Oilfield service giant Schlumberger Limited’s (NYSE:SLB) recent decision to acquire 51% stake in Russian drilling service provider, Eurasia Drilling Company Limited, might hit a rough patch due to the political turmoil between US and Russia. The tensions erupted after new sanctions were imposed by the U.S. government.

About the Sanctions

The latest sanctions against Russia are the result of Moscow’s alleged interference in U.S. elections and target Russian energy export pipelines. The bill of the sanctions received major support from the Congress before it was signed by President Trump in Aug 2017. It bans U.S. entities from providing goods, information, services, technology and support to energy export pipelines of Russia.

Their Impact

Schlumberger applied to the Federal Antimonopoly Service (FAS) of Russia seeking approval for the purchase in Jul 2017, after shareholders of Eurasia Drilling agreed to sell Schlumberger 51% of the total issued shares. However, the new sanctions may create a trade war and affect Schlumberger’s future in Russia.

In this context, we would like to remind investors that several other U.S. oil companies are also facing the uncertainty due to their link with Russia. For example, Chevron (NYSE:CVX) and ExxonMobil (NYSE:XOM) have $37 billion investment lined up for the Tengiz oilfield in Kazakhstan, which uses a Russian pipeline.

The Failed First Attempt

We note that the latest deal is Schlumberger's second attempt to invest in Eurasia Drilling. The company tried to buy 45.65% of Eurasia Drilling's stake for $1.7 billion in 2015. However, FAS objected to the same as the watchdog thought that the deal could help Schlumberger gain control of Russia's biggest oilfield service providing company.

What’s Next?

In the current scenario, Schlumberger will require a special approval from the U.S. Treasury. It’s only after the approval from the U.S. government that FAS will consider the deal. Even if the deal sees the green signal from the U.S. Treasury, Russia's Natural Resources Ministry is likely to impose limits on Schlumberger's ownership due to the industry's strategic importance for Russia. We note that a clause in the deal indicates that Schlumberger will receive full control of Eurasia Drilling after three years of operation.

Importance of the Deal for Schlumberger

Although expanding shale production in North America is driving revenues, Schlumberger is facing pressure in international and offshore operations due to weak oil prices. Low oil price is acting as a hurdle for the company in Europe and Asia. The deal will help Schlumberger to penetrate these markets as it will renew the strategic alliance between Schlumberger and Eurasia Drilling that started in 2011.

Completion of the deal will give Schlumberger access to Russia’s hydrocarbon industry, which has witnessed sustainable capital spending even in a low oil price environment. Also, Schlumberger can receive benefits from Eurasia Drilling's operations that include over 650 offshore and onshore rigs. In the second quarter of 2017, the Russian company had drilled 421 wells.

About the Company

Houston, TX-based Schlumberger is a leading oilfield services company, providing technology, project management and information services to the global oil and gas industry. Schlumberger’s reporting segments can be categorized under four segments: Reservoir Characterization, Drilling, Production and Cameron.

The company currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price Performance

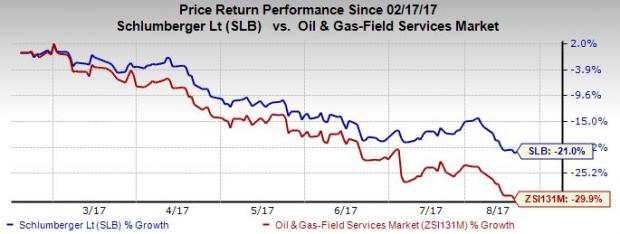

Schlumberger has lost 21% of its value in the last six month compared with 29.9% decline of its industry. Another company operating in this industry is Subsea 7 SA (OTC:SUBCY) .

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Schlumberger N.V. (SLB): Free Stock Analysis Report

Subsea 7 SA (SUBCY): Free Stock Analysis Report

Chevron Corporation (CVX): Free Stock Analysis Report

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

Original post

Zacks Investment Research