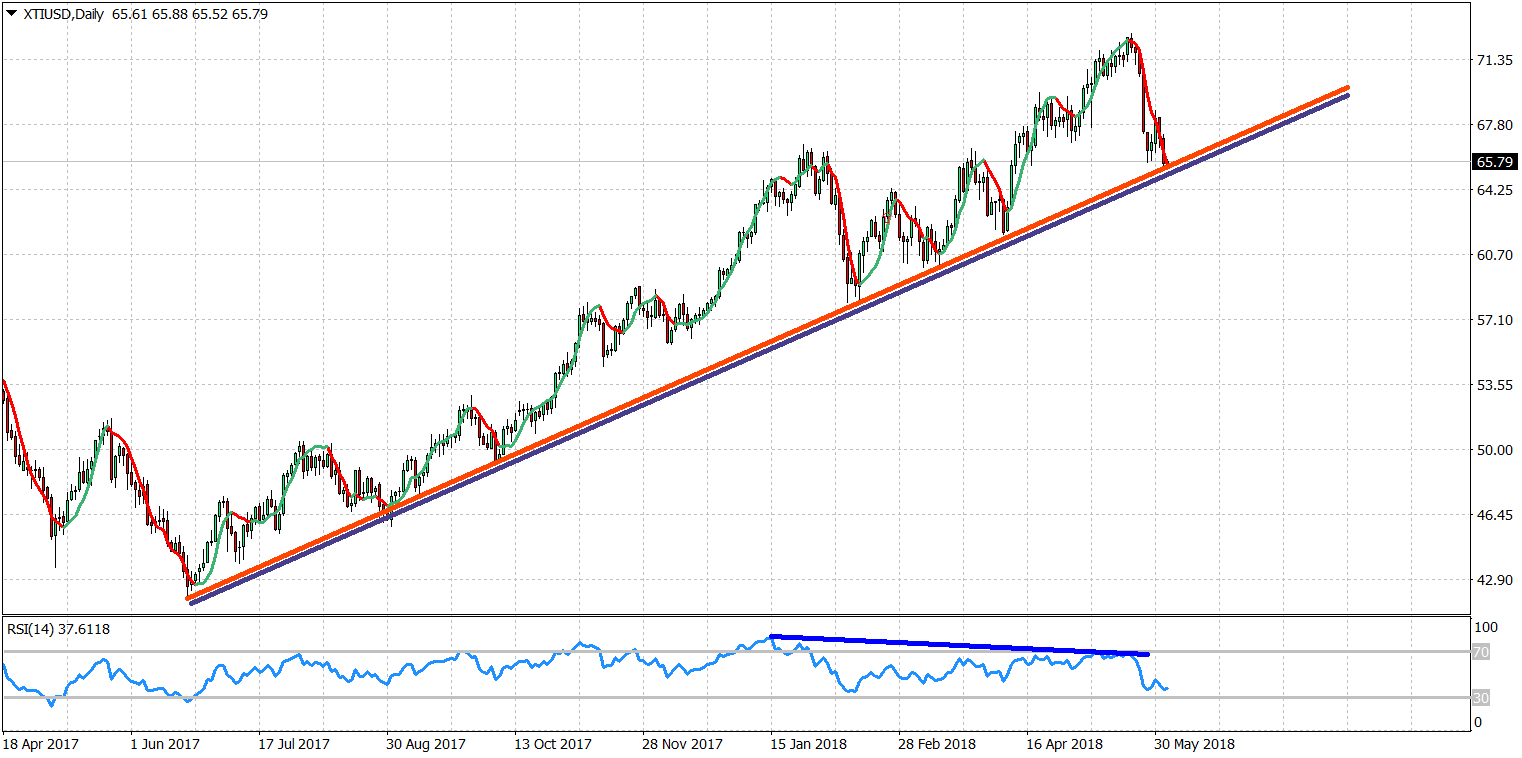

Oil prices have lost more than 7$ the last few weeks and we warned on time with this post, that a pull back was very close with 68-69$ as minimum targets. Oil price has reached the upward sloping support trend lines and we are now starting to initiate longs once again.

Yes there is a chance we see Oil price towards 63-62$ but if we break above 68.60$ the low will be in and the next leg higher for a move towards 80$ will have started. I’m not going full longs at current levels but I only have started building a long position. Gradually and will add at lower support levels or with a break above 68.60$.

Short-term support is at 65.50-65.40$. Break below it and we could see 64.50$. Resistance at 66$. Break it and we could see a move to 66.70$-67.30$. Major resistance as noted above is at 68.60$. Bulls need to break 68.60$ for trend to change back to bullish.

Bears should not get too overconfident now and should look to protect their profits. I’m turning neutral to slightly bullish from bearish.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that June be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.