Is U.S. crude oil production really at record highs?

Or is the EIA’s estimate out-of-whack with what’s happening on the ground, especially with the collapse in oil drilling rigs that we’ve been seeing week after week?

It’s a fascinating question that pops up every now and then, and for good reason too.

'The Most Closely Watched Oil Report In The World'

As Keith Schaefer of Oil & Gas Investments pointed out when the question surfaced three years back, the weekly supply-demand report by the Energy Information Administration is the most closely watched oil report in the world.

Issued at 10:30 AM ET each Wednesday, the report moves energy prices across the board unveiling stockpile levels for U.S. crude oil, as well as fuel products like gasoline and distillates.

Aside from inventory numbers in its main summary text, the EIA report contains a Petroleum Balance Sheet that breaks out crude balances according to the different U.S. zones.

Within that is an entry for stockpiles at the Cushing, Oklahama delivery point for the West Texas Intermediate crude futures contract.

The Cushing numbers typically are market-moving, and the accompanying figures on crude imports and exports can also have an impact.

Production Estimate: The Most Controversial Data

But, perhaps, the most important statistic in the Petroleum Balance Sheet is the EIA’s weekly estimate on crude production. It is possibly also the most controversial of the lot.

Ever since the U.S. shale oil boom took off in 2014, before slumping spectacularly in 2016 as the crude price crash led to the bankruptcies of dozens of oil drillers, the weekly production published by the EIA has time and again been a source of dispute—particularly with oil bulls, who feel the number is overinflated and lacks realistic correlation to drilling activity.

It must be stressed that this crude output number cited by the EIA each week is an estimate; nothing more, nothing less.

Schaefer of Oil & Gas Investments noted that it is “a fully-modeled estimate; which is a fancy way of saying it actually contains no new data from the previous week.”

Yet, it’s a number published by the custodian of the world’s most transparent and researched data on oil production and storage. And there is no other competing or authoritative data of its kind. Therefore, the market accepts it as the truth.

That isn’t a bad thing, only that the EIA production number now is flying in the face of another highly respected weekly report on drilling rigs issued by Baker Hughes, an oilfield services company with a sterling reputation as well.

EIA’s Record High Production Estimate Jars With Baker Hughes’ Sliding Rig Count

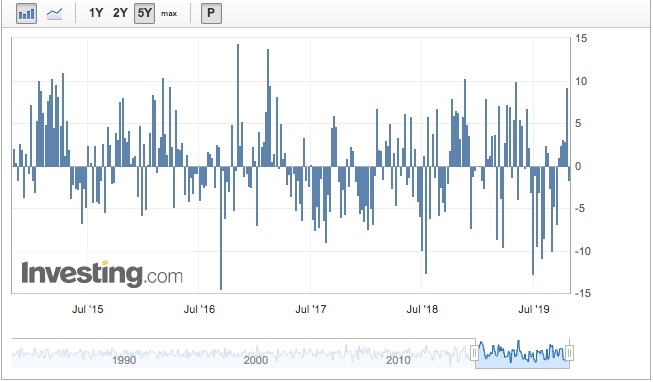

Baker Hughes weekly data from last Friday shows there are just 696 actively-drilling oil rigs now, the lowest since April 2017. The EIA’s estimated production, meanwhile, stands at a record high 12.6 million barrels per day—unchanged for three weeks now.

Based on Baker Hughes’ historical rig count rates, there are 56.7% fewer drilling rigs now since October 2014. But these rigs are producing an additional 3,725,000 barrels per day of oil—or 42% more—than they did five years ago.

If the EIA and Baker Hughes are both right, then the efficiency for oil drilling in the U.S. has jumped by more than three-fold in just five years, with 18,103 bpd coming out of one rig now versus 5,515.85 bpd in October 2014. Some analysts have trouble believing that.

Phil Flynn of the Price Futures Group in Chicago, who typically holds a bullish bias towards oil, is aghast that the EIA’s crude production estimate has been stuck at a record 12.6 million bpd for three weeks in a row, when shale production activity as a whole has been plummeting.

Said Flynn:

“We think that U.S. crude production will have to be adjusted downward. Lower rig counts and shale bankruptcies are taking their toll as many shale producers are figuring out that if you are losing money on every barrel, you can not make up for it in volume.”

If the weekly production published by the EIA is in dispute, what’s the next most authoritative number/source the market can turn to?

The answer, as you have it, is the Petroleum Supply Monthly report which, ironically, is also from the EIA.

Schaefer of Oil & Gas Investments once again answered why this is so:

“The monthly data has real data, and … is incredibly accurate. You can take those monthly numbers to the bank almost every month.”

It All Adds Up, Whether You Believe It Or Not

Schaefer conceded that over time, the EIA may overestimate, or even underestimate, weekly production given market dynamics. But the agency usually smoothes out the difference as each month concludes.

To make his point, Schaefer averaged out daily production from the monthly data published by the EIA across 2017.

The conclusion? He arrived at numbers that closely aligned with the weekly output estimated by the EIA.

We did the math at Investing.com too, just to be sure, taking the most recently available monthly production number—July’s 365,992,000 barrels—and dividing it over 30 days. The rounded-up answer was 12.2 million bpd.

The EIA’s weekly production estimate at end-July?

Also 12.2 million bpd.

We rest our case.