Markets hate uncertainty. Washington loves to create uncertainty since it provides leverage in political negotiations.

From Bloomberg

The Senate likely will not vote on a stopgap spending bill until this weekend, leaving the House just one full workday to act before spending authority for the federal government expires on Oct. 1. The House and Senate are at odds over language that withdraws funding for the 2010 health-care law. On another fiscal front, Treasury Secretary Jacob J. Lew told Congress yesterday that the extraordinary measures being used to avoid breaching the debt ceiling “will be exhausted no later than Oct. 17.” Failure to increase the debt limit could lead to a downgrade of the U.S. government’s credit rating.

Fear Is Increasing, But Not Significantly

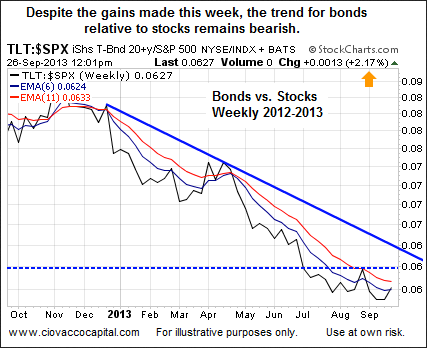

While there is no question the political drama in our nation’s capital is a negative for stocks, will it derail the bull market in stocks? Obviously, it is too early to definitively answer that question, but we can monitor the market’s current temperature using risk-on vs. risk-off ratios. The weekly chart below shows the demand for Treasuries (TLT) relative to stocks (SPY). The orange arrow highlights the impressive outperformance of bonds this week. However, the gains in TLT this week have not been enough to change the look of the weekly demand profile, which says bonds have some work to do to flip the playing field back to risk-off.

Economic Data Not Shouting “Imminent Recession”

Could the political process in Washington spark a correction or pullback in stocks? Sure it could, but studies of similar historical cases show the markets tend to stay focused on the bigger picture.

From The Wall Street Journal

The S&P 500 is riding a five-day losing streak, its longest of the year. But history suggests a stock selloff prior to important deadlines in the nation’s capital is actually par for the course.Stocks have tended to drop in the 10 trading days before a potential government shutdown and then rebound in the 10 days after a shutdown resolution was reached, according to Deutsche Bank forex strategist Alan Ruskin, who analyzed 17 instances dating back to 1976. He’s in the camp that says stock investors should use any future dips as buying opportunities. If the focus shifts back to the economy, the news on that front has continued to be strong enough to discount the imminent recession threat.

From Bloomberg:

The economy expanded at faster pace in the second quarter from the previous three months, a sign the U.S. was weathering federal budget cutbacks and higher taxes. Gross domestic product rose at a 2.5 percent annualized rate, unrevised from the previous estimate, after expanding 1.1 percent in the first quarter, Commerce Department figures showed today in Washington. The median forecast of economists surveyed by Bloomberg was a 2.6 percent pace.

Heyday For Bonds May Be Over

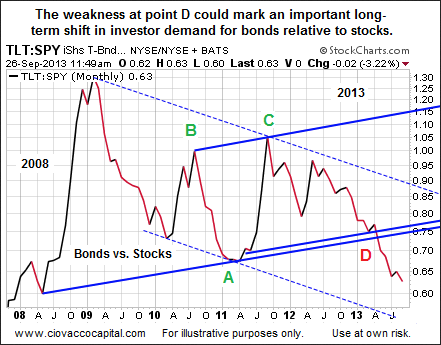

The monthly chart below (2008-2013) shows the demand for Treasuries (TLT) relative to stocks (SPY). The chart is busy, but the concepts are easy to follow if we examine them in isolation. Points A, B, and C define an upward-sloping and bullish trend channel for TLT relative to SPY. Point D shows a bearish break of the rising trend channel, which could mean more pain is ahead for bonds relative to stocks over the next several months/years.

Investment Implications

The fear of a government shutdown, thus far, has not resulted in meaningful damage to the bull’s grip on the market’s pricing mechanism. As we noted in this video segment, trying to predict the future actions of millions of market participants is a tall order. However, monitoring their collective tolerance for risk is very doable, which is exactly what our market model does. If an observable shift occurs in the demand for risk-off assets, such as TLT, relative to risk-on assets, such as SPY, we will reduce our exposure to U.S. (VTI) and foreign stocks (EFA). Should the market weather the budget-battle storm, we will continue to maintain our present course.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is The Market Tipping A Bearish Hand?

Published 09/26/2013, 02:00 PM

Updated 07/09/2023, 06:31 AM

Is The Market Tipping A Bearish Hand?

Bears Have Allies In Washington

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.