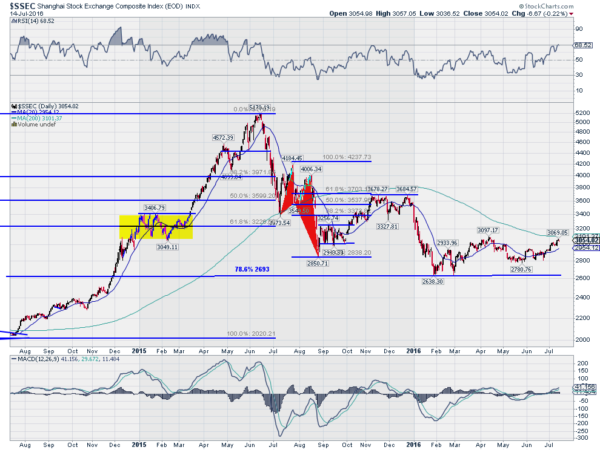

It seems like only yesterday that the Shanghai Composite started higher off of a base near 2000. It rose like a rocket to 3200 and consolidated there for about 3 months before an even bigger leg higher up to near 5200. The composite had jumped over 150% in less than a year.

The word 'bubble' could be heard and the Shanghai Composite agreed. It dropped 35% in the next month before slowing. There were a couple of cascades since, like the waterfall below that eventually had it retracing 78.6% of the move higher. It started to feel like the whole push higher had never happened. Then something changed.

The Shanghai Composite rose off the 78.6% retracement and stayed over its 20-day SMA for a short period of time. In April the bounce reached the yellow consolidation zone halfway through the big move up. But it eventually turned back down, like every other time. It made a higher low in May and started back higher again. Now it is back at that prior resistance. And the 200-day SMA is very nearby. It was an initial move over the 200-day SMA that started the 2014-2015 run higher and the Composite has not been over it since August 2015.

Will a push over the 200-day SMA signal the end of the bear market in China and the start of a new leg higher? Time will tell. In the meantime, keep an eye on the Shanghai Composite. It has strong momentum with a bullish RSI and MACD. And even just a touch at the 200-SMA right now over 3100 would make for a higher high, the beginnings of a trend. Maybe the bottom is in.