Halliburton Company (NYSE:HAL) is scheduled to report fourth-quarter 2017 earnings on Jan 22, before market opens.

In the preceding three-month period, the company delivered a positive earnings surprise of 10.5%, thanks to improved utilization and pricing gains in North America.

The world's second-largest oilfield services company, after Schlumberger Limited (NYSE:SLB) , has an incredible history when it comes to beating earnings estimates. The company posted average positive earnings surprise of 41.23% in the trailing four quarters. Investors should note that Halliburton hasn’t missed earnings estimates since mid-2014.

This Houston, TX-based provider of technical products and services to drillers of oil and gas wells is likely to maintain this trend in the fourth quarter too. Evidently, multiple tailwinds including the recovery in commodity prices have buoyed the entire space.

With U.S. activity accelerating and margins set to remain strong, Halliburton is likely to beat estimates in the quarter under review. The positive sentiment surrounding the stock can be gauged from the strong earnings estimate revisions with two estimates going up and none going down over the last seven days for the current quarter.

Factors at Play

Prices of oil at the end of the fourth quarter were $60.46 per barrel, up about 19.6% sequentially amid tightening supplies, improving demand outlook and OPEC-deal extension talks.The oilfield service provider is poised to benefit from recovering commodity prices.

With the North American land market improving rapidly, driven by increased utilization and pricing — particularly for pressure pimping — Halliburton remains optimistic of generating higher earnings.

The Zacks Consensus Estimate for the fourth quarter for Completion and Production revenues is pegged at $3,641 million, higher than $3,537 million and $2,268 million reported in the prior quarter and fourth-quarter 2016, respectively. Sales in the Drilling and Evaluation unit are forecasted to be $1,960million compared with the prior-quarter figure of $1,907 million and $1,753 million in the year-ago quarter.

We also appreciate Halliburton’s successful cost-management initiatives amid weak oil prices over a length of time. Last year, the company successfully implemented its plan of cutting annual costs by $1 billion. In fact, Halliburton has used the challenges prevailing in the industry to its advantage, mainly by offering low cost solutions that aids producers in churning out more by investing less.

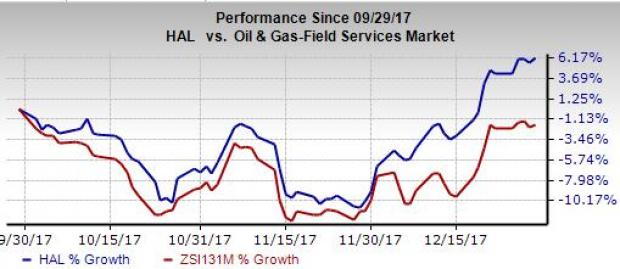

All these positive factors are also reflected in the price movement of the company. Shares of the company have rallied over 6% outperforming the broader industry’s decline of 1.9% in fourth-quarter 2017.

What the Zacks Model Unveils?

Our proven model shows that Halliburton is likely to beat earnings in the to-be-reported quarter because it has the right combination of two key ingredients.

Zacks ESP: Earnings ESP for this company is +0.79%. A favorable Zacks ESP serves as a meaningful and leading indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Halliburton carries a Zacks Rank #3 (Hold) which, when combined with a positive ESP, makes us confident of an earnings beat.

Note that stocks with Zacks Ranks #1 (Strong Buy), 2 (Buy) or 3 have a significantly higher chance of beating earnings. On the other hand, the Sell-rated stocks (#4 and 5) should never be considered going into an earnings announcement.

Energy Stocks With Favorable Combination

Halliburton is not the only energy firm looking up this earnings season. Here are some companies from the space which, according to our model, also have the right combination of elements to post earnings beat this quarter:

National Oilwell Varco Inc. (NYSE:NOV) has an Earnings ESP of +33.8% and a Zacks Rank #3. The energy equipment maker is expected to release earnings results on Feb 5. You can see the complete list of today’s Zacks #1 Rank stocks here.

McDermott International Inc. (NYSE:MDR) has an Earnings ESP of +25% and a Zacks Rank #3. The equipment service provider is anticipated to release earnings on Feb 20.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

National Oilwell Varco, Inc. (NOV): Free Stock Analysis Report

McDermott International, Inc. (MDR): Free Stock Analysis Report

Schlumberger N.V. (SLB): Free Stock Analysis Report

Halliburton Company (HAL): Free Stock Analysis Report

Original post