Investing.com’s stocks of the week

Over the past couple of years, investors have been robbed of opportunities if they have owned the banks, which have under-performed the broad markets for the last 18 months.

Is that trend about to change?

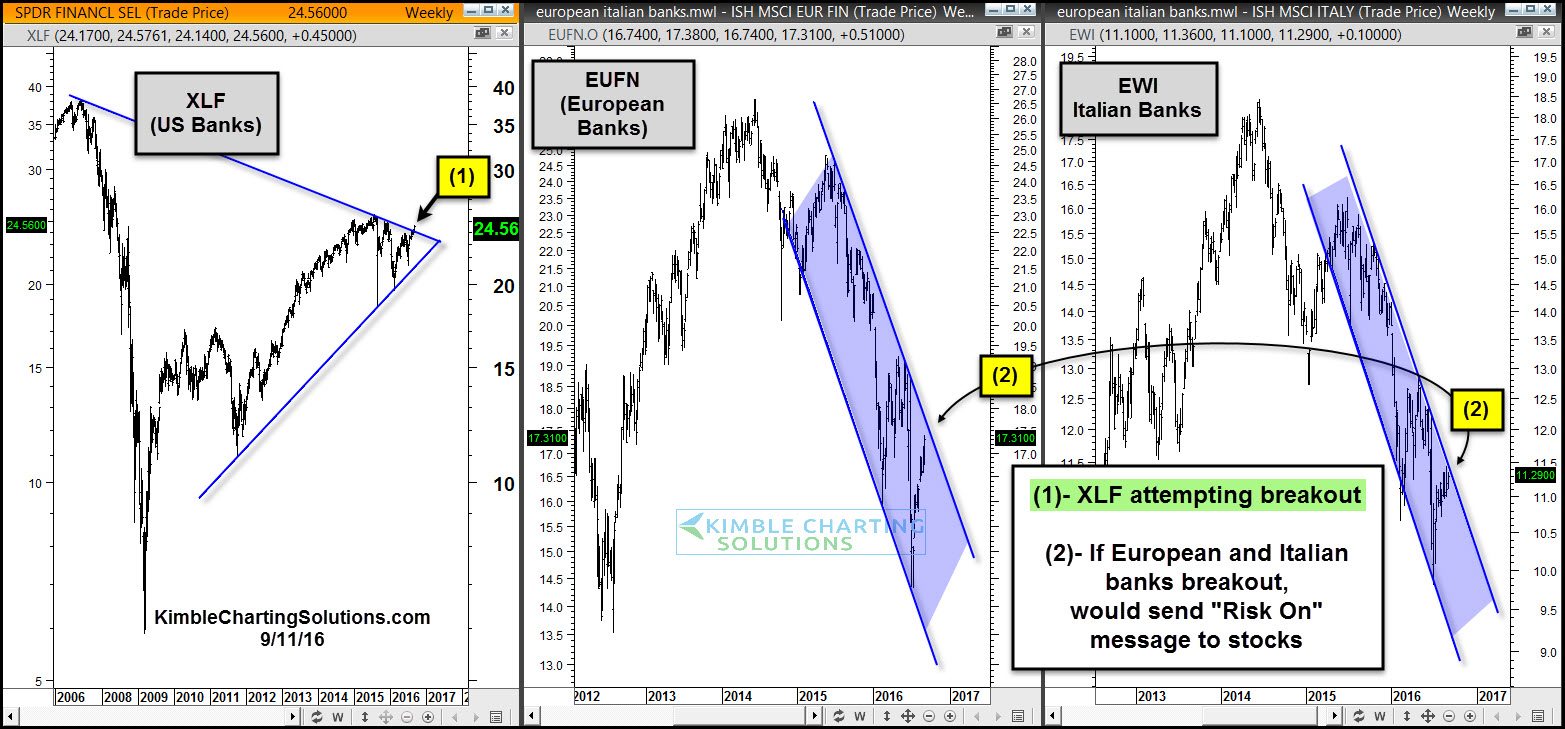

Below looks at Banks in the XLF, EUFN and EWI.

The U.S. looks to be forming a multi-year pennant pattern and trying to breakout at (1) above. The other two charts look at banks in Europe and Italy, which show both inside of uniform falling channels.

For Europe and Italian banks to send a risk-on message to banks and the broad market in general, they need to breakout above falling resistance at (2).

We think that portfolio construction between now and the end of the year will be greatly influenced by the price action of these bank ETFs.

Financials were one of the best-performing sectors last month, while the broad market was quiet. Most quality bull markets in stocks have seen banks going along for the ride. What EUFN and EWI do at (2) should have a big impact on whether the S&P 500 can solidly breakout above the 2,150 resistance zone.