The rally on Friday was accompanied by a sizable drop in the VIX (and even more so for the CBOE OEX Implied Volatility, which is the old calculation for the VIX). This triggered some old studies for me in which I noted that big drops in the VXO have had much different connotations depending on whether SPX is in a long-term uptrend or downtrend (as defined by its proximity to the 200ma). I decided to review those studies, which require a 15% 1-day VXO drop, in this weekend’s subscriber letter.

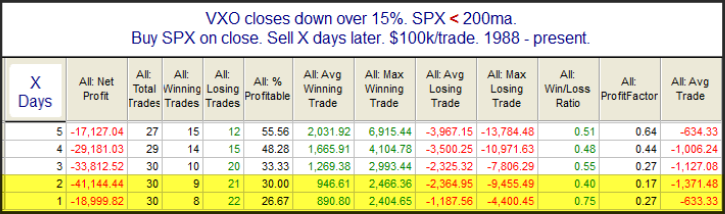

First let’s consider what has followed when the large VXO drop has occurred during a long-term downtrend.

We see here some bearish statistics over the 1-2 day period. There is rarely upside follow-through when fear dissipates that quickly during a downtrend.

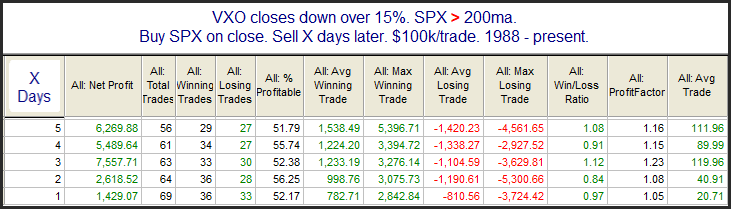

But now let’s consider times like the present where SPX is in an uptrend.

Here there is no hint of a short-term bearish inclination. In fact the setup has shown slight gains for each of the time periods measured. I don’t think the numbers are strong enough to consider this a bullish setup, but it certainly is not bearish. When considering short-term implications of strong moves or extreme indicator readings, it often helps to also view things with a long-term perspective.