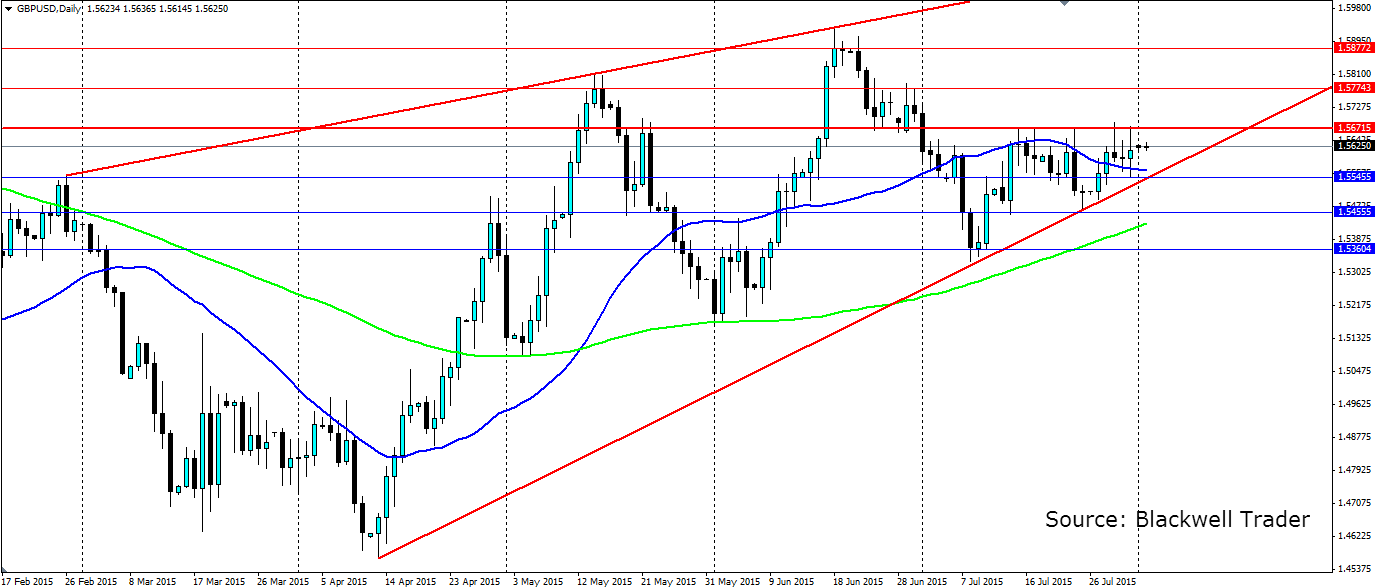

A large wedge structure on the daily charts is dominating proceedings, and the bottom of the shape is lifting the pound higher. It is consolidating under some solid resistance, but can the pound break through and charge higher?

The underlying bullish trend has been dominating proceedings over the last few weeks and the data has certainly helped the pound. GDP came in at a solid 0.7% q/q which highlights the underlying strength in the market. The data out of the US was relatively positive which held the gains in check and has contributed to the consolidation in the pair.

The consolidation has come under the firm resistance at 1.5671. The pair has tested this level numerous times over the last month with only one brief push through it. This level is one that has been a level of interest for the cable over the last few years. It has been a swing point which means the market has a natural gravitation to it.

Volatility will be seen across the board during the week ahead and the cable will be no stranger to it. UK Manufacturing and (importantly) Services PMIs are due this week. The BoE is due to deliver the quarterly inflation report and set interest rates which will likely be held steady. Any comment about when and if a rate rise from the BoE is coming will send the cable surging higher. This all comes before the all-important US Nonfarm Payrolls on Friday.

Price has moved above the 20 and 100 day Moving Average indicating the bullish sentiment remains and the trend is likely to hold. The consolidation may continue for a few more days but the volatility this week will likely see it seriously test the line in the sand. Watch for any break above 1.5671 as this will lead to a sharp rise in the cable which will target the recent highs.

The alternative here is if the data from the UK is poor and the BoE pours cold water on rate rise speculation. In which case watch for a bearish breakout of the trend line. Either way support is found at 1.5545, 1.5455 and 1.5360 with the trend acting as dynamic support. Resistance is found at 1.5671, 1.5774 and 1.5877.