Fed Days have a long history of showing a bullish tendency, and we have a large number of Fed Day studies to refer. For those that are unaware, a Fed Day is simply a day where the Federal Reserve completes a scheduled meeting and provides a policy announcement. Meetings typically take place 8 times per year, and in recent years the meetings have all been two days, with the second day being the “Fed Day”.

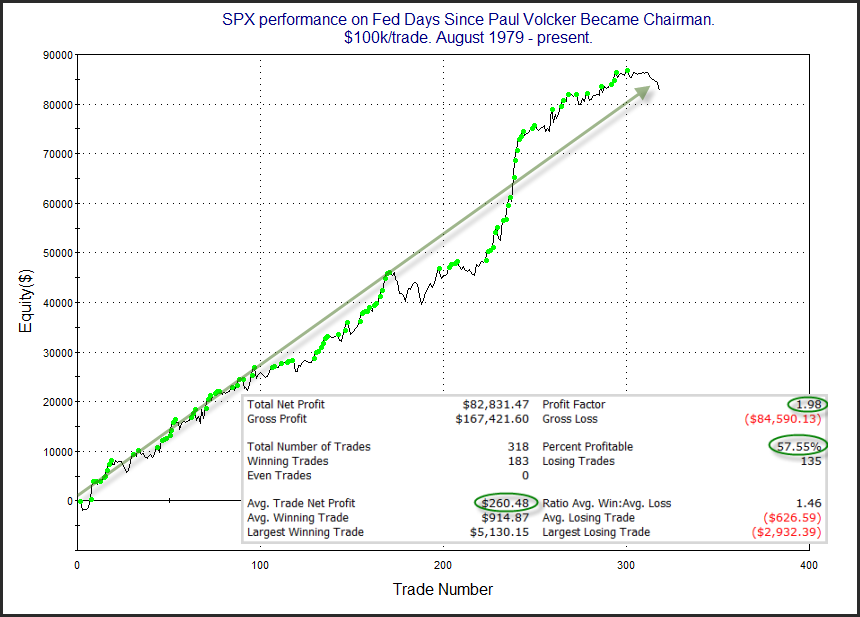

Below is a long-term look at Fed Day performance since Paul Volcker became chairman in August of 1979.

That is a long and fairly steady tendency we see for the market to rise on Fed announcement days, but recent instances have struggled. Below is a breakdown of Fed Day performance by Fed chairperson.

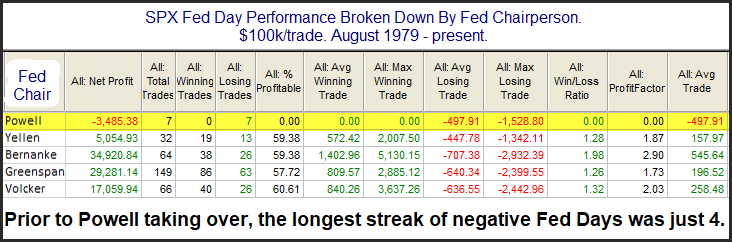

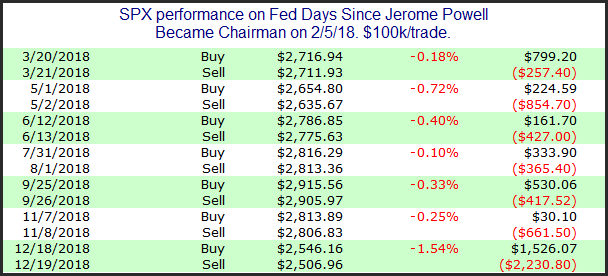

Fed Days under every chairperson aside from Fed Chair Powell since 1979 have shown a strong upside tendency. However, Powell’s Fed has garnered a negative reaction every time. Here’s the full list since he took over last year.

Nothing good to see here, but perhaps we should have realized the market did not respond well to him when the SPX closed down over 4% on his first day on the job (2/5/18).

It is worth noting that Fed Days have been mired in a previously unprecedented losing streak lately with seven negative reactions in a row.