In last week’s article, based on the Elliott Wave Principle (EWP ) and technical analysis, I concluded the Nasdaq 100:

“…Two weeks ago, I found, [wave-iv] should see a retest of the 12830s level once again before moving higher to the low-14000s. I can now update this to intermediate wave-iv is now likely under way, and although it can even make a new all-time high, it should ideally target 12800-13200 before the index rallies, most likely, one last time since the rally in March 2020 started.

Even in late-January (see here) I thought the index would top around 13810-14125 and then drop 12825-13120 before moving higher to the low 1400s. Although the index took a slight detour with the late-January low, as one cannot always foresee every single market turn, the index complied rather well overall. It erased all the prior gains as I anticipated in early February (see here).

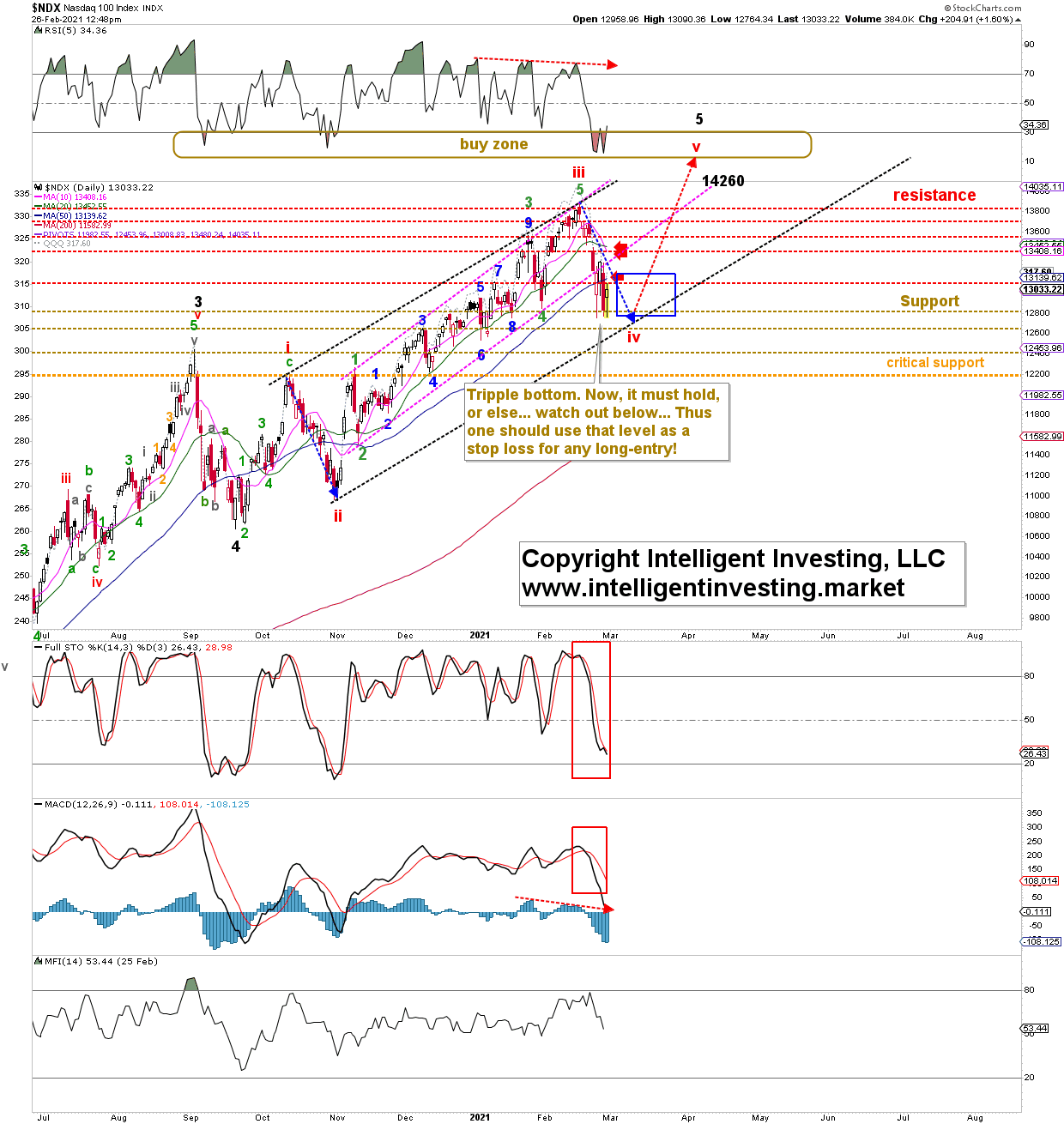

Figure 1. NDX100 daily candlestick chart with EWP count and technical indicators:

This week, the index has bottomed three times at around 12765+/-10p. See Figure 1 above. Thus, the 12800s were reached (I was off by 0.3%, so please pardon my inaccuracy). Although the NDX can still go as low as 12710+/10 in the last few twist and turns to complete a picture-perfect wave-iv=ii relationship (blue symmetry arrows), sentiment has done enough to meet the (red) intermediate wave-iv criteria. If this week’s lows hold, on preferably a daily closing basis as that allows for an intra-day flush down to 12710, the index can now start to move higher for (red) intermediate wave-v.

Wave-v to ideally 14260+/-40 will be stepwise confirmed with

A) a daily close back above the 50-day simple moving average (SMA),

B) a daily close back above this week’s bounce higher, which in EWP-terms would be labeled as a b-wave,

C) a daily close back above the 20-d SMA.

Bottom line: This week, the NDX (finally) reached the ideal wave-iv target zone of 12800-13200, as anticipated it ideally would over the past several weeks, almost to the T. Although not necessary a last intra-day stab lower to SPX12710+/-10 within the next few days can be allowed for, and, thus, this week’s triple bottom should hold on a daily closing basis. If not, a larger flush down to 12200, based on simple symmetry, cannot be excluded. Even such a big pullback would still not invalidate the EWP count as shown, for as long as the (red) intermediate wave-i made on Oct. 12, 2020, at 12187 is not exceeded to the downside. Why? Because in an EWP standard impulse, a 4th low and 1st wave high are not allowed to overlap. If that happens, I must adjust my thinking and accept that a much larger top may already have been struck.