Last week my post concentrated on prime interest rates' relationship with the economy - and showed there was a general lack correlation between economic growth and the prime interest rates. With over 2/3rds of the USA economy driven by the consumer - it seems to me the real question is what is wrong with the consumer?

Follow up:

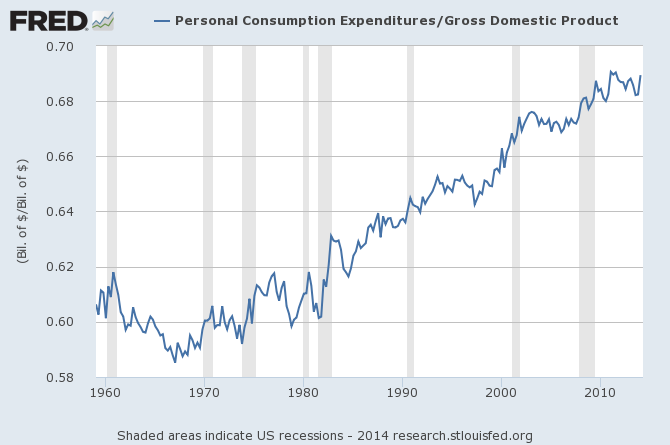

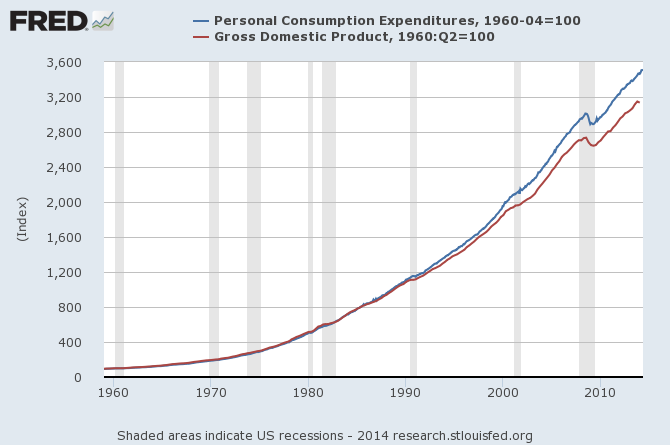

The graph below, showing the ratio of Personal Consumption expenditures to GDP - shows that the consumer has been been a growing driver of the economy - however, the growth rate appears to be stagnant since the end of the Great Recession.

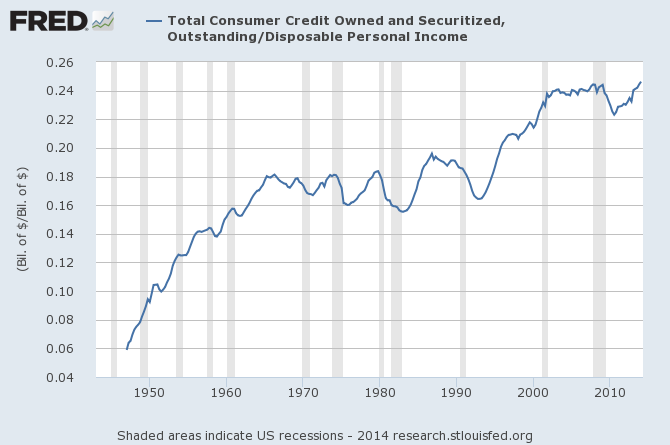

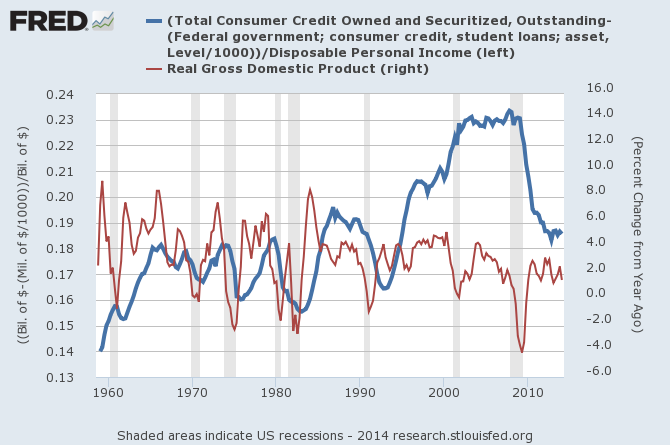

So it should follow if economic growth is slow, then it is not the government or business that is slacking - but the consumer. Testing the level of debt in various periods, the below graph looks at the total debt load as a ratio to Disposable Personal Income. Note that home mortgages are NOT included in this data set.

It appears consumer credit as a percentage of income is at an all time high. Below is the same data set removing student loans.

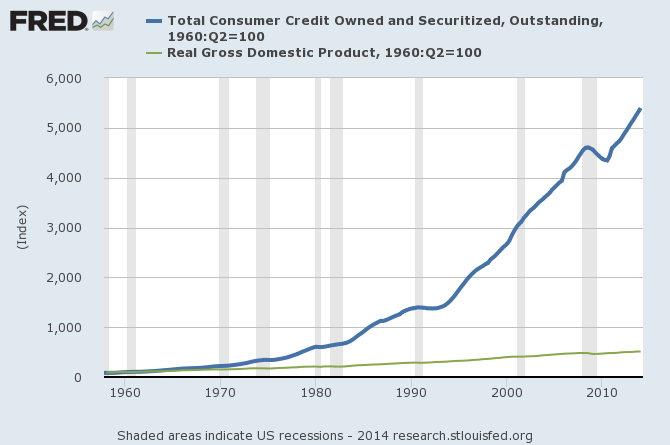

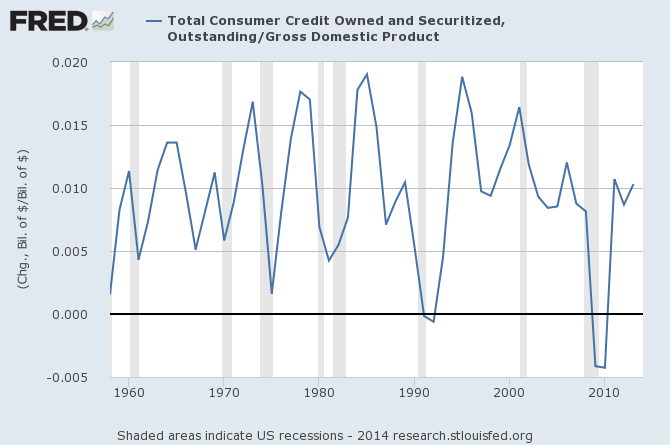

It appears that after removing student loans (blue line), the current consumer debt levels may not be excessive. But consider that consumer loans outstanding are growing at a rate over ten times the rate of GDP growth. It is likely that at this large of differential of rates of growth - the USA has passed or will pass the debt tipping point (where private debt slows economic growth).

Consider:

- When a consumer borrows money to buy a product, it adds to GDP today - but will reduce the consumption in the future as the consumer repays the loan. The year-over-year growth of consumer credit would account for approximately 1% of GDP growth.

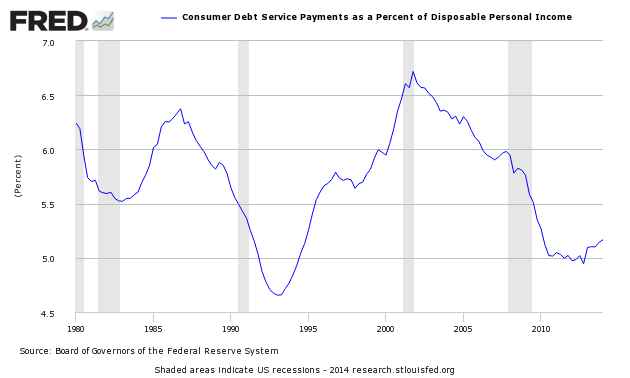

The percent of consumer disposable income used to repay consumer loans (not including mortgages) is historically low because of the moderation in interest rates. My takeaway is that consumer debt is not overpowering the consumer in general.

I cannot correlate consumer debt levels or flow to economic activity (expressed as GDP) unless I cherry pick time frames or data series. Still the growth of the USA economy is not outstanding - and consumption is the reason. Here are my final thoughts in graphs:

- Since the mid-1980s, the consumption rate of growth has been faster than the general rate of growth of GDP.

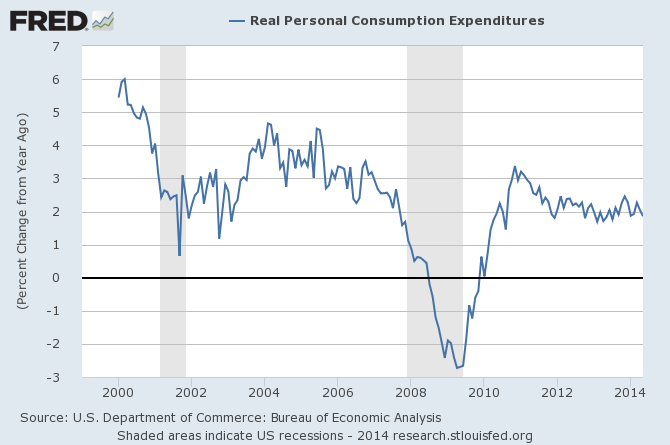

Currently the rate of growth of consumption is almost 2% lower than the periods proceeding the Great Recession

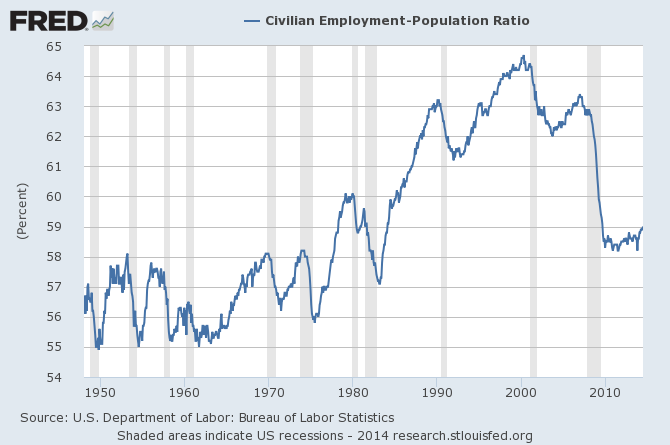

Disposable income and consumption expenditures go hand in hand. It is no stretch of imagination to understand that income growth is lagging at the rate of 2% per year. The overwhelming reason is that the population not working is 4% larger compared to the period before the Great Recession. Even job growth at minimum wage would help the economy grow.

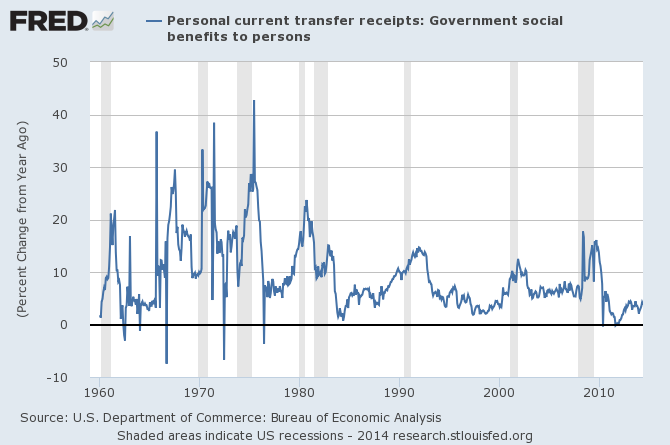

Listening to the press, there is a perception of huge growth in safety nets (government benefits to the lazy sods) - currently the growth rate of transfer payments is on the low side historically.

Job growth is a lagging economic indicator. However, it is also true that lack of jobs constrains economic growth - a situation we are facing today.

Other Economic News this Week:

The Econintersect Economic Index for July 2014 is showing continued growth acceleration. Outside of our economic forecast - we are worried about the consumers' ability to expand consumption because the ratio between income and expenditures continues near all time highs. The GDP contraction for 1Q2014 is a paper contraction as GDP is determined by playing games with accounts. For 2Q2014 GDP, the trade balance will be a serious headwind.

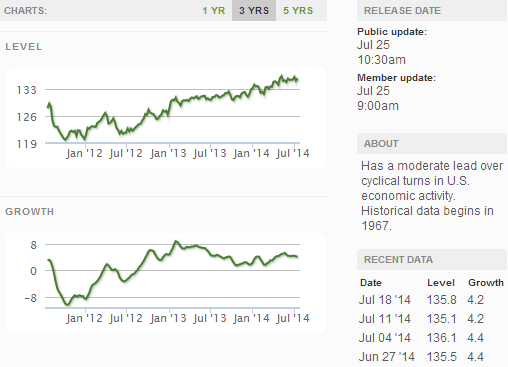

The ECRI WLI growth index value has been weakly in positive territory for many months - but now in a noticeable improvement trend. The index is indicating the economy six month from today will be slightly better than it is today.

Current ECRI WLI Growth Index

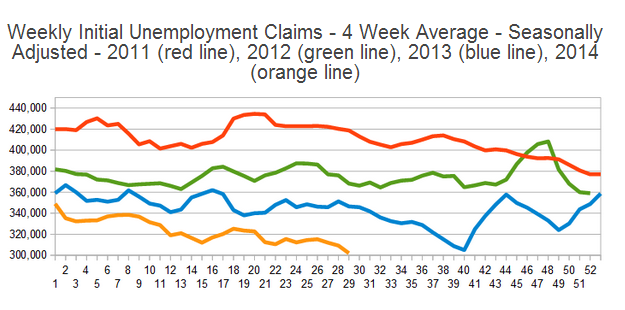

The market was expecting the weekly initial unemployment claims at 305,000 to 320,000 (consensus 310,000) vs the 284,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 309,250 (reported last week as 309,000) to 302,000.

Weekly Initial Unemployment Claims - 4 Week Average

Bankruptcies this Week: None

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: