The bounce in stocks has reached ludicrous proportions.

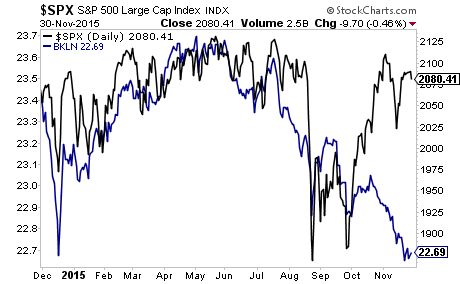

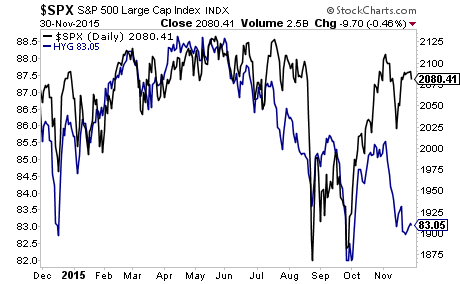

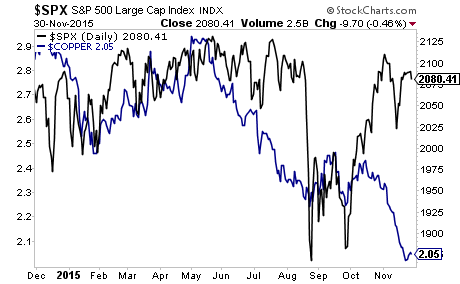

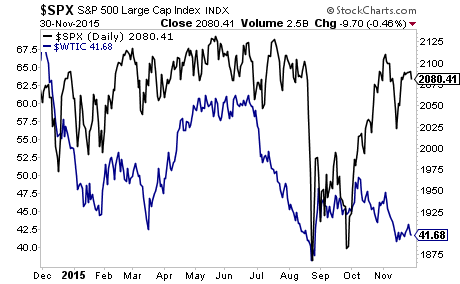

The S&P 500 has completely disconnected from most risk assets, driven by the usual manipulation during options expiration week, performance gaming by hedge funds before end of the month results are posted, and short covering.

Stocks are now disconnected from leveraged loans:

High yields bonds iShares iBoxx $ High Yield Corporate Bond (N:HYG):

Copper, the commodity with a PhD in economics:

Etc.

In simple terms, virtually no other asset class on the planet is confirming the move higher in the S&P 500. This has all the hallmarks of a dead cat bounce. What’s coming won’t be pretty.

Smart investors are preparing now. The August-September correction was just a warm up. The REAL drop is coming shortly.