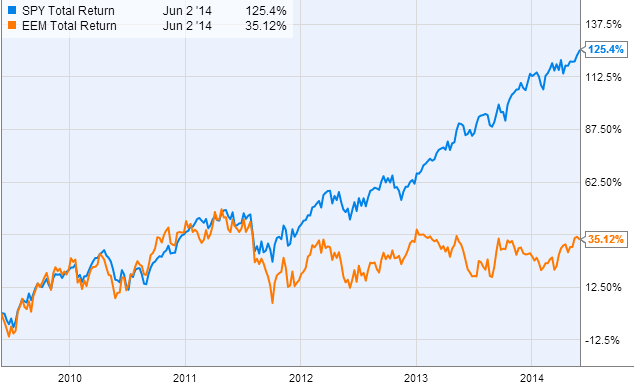

The underperformance of emerging markets equities (iShares MSCI Emerging Markets (ARCA:EEM)) [see this discussion from a year ago] over the past couple of years has been quite spectacular. Valuations of developed markets shares, particularly in the US, have diverged dramatically from those in emerging economies.

Is this trend expected to persist? Investment consulting firm deVere Group is seeing a shift, as their clients show increasing appetite for emerging markets shares. The firm provides 3 key reasons for this change in investor sentiment:

Nigel Green (deVere): - “First, as developed markets approach old highs, or surpass them, the valuation discount of emerging stock markets has become more compelling.

“Secondly, the tapering of QE has not resulted in higher US Treasury yields and more expensive borrowing costs for emerging market countries. The persistent low yields on US Treasuries is something of a mystery, but it is nevertheless a ‘fact on the ground’ that supports risk assets.

“Thirdly, political uncertainty has eased a little. Russia has not invaded Ukraine; India has voted overwhelmingly for a new prime minister, Mr Modi, who is unambiguously dedicated to the cause of economic reform; whilst China has shown itself willing to step in to prevent the collapse of large savings trust companies, and a wave of bad debt coming from Chinese property-related companies and banks has not, so far, materialised.”

The jury is still out on the China property bubble situation and there is a real risk that rates in fact do rise in the US later this year. Nevertheless, this renewed interest in the asset class should not be dismissed. Nobody expects a massive rotation into emerging markets at this point, but given the underperformance, we could certainly see some rebalancing taking place this year.