After coming under intense selling pressure last week, chipmaker NVIDIA (NASDAQ:NVDA) is slipping into a bear market.

The sell-off, which pushed semiconductor sector shares more than 18% lower from their November peak, comes after a stunning rally of the past year. That abrupt pullback, however, has left many investors wondering if this is the right time to buy the stock of the US's largest chipmaker by market cap.

NVDA shares closed on Friday at $272.47, down more than 7% during the first trading week of 2022. This as investors shunned high-growth technology stocks amid concerns that with interest rates headed higher it will be difficult to justify the nose-bleed valuations of these former market darlings.

High-growth stocks are most vulnerable when rates begin to rise because their value relies heavily on future earnings, which analysts discount into current dollars by using prevailing market rates. The higher those rates go, the smaller the current value of those earnings becomes.

According to data compiled by Bernstein, about one-third of all tech stocks were recently trading at more than 10 times their revenues. For comparison, the S&P 500 was valued at 3.2 times sales, according to Bloomberg data.

While the macro outlook is clearly becoming hostile for NVIDIA and other technology names, this pullback may finally offer investors a chance to take a position in a fantastic business that's experiencing explosive growth.

In its most recent earnings report, released in mid-November, the Santa Clara, California-based chipmaker produced record sales and delivered another bullish forecast for the company’s fiscal fourth quarter. That guidance far exceeded analysts' average estimates.

Bullish Consensus Continues

NVIDIA has averaged about 57% revenue growth over the last eight quarters. That performance has helped make it one of the top 10 companies by market value on the S&P 500. And that's made NVDA one of the most loved chip stocks.

The company has topped analyst estimates for earnings consistently over the past five years and has beaten Street revenue estimates for 10 consecutive quarters.

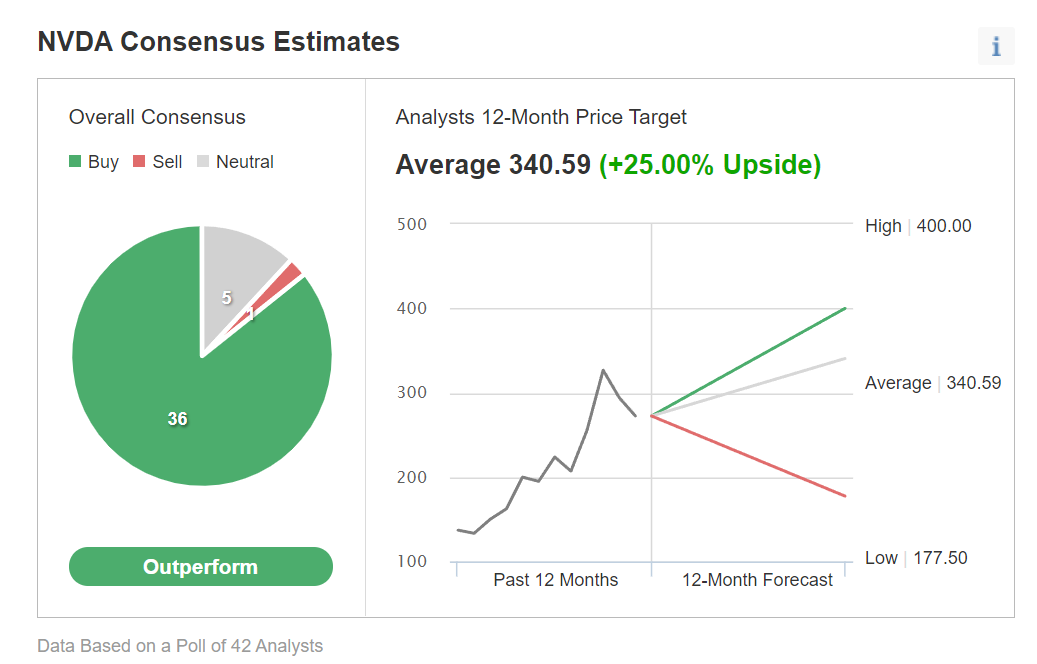

Chart: Investing.com

In a poll of 42 analysts conducted by Investing.com, 36 gave the stock an “outperform” rating with a consensus 12-month price target of $340.59, showing a 25% upside potential from the current market price.

Citibank, in a note to clients last week, said it sees several positive catalysts for the chipmaker in 2022, including a strong holiday gaming season, solid data center demand trends, and gaming/networking supply improvements in the second-half this year.

NVIDIA is a provider of the key components required for all the sector's large, high-growth technologies, including cloud computing, artificial intelligence, robotic automation, mobile computing, the internet of things, and crypto mining. Gaming and data centers have been the main breadwinners for NVIDIA, but the company is also well-positioned to benefit from other secular trends.

NVIDIA’s investment appeal further strengthened after Meta Platforms (NASDAQ:FB), the company formerly known as Facebook, announced in October its new push to develop the metaverse, a digital environment accessed with virtual reality tools that rely on high-powered processors. Meta and other tech giants are investing billions into this initiative and NVIDIA is expected to be a key beneficiary and contributor in this new phase.

Bottom Line

NVIDIA shares, after dropping close to 20% during the past five weeks, have become attractive for investors who were sitting on the sidelines waiting for a better entry point. That weakness, however, has more room to run, in our view, as large institutional investors continue to align their portfolios, moving their cash to safe haven assets.

We believe, therefore, that long-term investors will get a much better price point for NVDA stock in the next few weeks.