- Home Depot's Q1 2023 sales and net profit declined compared to last year due to adverse weather conditions and lower lumber prices.

- Investors remained confident in Home Depot despite the lower earnings, as the stock jumped 1.33% following the earnings release.

- Analysts forecast short-term revenue and earnings declines for Home Depot in 2023 but are optimistic about its long-term growth potential.

The post-pandemic hangover in home improvement product sales has finally taken a toll on the industry's largest company, Home Depot (NYSE:HD).

For the first four months of the year, the Atlanta, Georgia-based company reported revenues of $37.3 billion, showing a 4.2% decline in sales compared to the same period last year. Similarly, net profit for the first quarter of 2023 was $3.9 billion, indicating a decline from the $4.2 billion net profit reported in the same period last year.

Although the net profit per share slightly increased to $3.82 compared to the previous period, it decreased in comparison to last year's profit per share of $4.09.

In a statement regarding the financial results, company officials acknowledged that adverse weather conditions and declines in lumber prices contributed to the quarterly earnings falling below expectations.

CEO Ted Decker expressed confidence in the medium and long-term outlook for the home improvement industry, emphasizing their commitment to increasing market share despite the uncertain short-term environment.

Home Depot's CEO also addressed the short-term challenges by revising its expectations for 2023. The retailer anticipates a 2% to 5% contraction in sales compared to the previous year and a projected decline of 7% to 13% in profit per share compared to 2022.

Using InvestingPro, let's assess the future outlook for the Home Depot stock. InvestingPro users can do the same analysis for every major name in the market just by signing up on the following link. Try it out for a week for free!

What Does the Future Hold for Home Depot?

Starting with the stock's reaction to the earnings. Despite the figures falling below expectations, the stock jumped 1.33%.

This suggests that investors have maintained their confidence in the stock. While the first quarter results were lower than the previous year, it's worth noting that they showed relatively higher revenue and earnings per share compared to the last quarter of 2022.

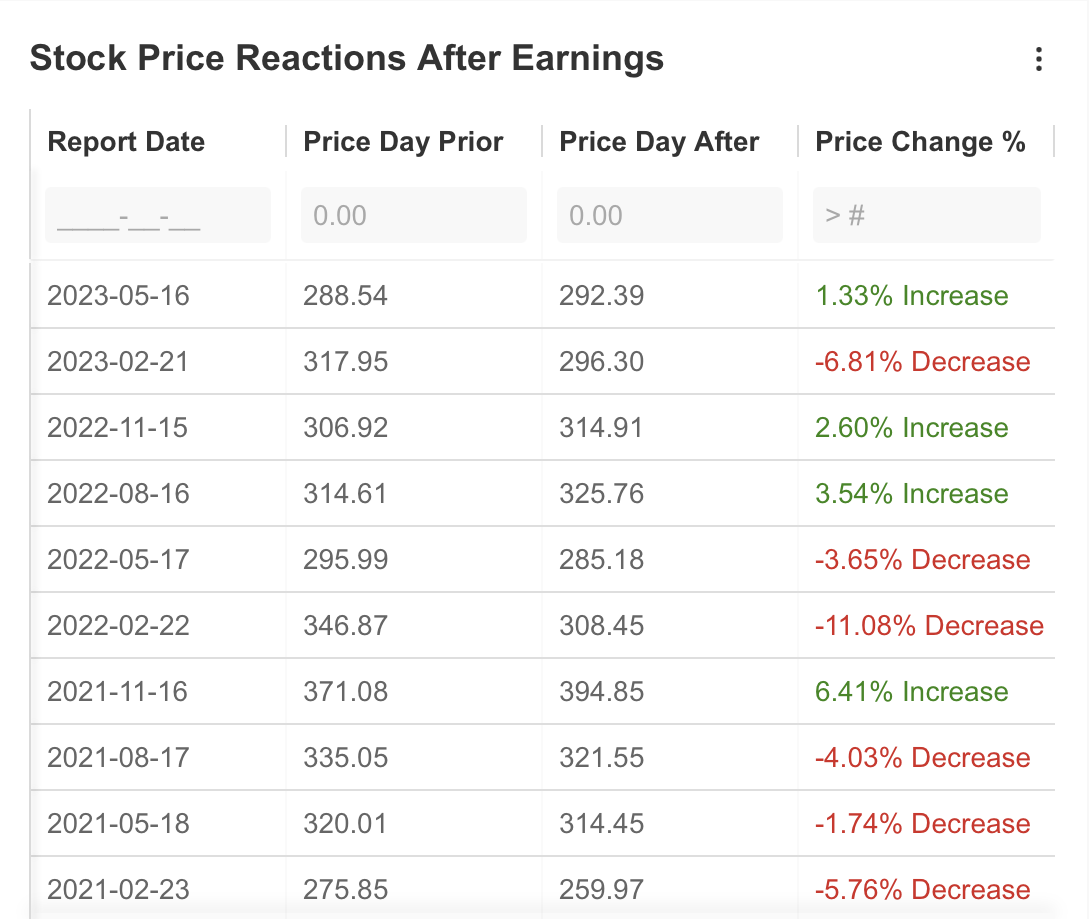

Following a decline in the previous quarter, the share price dropped by nearly 7%, falling below the $300 mark. The following is a snapshot of the stock's reaction to previous earnings, a key insight from InvestingPro. Source: InvestingPro

Source: InvestingPro

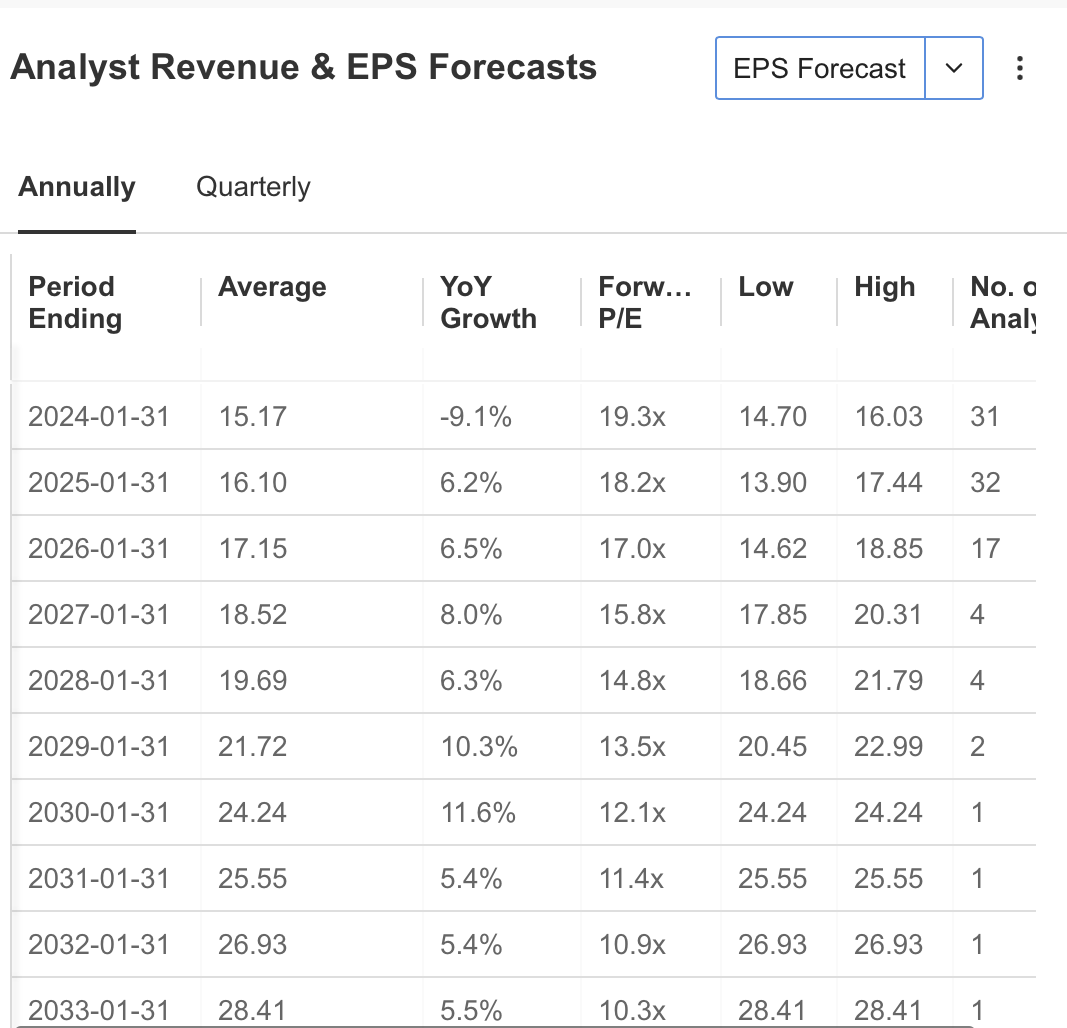

According to InvestingPro, analysts forecast a 9% decline in Home Depot's revenue and earnings per share over the next year, aligning with the company's expectations.

Looking ahead to 2025 and beyond, analysts are increasingly optimistic, projecting a potential long-term increase in earnings per share to reach $28 annually. Source: InvestingPro

Source: InvestingPro

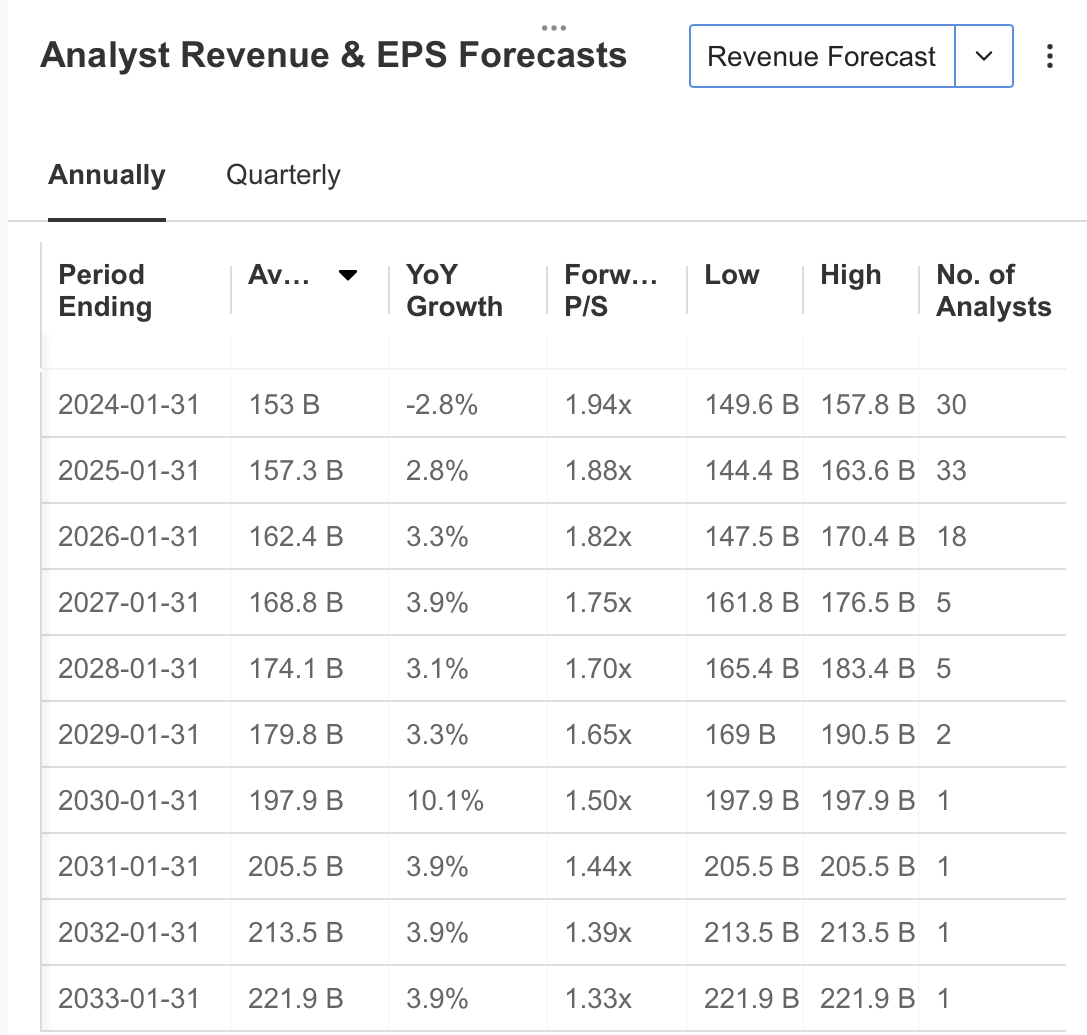

Similarly, analysts predict that Home Depot's revenue may fall by close to 3% this year. However, they expect steady revenue growth from 2025. Source: InvestingPro

Source: InvestingPro

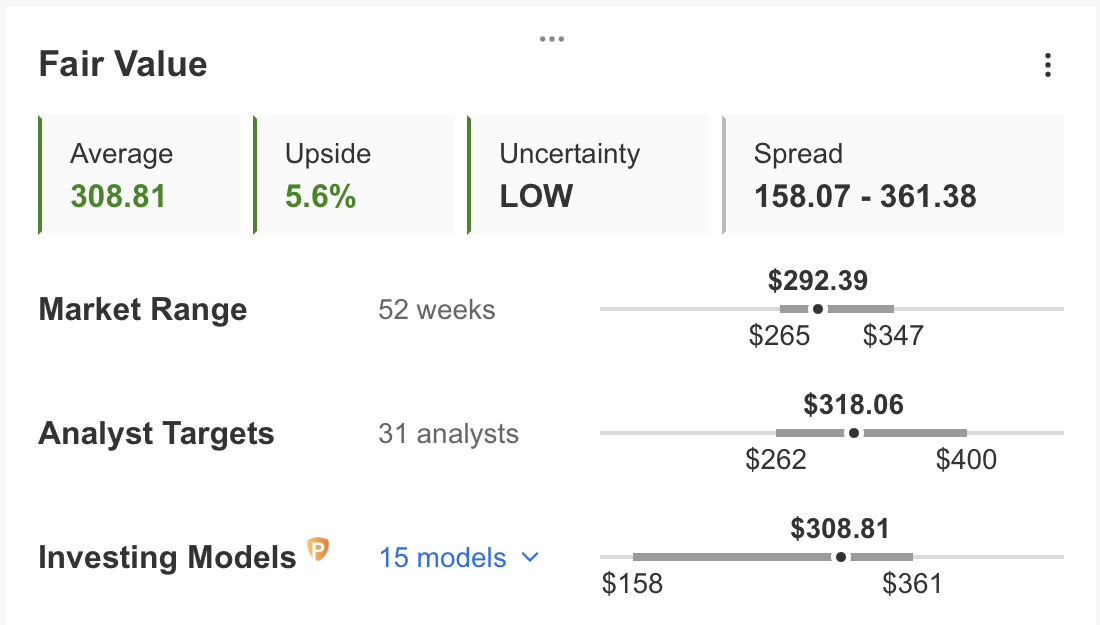

The company is expected to see some revenue and earnings declines this year. The fair value, as calculated by InvestingPro using the average of 15 financial models, is currently $308.

Thus, HD stock, which is trading at $292 today, is within its fair value range. It should be noted that 31 analysts estimate the price target at $318, which seems to exceed the ratio. Source: InvestingPro

Source: InvestingPro

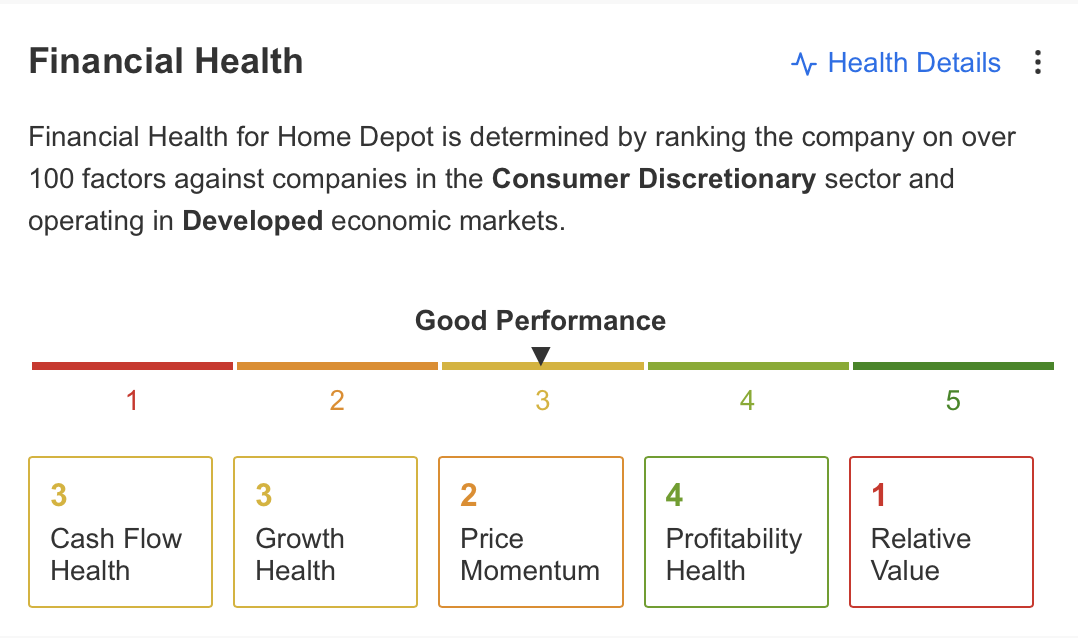

Evaluating the company's financial health using InvestingPro, the strongest criterion is profitability, scoring 4 out of 5.

Although the company's cash flow and growth are considered stable, its price momentum has weakened, and the relative value of the company is seen as the weakest point. Source: InvestingPro

Source: InvestingPro

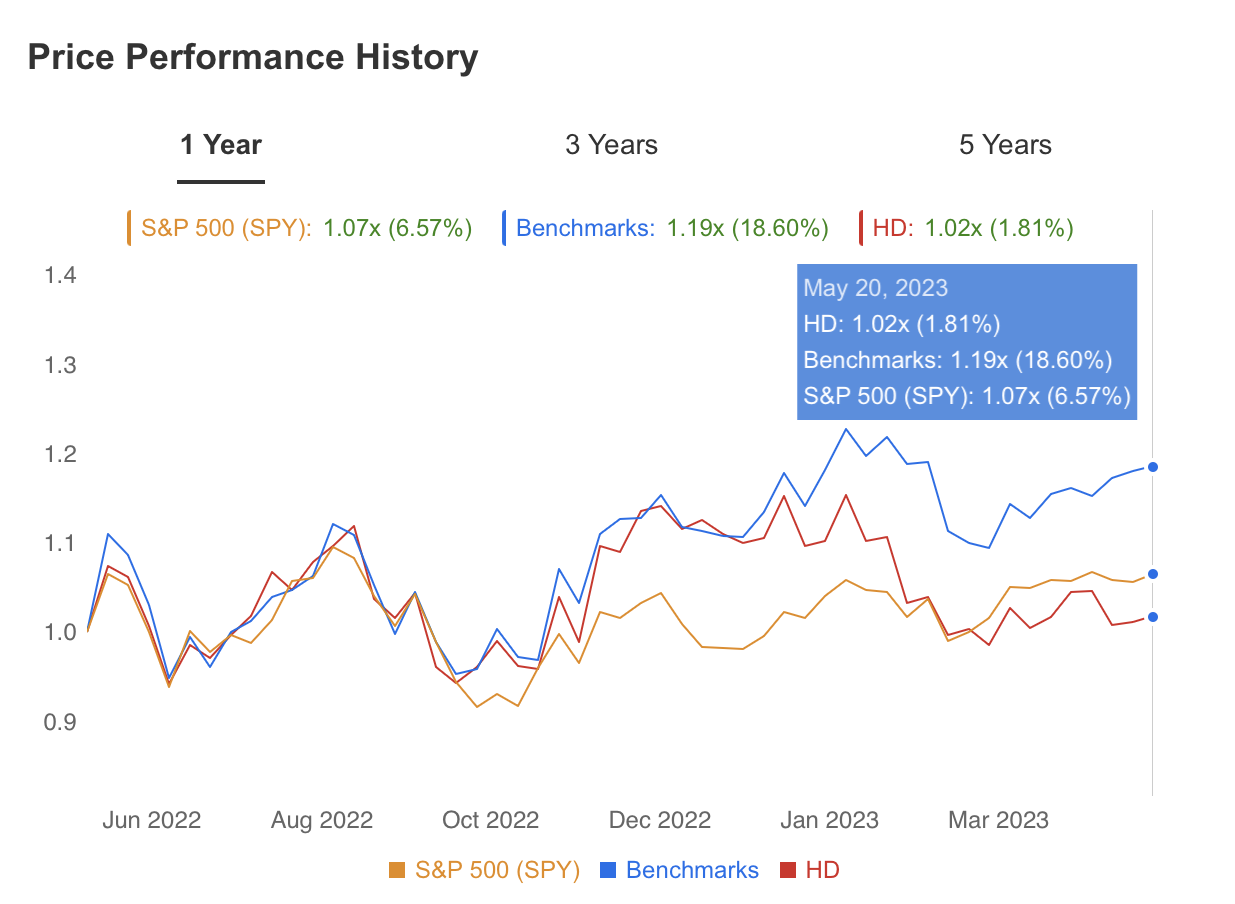

The stock has declined 7% since the beginning of the year, currently trading around the $292 range.

HD's performance has diverged negatively compared to the industry average and S&P 500 due to the price decline since the beginning of the year. Source: InvestingPro

Source: InvestingPro

The home improvement sector is currently experiencing short-term uncertainty. The impact of high-interest rates on resale home sales is causing a slowdown in the demand for home remodeling.

Additionally, although inflation in the U.S. is heading lower, it remains above the target level. This raises the concern that consumers may prioritize basic needs over home remodeling and other discretionary expenses.

However, despite these challenges, Home Depot officials maintain a positive outlook on the long-term prospects.

They believe that the limited housing supply, coupled with the aging housing stock, will eventually drive the need for budgeting and renovations, creating opportunities for the company in the future.

As you saw in this article, with InvestingPro, you can conveniently access comprehensive information and outlook on a company in one place, eliminating the need to gather data from multiple sources such as SEC filings, company websites, and market reports.

In addition to analyst targets, InvestingPro provides a single-page view of complete information, saving you time and effort.

You can use InvestingPro tools to analyze the companies you are investing in or considering investing in and benefit from analyst opinions and up-to-date forecasts calculated using dozens of models.

Start your InvestingPro free 7-day trial now!