Key Points:

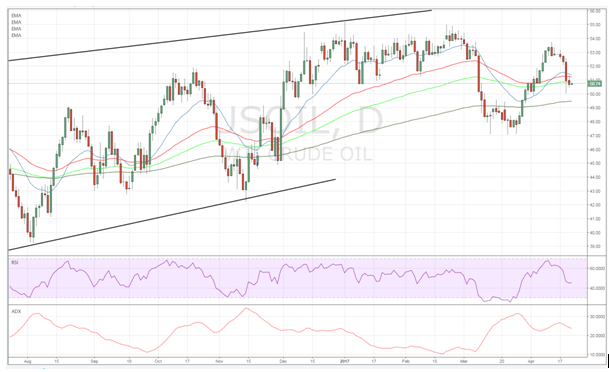

- Price action fails to breach $50.00 handle and short move is stalled.

- 100 day MA and key support zone is limiting downside moves.

- Watch for a bounce towards the $51.90 target in the coming week.

The past few days have seen the price of crude oil (WTI) collapsing towards a major support zone around the $50.00 handle. The move was relatively obvious given the fact that price action failed to break through resistance at $53.74 leading to a sharp rejection and sentiment swing to the short side. Subsequently, traders largely piled in to short positions but with WTI prices having now reached the $50.00 level its worth asking if the trade is now over crowded.

The reality is that crude oil prices are reacting to not just technical factors, but also a range of shifting fundamentals with OPEC chief amongst them. Subsequently, given that oil prices remain strongly within an ascending channel, the downside was always likely to be limited especially when OPEC is countering falling prices with a potential extension to their present supply cuts. Therefore, the short side push was only ever likely to take the commodity to striking distance of the $50.00 handle.

Currently, the large institutional money (smart money) is winding back its short positions and looking for some gains in crude oil prices in the coming week. Subsequently, the net positioning is shifting long and the initial signals early on Friday is one of some upward pressure. This is especially prescient given that price action is currently sitting right on the 100 day MA, as well as key support zone.

In addition, rumours are currently swirling that the next OPEC meeting in May could bring about an extension of the current supply freeze and even potentially further cuts to world OPEC supply. Given that OPEC leaks like a barbed wire canoe it is no surprise that this information is permeating markets.

Subsequently, the production cut rhetoric is significantly limiting any further downside moves, from a fundamental perspective. Whether OPEC actually follows through with the purported cuts is another question but the risks are certainly slanted to the upside given many members needs for a higher oil price to balance their domestic books.

Ultimately, the short trade has now become overcrowded and any further decline below the $50.00 handle in the short term is unlikely. Additionally, the technical indicators are also suggesting another bullish wave higher given that price action rests at the junction of the 100 day MA and some key support. Subsequently, the most likely scenario for the week ahead is some sideways consolidation before a break back above the $51.00 handle and appreciation towards our short term target of $51.90 a barrel.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.