Expedia (NASDAQ:EXPE) CEO Dara Khosrowshahi has reportedly revealed plans to expand the company’s railway booking services. The company is eyeing important markets such as Europe. In this regard, we note that it has already begun railway ticketing in the U.K. and Germany.

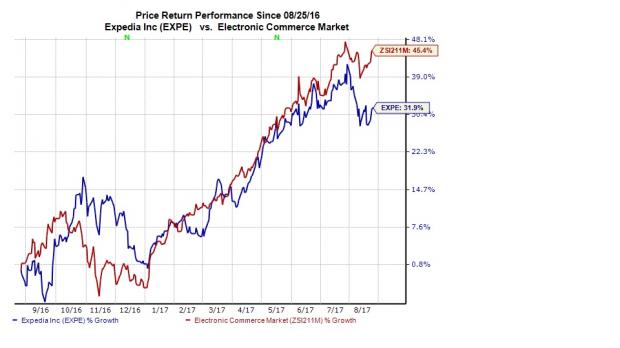

Expedia has built a very strong position and an extensive portfolio across hotel, air and car-related services. These have surely made a significant contribution to the company’s noteworthy 31.9% share price surge over the last one year. It has, however, underperformed its industry’s rally of 45.5% over the same time frame.

With its latest effort, it seems to be trying to leverage on its existing capacities to expand its railway offering globally.

Putting SilverRailto Good Use

It goes without saying that the acquisition of SilverRail and the successful partnership of the two companies prior to that will be of great use to Expedia in this endeavor. Expedia completed the acquisition in June. The duo had been in a rail distribution partnership since 2015 per which SilverRail powered Expedia’s search and ticketing of rail services.

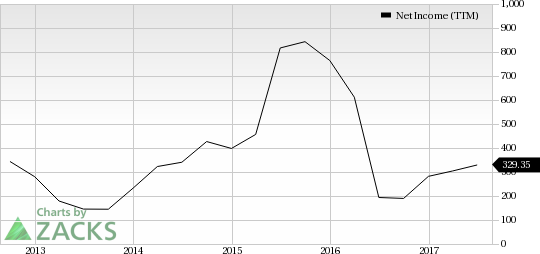

Expedia, Inc. Net Income (TTM)

This could also enable the company better compete with the likes of Priceline (NASDAQ:PCLN) , Alphabet (NASDAQ:GOOGL) subsidiary Google and Facebook (NASDAQ:FB) that are gradually encroaching its turf.

Investor Reaction

It should be good news for investors. This is because the planned endeavor appears to be nothing but a part of Expedia’s prudent growth plan for both domestic and international markets. Expedia’s success is largely backed its technology and diversity and expanding rail ticketing on a global scale will certainly add to it.

We believe that the move will help Expedia expand its offerings and attract more customers, which in turn will lead to revenue growth and margin expansion.

Currently, Expedia has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Expedia, Inc. (EXPE): Free Stock Analysis Report

The Priceline Group Inc. (PCLN): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Original post

Zacks Investment Research