Alphabet Inc.’s (NASDAQ:GOOGL) Google is rolling out its free Wi-Fi program Google Station in Indonesia as part of which public places like railway stations and universities will have free connectivity.

The program will be initially launched in a few cities and expanded going ahead. Google is working with internet service providers (ISPs), system integrators and venue owners on this endeavor.

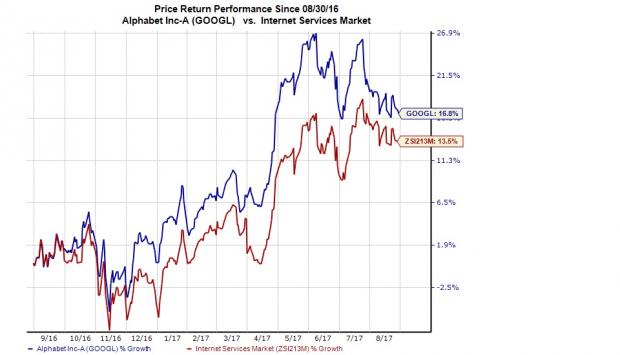

We observe that Alphabet stock has gained 16.7% over the past year, outperforming the 13.4% rally of the industry it belongs to.

Replicating the Success in India

Google launched this program in India in January 2016, partnering with Indian Railways’ Internet services arm RailTel to provide public Wi-Fi service at the Mumbai Central station. In September, Google expanded the project to other public places including malls, cafes, universities, stations and hangout spots.

The company claims that the service is currently active in more than 150 stations and plans to extend it to 400. With the new move, it seems that Google is trying to repeat the success of this program in Indonesia.

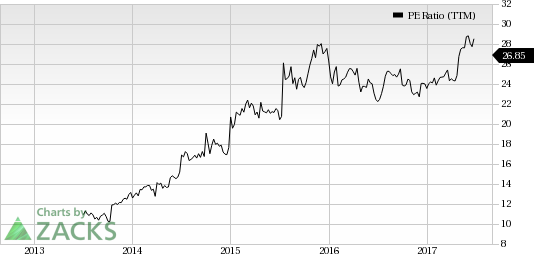

Alphabet Inc. PE Ratio (TTM)

Opportunities in Indonesia

According to eMarketer, Indonesia currently has about 100.8 million internet users, the highest among Southeast Asian countries. The figure is expected to reach 137.2 million by 2021.

However high-speed internet connectivity is lacking in the nation. Per a data from Akamai, Indonesia had just 7.2 megabits per second (Mbps) of average data connection speed in the first quarter of 2017.

Furthermore, mobile users of the country prefer connecting to Wi-Fi rather than internet from mobile service providers to save usage fees. Per a JakPat survey from February 2017, more than 50% of mobile internet users in the country connected to Wi-Fi on a daily basis.

Furthermore, according to a report by Singapore’s sovereign wealth fund Temasek and Google, the internet economy of Southeast Asia is expected to surge to a massive $200 billion by 2025.

These trends offer ample opportunities for Google to tap the growing number of data conscious and budget friendly internet users in Indonesia and lure them to its high-speed services.

The company is also launching the YouTube Go app in the country that will allow users save videos and watch or share them offline.

Our Take

We believe that with this move, Google is looking to strengthen its global foothold as well as boost ad revenues. The company’s ability to innovate has translated into strong growth as it continues to adapt to changing market trends.

It seems that it has all resources and technology to create successful ventures in Asia. The company is banking on its huge cash balance and technological prowess to pursue growth in any market that exhibits true potential.

Zacks Rank and Stocks to Consider

Currently Alphabet carries a Zacks Rank #3 (Hold). Better-ranked stocks in the broader technology sector include Lam Research (NASDAQ:LRCX) , Applied Materials (NASDAQ:AMAT) and Applied Optoelectronics (NASDAQ:AAOI) , each carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term expected earnings per share (EPS) growth rate for Lam Research, MiX Telematics and Alibaba (NYSE:BABA) are a respective 17.2%, 17.1% and 17.5%, respectively.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research