We issued an updated research report on The AES Corporation (NYSE:AES) on Sep 7. This global power company follows a strategy of reducing complexity and portfolio simplification through withdrawal of operations in the markets that carry risks.

In line with this strategy, AES Corp. sold its combined heating and power coal plants in Kazakhstan, for net proceeds of $24 million, in April 2017. In the same month, the company agreed to sale the undivided interest of its DP&L subsidiary in Zimmer and Miami Fort for $50 million in cash. The transaction is expected to close in the third quarter of 2017.

One of the company’s notable business strategies include reduction of costs. To this end, AES Corp earlier launched initiatives worth $400 million for cost reduction and revenue enhancement initiatives. The initiatives will include overhead reductions, procurement efficiencies and operational improvements.

Moreover, the company is merging its Europe and Asia strategic business units this year that is expected to lead to significant savings. Such initiatives are expected to enable the company achieve $50 million of incremental annual benefits in 2017 and to reach its annual savings target by 2020.

Further, to curb carbon emission, AES Corp.’s generation mix includes a large portion of gas and renewables. In this line, AES Corp. is on track with its 1,384 MW Southland Repowering Project in California and has completed the $2 billion non-recourse financing for the project this June. The project is expected to initiate following this financing, in line with management’s expectation.

AES Corp. has a 1,320 MW OPGC 2 project in India, which is making steady progress on construction. The project is expected to come online by the end of 2018.These projects are expected to be a key contributor to the company’s earnings and cash flow growth through 2020.

On the flip side, the company’s results has been reflecting lower margins owing to deferred fuel cost following the rate case of IPL in 2016, as well as lower regulated ESP rates at DPL.

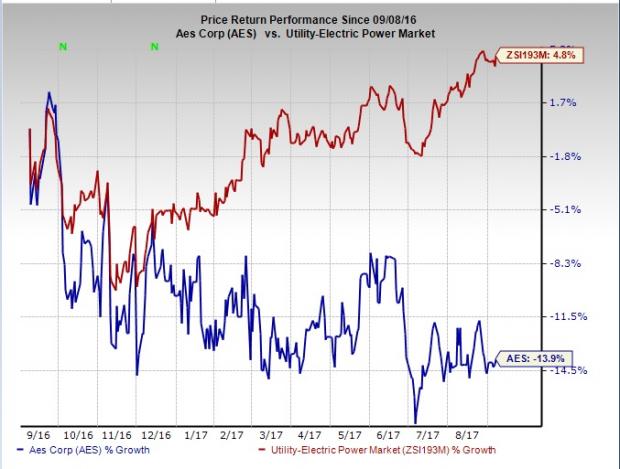

This might have lead the company to underperform its broader market. Evidently, AES Corp.’s share price has lost 13.9% in the last one year, against its broader industry's gain of 4.8%.

The company also faces tough competition from its peers like Ameren Corporation (NYSE:AEE) , CenterPoint Energy, Inc. (NYSE:CNP) and Duke Energy Corporation (NYSE:DUK) .

Zacks Rank

AES Corp currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Ameren Corporation (AEE): Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP): Free Stock Analysis Report

Duke Energy Corporation (DUK): Free Stock Analysis Report

The AES Corporation (AES): Free Stock Analysis Report

Original post