The Chinese stock market crash is approaching its 2 year anniversary. You don’t remember? Probably because the US markets were also making their lows in early 2016, but not in as drastic a fashion. From a peak in December to the trough in February, the Shanghai Composite lost over 1000 points, or almost 30%. A very bad 3 months. But since then it had plodded higher. Recently that move has stalled and reversed though. Is the bull market in China over?

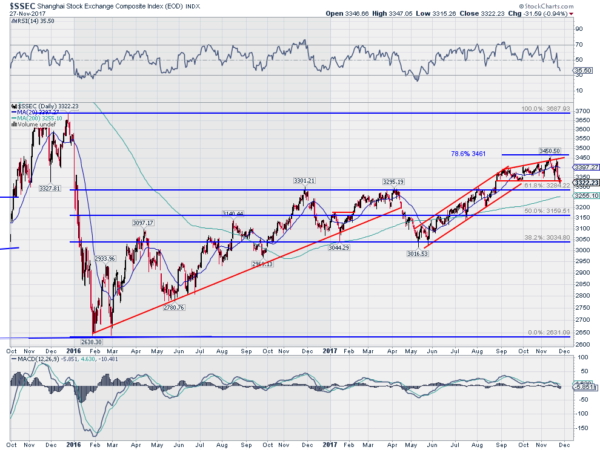

The chart below gives some insight. After that early 2016 bottom, the Shanghai Composite moved higher over the next 15 months. It made a series of higher highs and higher lows until reaching a 61.8% retracement of the down leg in November 2016. It tested that 61.8% retracement again in March 2017 before a pullback. The pullback found support at the 38.2% retracement again and it appeared to be moving sideways in a broad channel.

Then in August it broke that channel to the upside. All looked rosy for the Composite and it established a target to 3680, a full retracement of the move lower. The movement since September created an expanding wedge, and it broke that wedge to the upside earlier this month. That move failed though at the 78.6% retracement and it pushed lower. A bounce to a lower high then reversed and now it is falling through support. A lower low after a lower high is not what Chinese bulls want to see.

The price action could reverse back higher and negate the worry. But in the short run the easier path looks lower. The RSI is also making a lower low as it falls into the bearish zone and the MACD is crossed down and falling. Both support more downside price action.The 200 day SMA has played an important roll with the Shanghai Composite. It remains below and has not been touched since July. Perhaps another test there is in the card. Failure there, and a retest of 3000 seems likely.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.