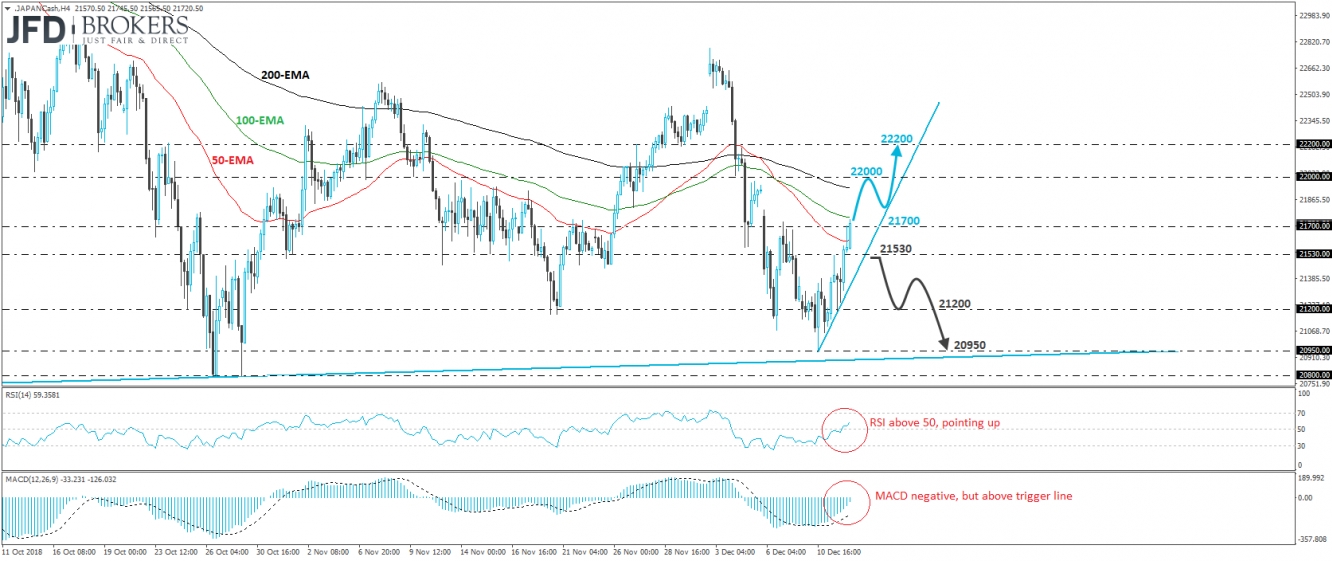

The Nikkei 225 cash index traded higher today, breaking above the 21530 barrier during the Asian session and poking its nose above 21700 during the European morning. The recovery in this index started on Monday, when it hit support at 20950, slightly above the somewhat-upside line drawn from the low of the 23rd of March. Now, the cash index is trading above a tentative short-term uptrend line and thus, we see the case for some further recovery.

We believe that the break above 21700 may have opened the way for the 22000 territory, slightly above the high of the 5th of December, and near an intraday swing low formed the previous day. Another break above 22000 could see scope for more extensions, perhaps towards the 22200 area, defined by the inside swing low of the 29th of November.

Shifting attention to our short-term oscillators, we see that the RSI emerged above its 50 line and it now points up, while the MACD, although negative, lies above its trigger line and looks to be heading towards zero. It could obtain a positive sign soon. These indicators corroborate our view that Nikkei may extend its current recovery.

Alternatively, a dip back below 21530 may signal the break below the aforementioned tentative short-term uptrend line drawn from Monday’s low. This could be an indication that buyers are not willing to add to their positions and thus, the price may slide towards the 21200 level. Another break below 21200 may pave the way for Monday’s low, at around 20950, or the somewhat upward sloping line drawn from the low of the 23rd of March.