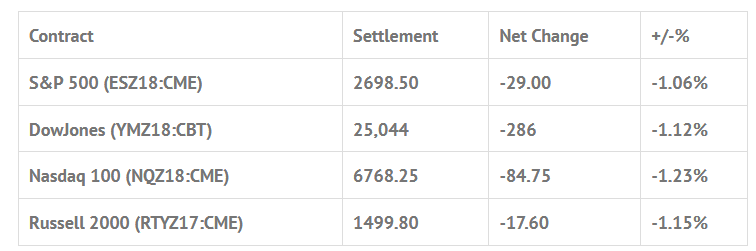

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Comp +1.36%, Hang Seng +1.75%, Nikkei -0.20%

- In Europe 9 out of 13 markets are trading lower: CAC -0.17%, DAX +0.19%, FTSE +0.16%

- Fair Value: S&P +1.28, NASDAQ +11.17, Dow -2.55

- Total Volume: 2.28mil ESZ & 830 SPZ traded in the pit

As of 8:00 AM EST

Today’s Economic Calendar:

Today’s economic calendar includes Weekly Bill Settlement, Jobless Claims 8:30 AM ET, Philadelphia Fed Business Outlook Survey 8:30 AM ET, Retail Sales 8:30 AM ET, Empire State Mfg Survey 8:30 AM ET, Import and Export Prices 8:30 AM ET, Business Inventories 10:00 AM ET, Randal Quarles Speaks 10:00 AM ET, EIA Natural Gas Report 10:30 AM ET, EIA Petroleum Status Report 11:00 AM ET, Jerome Powell Speaks 11:00 AM ET, Raphael Bostic Speaks 1:00 PM ET, Neel Kashkari Speaks 3:00 PM ET, Fed Balance Sheet and Money Supply 4:30 PM ET.

S&P 500 Futures: #ES 2700 Retest, And More…

The S&P 500 futures sold off down to the 2711.00 area on Globex Tuesday night, down 16 handles, but rallied all the way up to 2746.50 before yesterday’s 8:30 CT futures open. The first print of the day came in at 2743.75, up 16 handles. After the open the futures pulled back to 2740.50, rallied up to 2748.50, and then reversed lower when the NQ sold off. Initially, the ES broke down to 2727.25, rallied back above the vwap up to 2735.25, and then sold off all the way down to 2705.50 at 10:43 CT.

After making the low, the ES rallied up to 2717.25, and then ‘flunked’ back down to the low at 2705.50, rallied up 2719.00 then sold off again down to a new low at 2704.00. The next move was a up to 2713.50, and then in came a series of lower lows all the way down to 2698.25. After several more rips and dips, the futures tanked down to 2686.25, popped up to the 2708.00 area, pulled back a little, then got hit by a big buy stop run that pushed the ES backup to 2717.00 just before 2:00.

After another small pullback, the futures traded up to 2723.50, and at 2:20 sold back off down to 2715.50 as the MiM started to show over $500 million for sale, then down to 2709.50 as the MiM went to $464 million to sell. The ES traded 2709.50 on the 2:45 cash imbalance reveal, as the MiM flipped to $23 million to buy, to $1 milion to buy. The futures wen on to trade 2703.75 on the 3:00 cash close, and settled the day at 2698.75 on the 3:15 futures close, down -28.75 handles, or -1.05% on the day.

In the end it was all about margin selling tied to the November options expiration. In terms of the markets overall tone, the ES did rally late in the day, the NQ actually went positive for a few seconds, but the late push back down was not a good sign. In terms of the days overall trade, 2.28 million ES contracts traded which, is pretty much inline with the big down days we have been seeing, maybe a little on the light side, but still high.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.