The headline of the day is Billionaire bond guru Jeffery Gundlach Predicts he will make 400% on his bet against the stock market.

Gundlatch bought S&P PUTs betting the stock market will drop.

Does that make him bearish? Let’s find out.

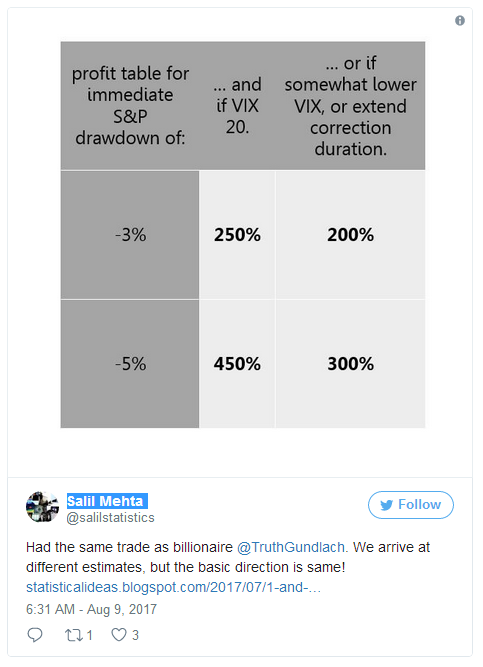

“I’ll be disappointed if we don’t make 400 percent on the puts, and we don’t even need a big market decline for that to happen,” Gundlach said Tuesday on CNBC’s “Halftime Report.”

He said that in his firm’s analysis, volatility is so low that it can make a big return by buying put options — bets for a decline — on the S&P 500 for December. “It’s not really a bear call on the S&P 500. It’s more of a bull call on volatility,” he said.

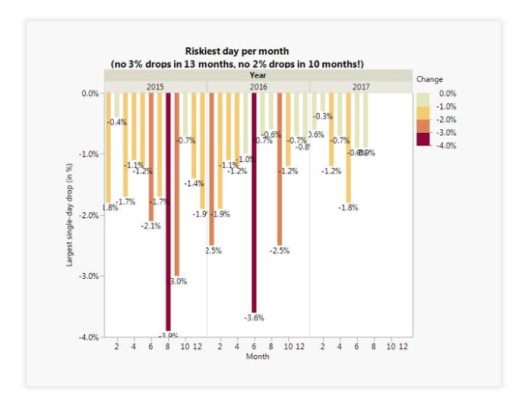

“I think going long the VIX is really sort of free money at a 9.80 VIX level today,” Gundlach said. “I believe the market will drop 3 percent at a minimum sometime between now and December. And when it does I don’t think the VIX will be at 10.”

Gundlach reiterated his expectations for a snap higher in the VIX once volatility picks up, since hedge funds have piled heavily into bets that volatility will remain low.

The investor believes the VIX could double to 20, he said.

3% the New Bear Market

Here’s the kicker. If the stock market pullback is driven by seasonality or a change in investor sentiment, Gundlach said he thinks “it will be contained and you can buy it.”

Wow, talk about embracing the bubble.

Statistical Analysis

Salil Mehta at Statistical Ideas came up with a similar idea on 1% and 2% Market Drops.

In contrast to Gundlatch, Mehta offered no opinion as to whether the “carnage” would be contained to 3%.