The Cable has been relatively volatile over the past few weeks as the currency has been buffeted with a range of increased BREXIT talk and sliding economic indicators. Subsequently, as the pair narrows in on the key 100-Day MA point a review of the week ahead is highly salient.

The Cable had a strongly negative week as the pair reacted to a range of disappointing UK economic data points. Primarily, the UK Manufacturing PMI fell sharply into contraction from 51.0 to 49.2 and this commenced a general sell off of the pound. In addition, the Services PMI also proved disappointing at 52.0 (54.0 prev) which helped fuel the selling. Ultimately, much of the selling was due to increasing rhetoric around a BREXIT with the latest news pointing to renewed contingency planning by the Bank of England.

The week ahead is likely to be relatively volatile for the Cable as the pair faces a decision on interest rates from the Bank of England. The eminent forecast is that rates are likely to remain on hold at 0.50%, however, the MPC statement following the decision will be closely watched by markets. Any move towards the dovish side of the road could see the pair reeling and sharply challenging the downside. In addition, Friday sees a bevy of US economic indicators due out, including the critical core retail sales data. Subsequently, the week is likely to remain a busy one for the embattled pair.

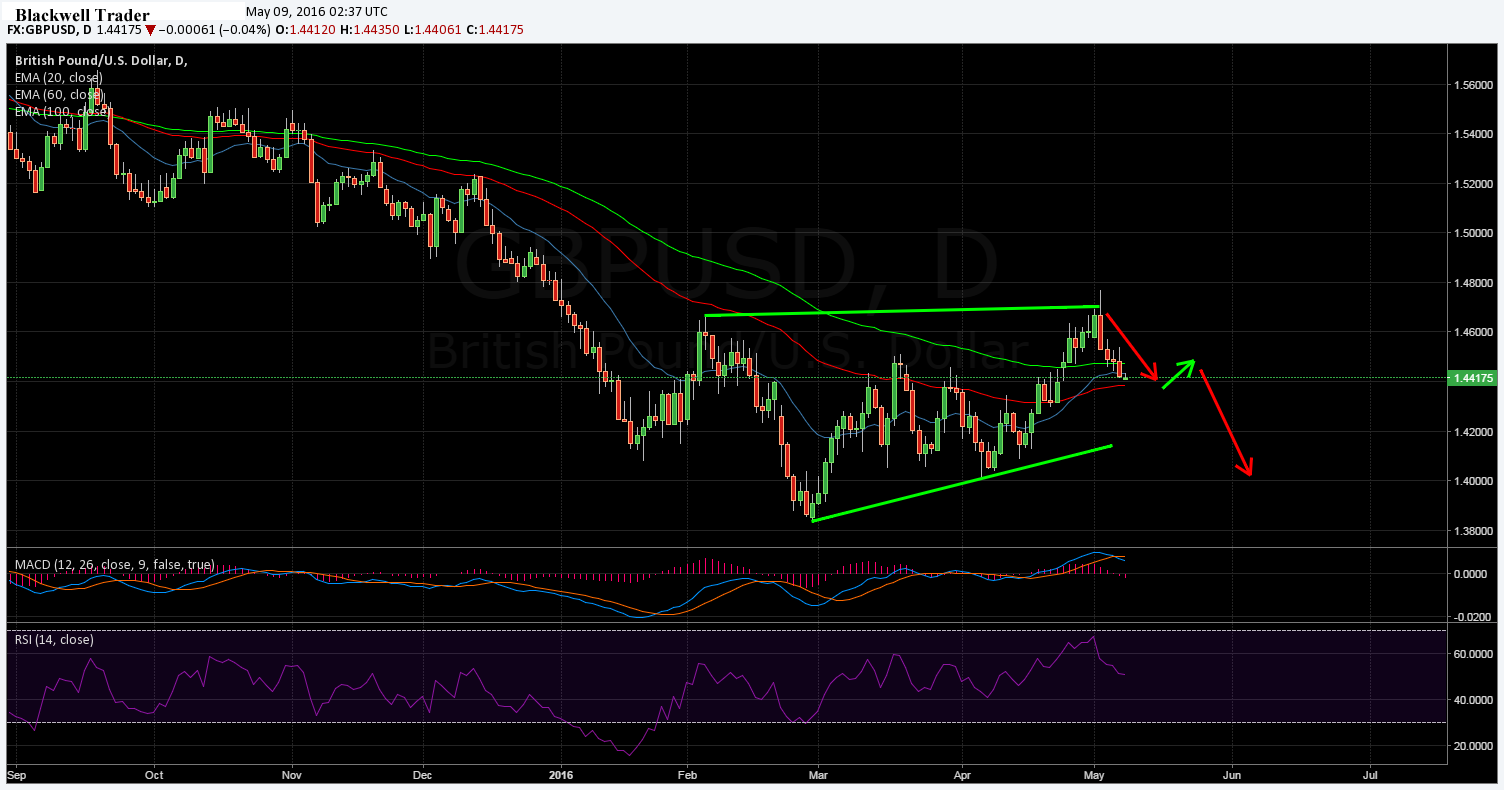

From a technical perspective, the Cable remains largely bearish and is currently challenging the 100MA. A close below this key level could signal a significant pullback towards the 1.40 handle is ahead. In addition, the RSI Oscillator is also trending lower, away from overbought territory, and still has plenty of room to move on the downside. Subsequently, our bias remains bearish for the Cable as a move lower appears the likely direction.

Ultimately, the next few days are likely to be a critical inflection point for the Cable as a break below the 100-Day moving average would precipitate a sharp pullback towards support around the 1.40 handle. Subsequently, keep a close watch on the pair during the release of Wednesday’s Manufacturing Production figures as a weak result could cause a convincing break to the downside.