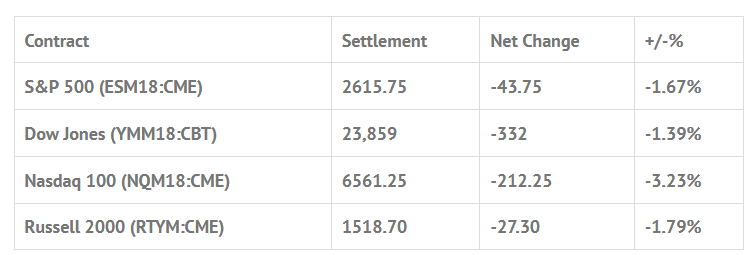

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 11 out of 11 markets closed lower: Shanghai Comp -1.40%, Hang Seng -2.50%, Nikkei -1.34%

- In Europe 10 out of 12 markets are trading lower: CAC -0.68%, DAX -0.57%, FTSE +0.02%

- Fair Value: S&P +0.51, NASDAQ +14.61, Dow -20.94

- Total Volume: 2.4mil ESM, and 1.3k SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Bank Reserve Settlement, MBA Mortgage Applications 7:00 AM ET, GDP 8:30 AM ET, International Trade in Goods 8:30 AM ET, Corporate Profits 8:30 AM ET, Retail Inventories 8:30 AM ET, Wholesale Inventories 8:30 AM ET, Pending Home Sales Index 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, Raphael Bostic Speaks 11:30 AM ET, and Farm Prices 3:00 PM ET.

S&P 500 Futures: #NQ Down -3.15%, Social Media Kills The Upside Party

Tuesday night, Asian markets rallied, the Nikkei closed up 2.7%, Shanghai closed up 1.4%, and the Korean Kospi gained 0.6%. In Europe, the Stoxx 600 made back all of Monday’s losses, and was up 1.3%.

After closing up 2.7% on Monday, the S&P 500 futures leapt up to 2679.75 on Globex Tuesday morning, and then sold off down to 2667.00 just before the open. The ES traded 2670.50 on the 8:30 CT bell, and immediately sold off down to 2656.25. As Facebook (NASDAQ:FB) and Twitter continued to tumble, so did the ES. Just after 2:00 the futures traded all the way down to 2619.25, 60.50 handles off its Globex high, and 51.25 handles off its opening print.

I could do all the ups and downs, but it was one sell program after another.

The MiM opened up flat, and slowly increased to $862 million to sell. After the release of the imbalance the ES sold off down to 2596.00 at 2:48, and then rallied up to 2614.60 at 2:52:28, an 18.50 handle move in less than 5 minutes. On the 3:00 cash close the ES printed 2615.75 and ended the day down -44.50 handles, or -1.67%. The Nasdaq, which rallied 50 points off its lows, closed down -213 points, or down -3.15%.

In the end, there has been a big uptick in algorithmic and hft trading in 2018, and it has a lot to do with the jump in volatility and all the headline news. Is this type of market price action going to stop anytime soon? We don’t think so!

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.