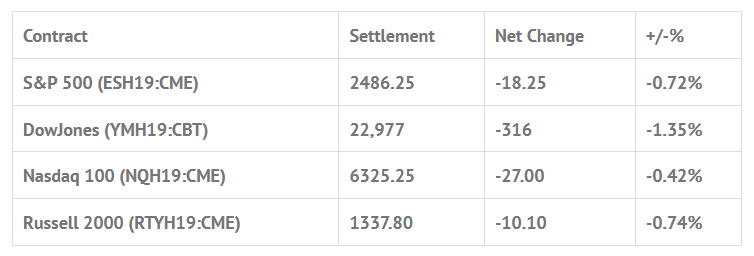

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Comp -0.79%, Hang Seng +0.51%, Nikkei -1.11%

- In Europe 13 out of 13 markets are trading lower: CAC -0.42%, DAX -0.29%, FTSE -0.29%

- Fair Value: S&P +0.99, NASDAQ +18.18, Dow -9.59

- Total Volume: 3.67mil ESH & 933 SPH traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes the Dec Quadruple Witching, Durable Goods Orders 8:30 AM ET, GDP 8:30 AM ET, Corporate Profits 8:30 AM ET, Personal Income and Outlays 10:00 AM ET, Consumer Sentiment 10:00 AM ET, Kansas City Fed Manufacturing Index 11:00 AM ET, and the Baker-Hughes Rig Count 1:00 PM ET.

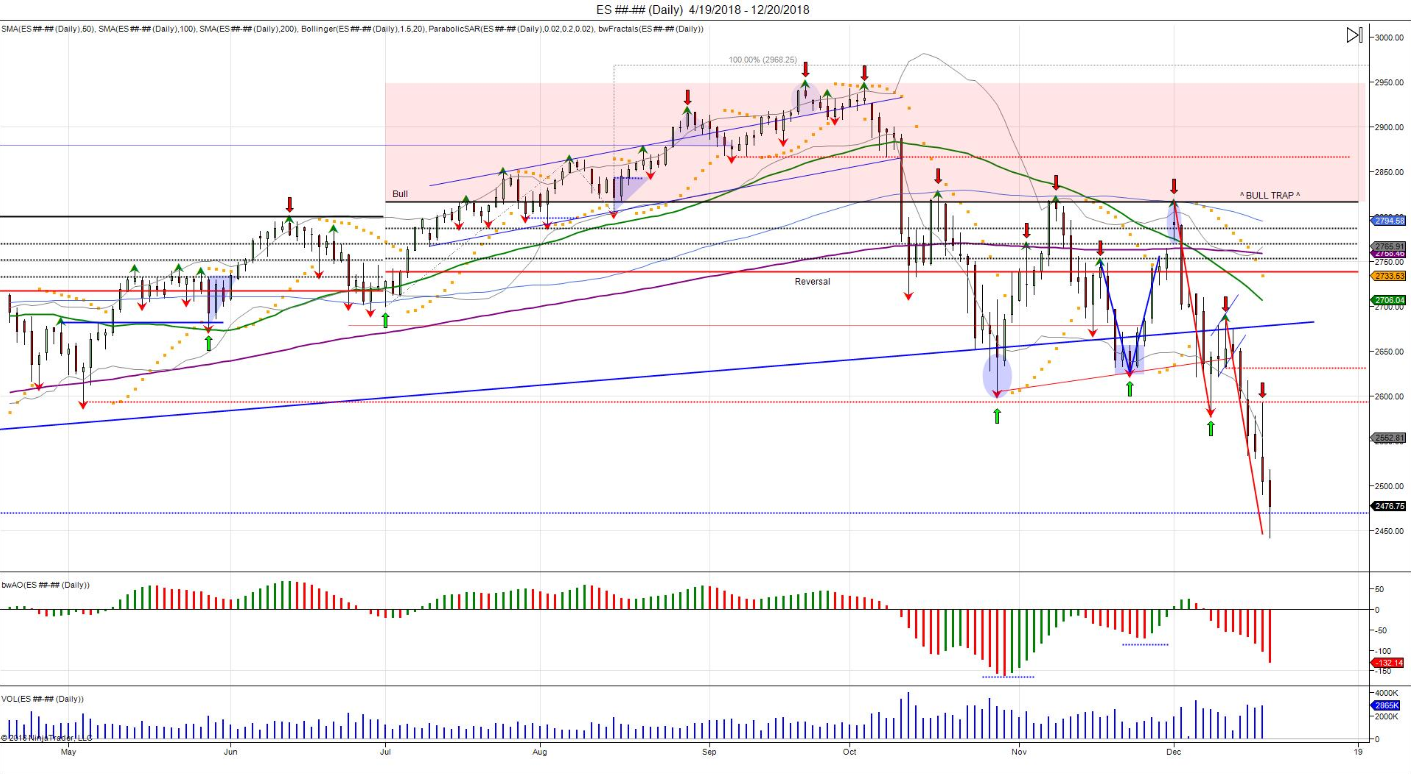

S&P 500 Futures: Down And Out In Beverly Hills #ES2441

After trading modestly higher during the overnight session, the S&P 500 futures opened yesterday’s cash session as 2494.25, and traded up to an early morning high of 2503.75. From there, selling pressure stepped up, taking the ES down to an early morning low of 2784.25 just before 9:00. After that, the ES bounced to a mid-morning high of 2512.00, and following a 17.50 handle pullback, traded to a late morning high of 2511.25. The failed retest of the high opened the door for lower prices, as the benchmark futures sold off down to a new low of day, finishing the morning with a low of 2463.25 before bouncing up to 2487.75.

In the afternoon, an additional wave of selling hit pulling the ES back to new lows, printing 2441.50, and what would amount to the low of day at 1:15. Strong buying started coming in after the low was set, leading to a sharp rally into the close, with the late afternoon high reaching 2490.25, before retracing 30.75 handles in less than 20 minutes. The ES chopped around heading into the close, as the MiM showed well over $1 billion to sell, with the actual MOC coming out at $3 billion to sell. The futures went on to trade down to 2456.25, and printed 2468.25 on the 3:00 close, before settling the day at 2487.00, down -17.50 handles or -0.70%.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.