Prepare to hear/read this question at least 5x this week and the next..."Is the Bottom In?

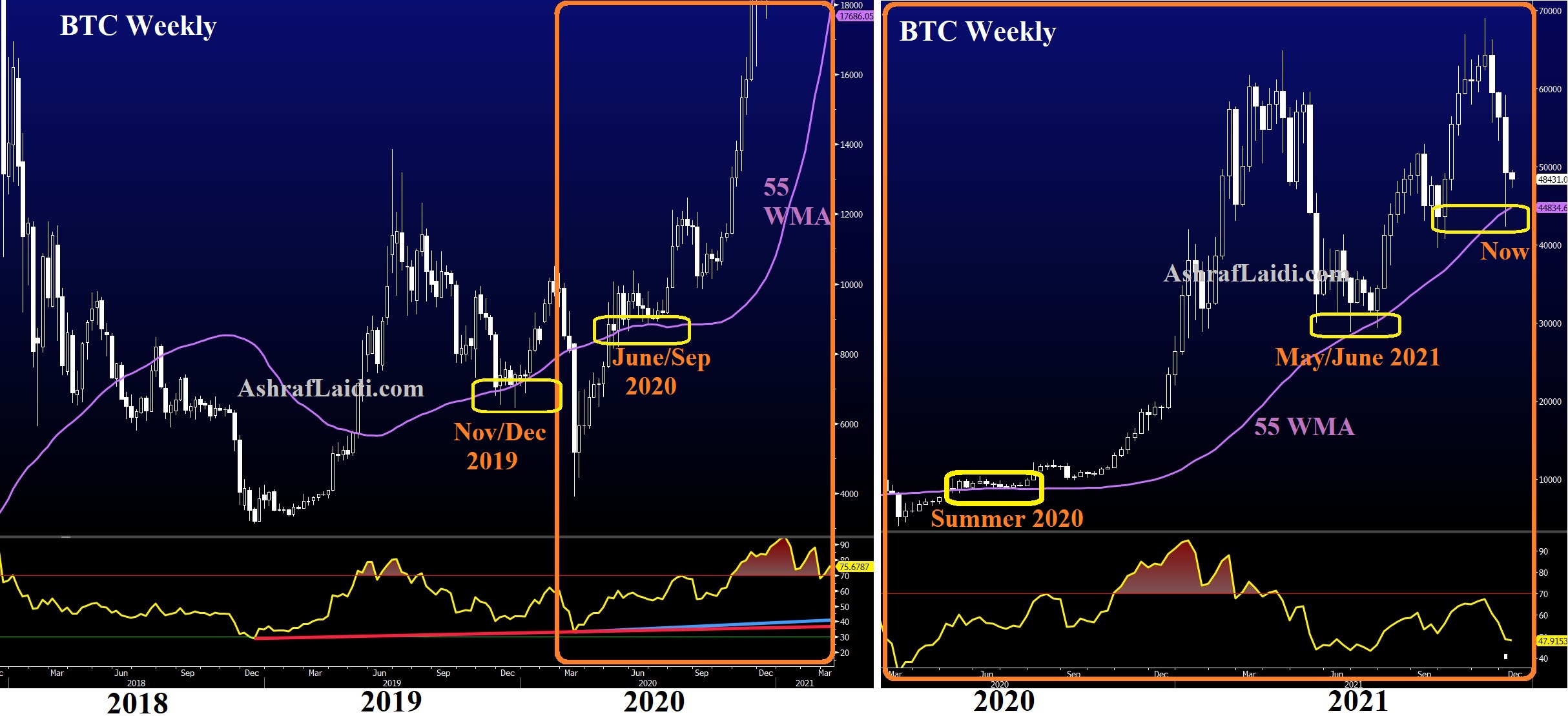

Bitcoin respected the 55-WEEK MA as did the Dow Jones Industrials Index, which held above its 200-DAY MA while the S&P 500 bounced off its trendline support from the late September low.

What about gold's trendline support at 1760...or the horizontal support on the 10-year yield at 1.38%—in line with the 100-DMA.

Figuring out all of these levels make us appear astute and especially clever when they're all in synch. But the challenge lies with the repetitive manner these levels will likely have to be tested, just as we saw in the SPX bottom of late Sep/early Oct. Back then, the index re-tested its 100-DMA at least 4x before mounting a 450-pt ascent in a mere 7 weeks.

All of the aforementioned markets are sure to retest their recent levels sometime this week (US CPI report due Friday) and most likely next week when the Fed, BoE and ECB all decide on QE and interest rates.

One thing we learned during the lows of late September/early October is to look beyond wicks and focus on the cash close. Whether you're bullish or bearish, make sure to exercise extra caution ahead of next week—considered one of the most important weeks of the year.

Earlier today we told the WhatsApp Broadcast Group we were long the DOW30 based on the VVIX/VIX technicals. I've explained how to use/read the VVIX/VIX in a detailed video here and will make sure to do an update very soon.