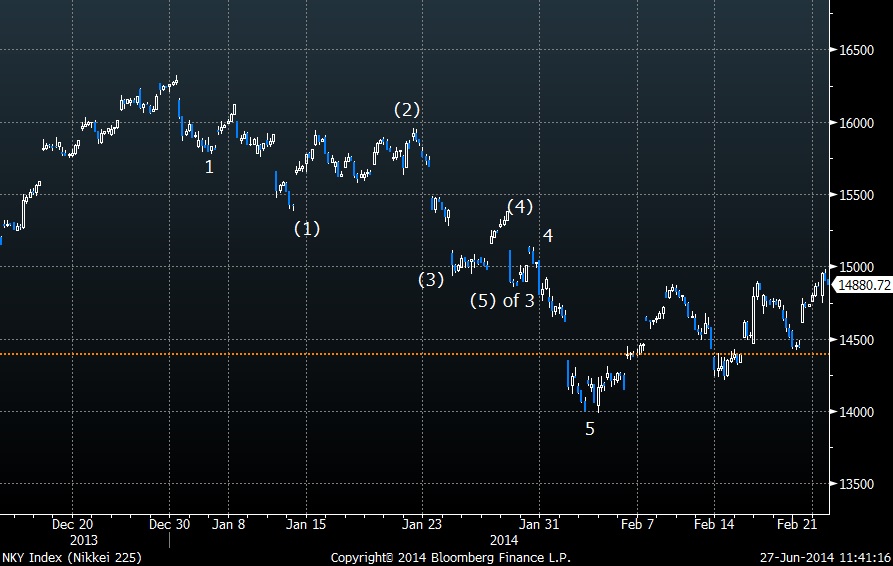

The Nikkei made a bearish reversal thursday from its new 6-month highs. We also saw a bearish price reversal in USD/JPY. NIKKEI has finished 5 waves up from its lows from mid-April. In the chart below you can see the 5 wave upward move in NIKKEI from just under 13900 to 15500. I at least expect a downward correction toward the 50% or 61.8% Fibonacci retracement of this upward move.

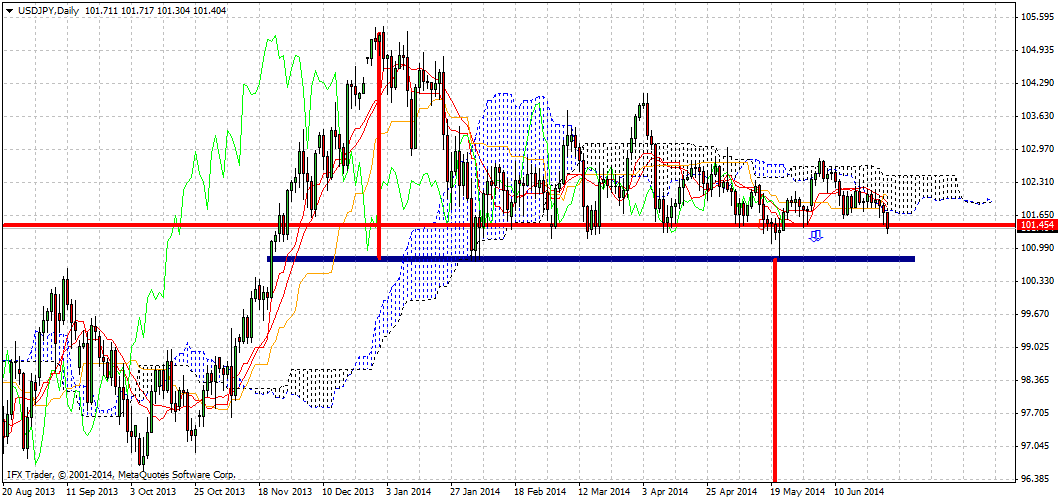

This time the risk off signals from USD/JPY coincide with a bearish pattern in NIKKEI. So my target for the short-term is to fall towards 14600-14450. A reminder for USD/JPY, the important level to watch is 100.70. Breaking below that level will signal risk off for Equities and most probably affect markets accross the globe. Breaking below 100.70 could push this fx pair toward 92-94.

NIKKEI has made a top and a bearish reversal at the 61.8% retracement of the downward move shown in the chart below. I label the decline as wave 1 and post below the chart with my elliott wave count of the decline.

The reversal at the 61.8% could mark the end of wave C as the pattern of A-B-C is clearly corrective with lots of overlapping waves. The only impulsive wave is C as I showed in the first chart of this post.

Counting waves was very complicated when analysing the futures contract chart and could only find an move when analysing the spot price of the index as shown in the chart above. Nevertheless, apart from Elliott waves, we are currently at a major resistance area and the bearish reversal justifies a move lower. It is important for this pull back to make a higher low in order for the longer-term trend to remain intact.

I chose to mention NIKKEI today as I believe a market sell off in this index will have bearish implications for other major equity markets around the world. As always, thank you for taking the time to read my new post.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.