The past few years have been relatively kind to US equities as the slew of money from quantitative easing worked its way around financial markets seeking yield. Subsequently, the S&P 500 has continued to soar to new heights but the recent pull backs have left many within the market questioning if the party is finally over.

Market pundits are typically a special breed who are largely adept at observing and gauging human behaviour in the financial markets. Subsequently, the last month has seen a myriad of published models that appear to show that the major US indexes are in a corrective mode, not a bear market. The problem is, as most economists will tell you, gauging sentiment and expectations is particularly difficult. Subsequently, it would be prudent to look beyond the sell side rhetoric and review the data to form your own view on which way the S&P is heading.

Recently, the keenly monitored index has broken through the bottom of the wedge pattern that had been in place for most of 2016. This is actually a highly bearish move that could return the key 2,000 index level to focus. In addition, although the index remains above the 100-Day Moving Average, the RSI oscillator is at the top of its range and is looking potentially over-bought. Overall, technical analysis is suggesting that a pullback might very well be on the cards in the short term.

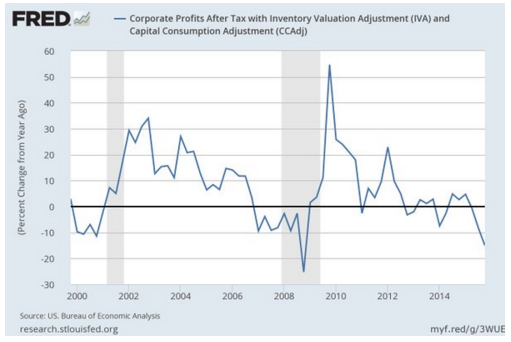

However, taking a look at the long term paints a bleaker picture as some problematic fundamentals align for the US economy. In fact, the venerable St Louis Federal Reserve has just released some data which points to shrinking corporate profits. It would appear that corporate profits have largely seen a declining trend since a relative spike in 2010 and have just recently fallen into contraction. In fact, the last time that a contraction of this nature was observed within the data set was during the height of the GFC. Subsequently, this paints a relatively concerning image for those of us that are highly leveraged or dependent upon US equities.

The reality is that the US economy is currently in trouble and it is looking increasingly likely that the powerhouse could subsequently see a recession in 2016. In fact, there has already been plenty of debate over whether we are actually already experiencing one. The problem with recessions is that you never know you are in one until after it has started and the Fed doesn’t have the most sterling of reputations when it comes to predicting downturns.

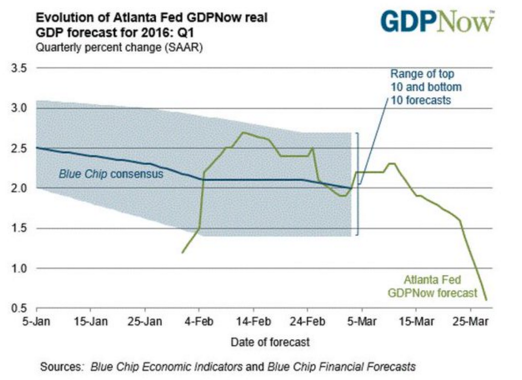

Further supporting the case for a contraction is the recent downward growth revision by the Atlanta Fed. The Fed’s highly accurate GDPNow Indicator was recently revised lower with Q1 being downgraded to an anaemic 0.6%. Subsequently, there is plenty of speculation that the figure could be revised further or that Q2 could prove to be contractionary.

Subsequently, despite protestations otherwise, there is a very real risk that US growth could turn negative in short order. A dent to public perception and sentiment along these lines could cause a calamitous meltdown in US equities and put the S&P 500 firmly into bear territory. Although stocks are largely only 4% lower from their peak the announcement of a recession would see values plummet and capital vanish quickly.

Ultimately, it might be time to buckle up and prepare for the ride because a new crisis is coming and is likely not far away given the collapse in corporate profits and growth. Subsequently, expect to see plenty of carnage before the damage from the Fed’s QE problem is finally excised from the equities market.