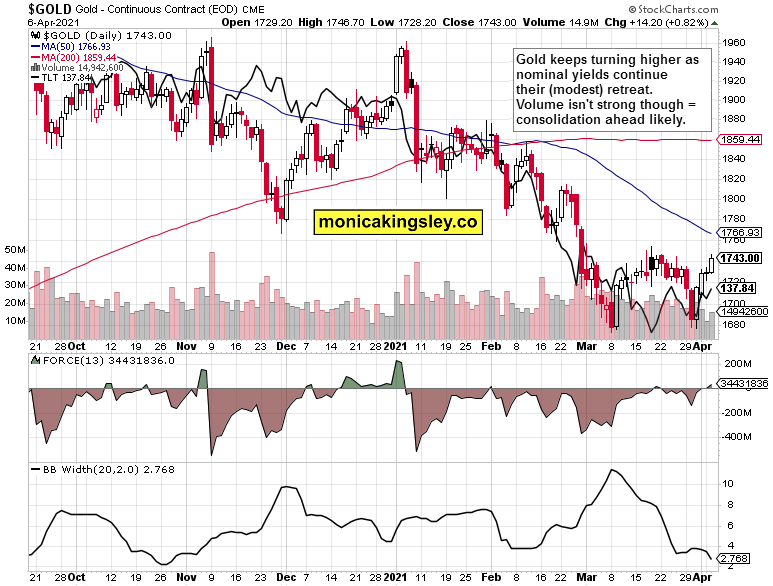

And that's probably what gold is sensing as it grew weak yesterday. The rising yields aren't yet at levels causing issue for the S&P 500, but the commodities' consolidation coupled with nominal yields about to rise, has been sending gold down yesterday – and miners confirmed that weakness by leading lower. This would likely be a daily occurrence only unless and until copper gives in and slides – that's because of the inflation expectations having stabilized for now, but Treasury yields not really retreating. Yes, gold misses inflation uptick that would bring real rates down a little again – and is getting one in today's

CPI as we speak.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

S&P 500 Outlook

The S&P 500 is no longer trading above the upper border of Bollinger Bands, but volume isn't picking yet up either. That makes a largely sideways consolidation the more likely scenario here.

Credit Markets

Both high-yield corporate bonds (iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG) ETF) and the investment grade ones (iShares iBoxx $ Investment Grade Corporate Bond ETF (NYSE:LQD) ETF) declined yesterday, while long-dated Treasuries went nowhere. But the bullish spirits in stocks didn't evaporate proportionately. This non-confirmation isn't too pressing at the

moment.

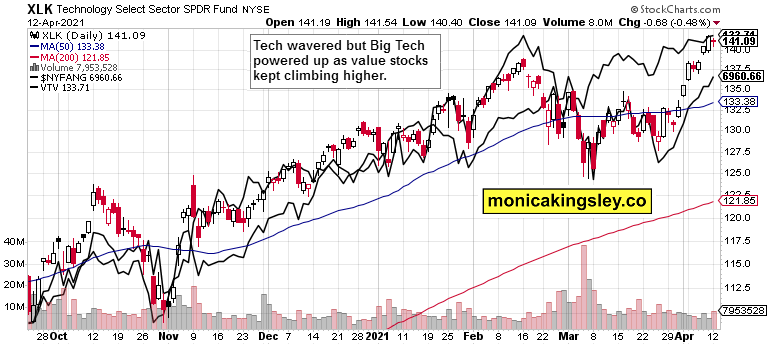

Technology and Value

Tech (Technology Select Sector SPDR® Fund (NYSE:XLK) ETF) stumbled yesterday, and it wasn‘t because of FANG (black line) – yet value stocks didn't sell off either during these lately turning vapid rotations.

Small Caps And Emerging Markets

The long underperformance in both indices vs. the S&P 500 goes on, and is actually a stronger watchout than the corporate credit markets at the moment.

Summary

S&P 500 still appears as entering a consolidation, but I'm not looking for too much downside. The big tech names would decide, and if you look at Tesla (NASDAQ:TSLA) doing well yesterday, the S&P 500 correction would play out rather in time than in price.

Gold depends upon the miners‘ path, and nominal yields trajectory. Once more inflation spills over into CPI readings, that would work to negate temporary weakness caused by real rates pressures, which is what we are getting.