The underperformance across emerging markets stocks is becoming increasingly severe. In spite of Friday's beating to the S&P500, emerging markets indices are faring worse. For example, the Brazil's Bovespa is down 14.5% year-to-date (vs. S&P500 up 15% YTD). This level of dispersion is unusual, and indicates fundamental concerns about growth in emerging markets.

Part of the issue with these markets is the ongoing weakness in commodities. Commodity producing nations such as Brazil, Mexico, and South Africa are increasingly feeling the pressure. Just the last few days for saw a steady selloff across commodity markets (below).

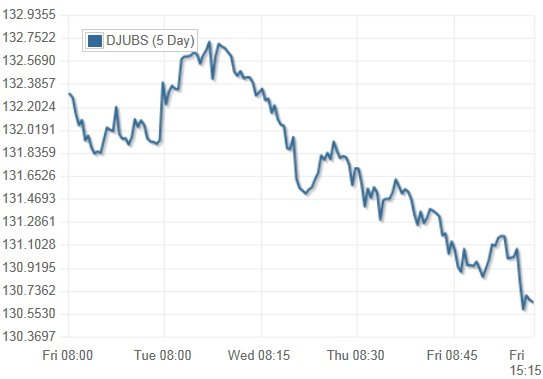

As an example, take a look at the decline in sugar prices, which will hurt sugar producers in Brazil. And the recent weakness in gold price is hurting South African mining firms. Add to that political stability risks (such as protests spreading in Turkey), and it makes for a difficult investment climate. And the weakness is not limited to emerging markets stocks. Many bond markets are being pressured as well. Just take a look at the price action on iShares Emerging Markets Bond ETF (EMB):

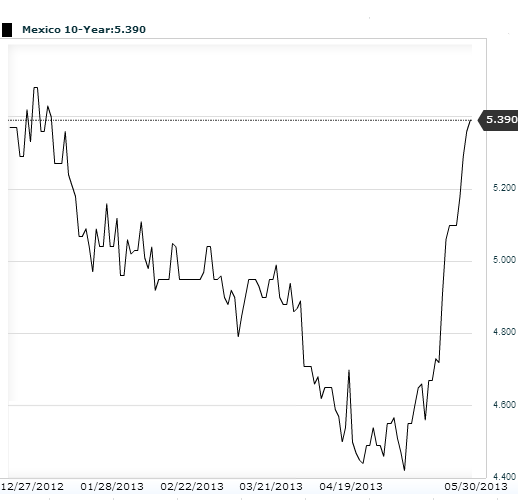

And here is the Mexican government 10-year bond yield in recent months. Government bonds in Brazil, Turkey, Russia and others are also seeing spikes in yields.

Part of this bond weakness is of course driven by raising yields in the U.S. and fears of Fed's eventual exit. It only goes to demonstrate how dependent global markets have become on central bank stimulus.

Some portfolio managers have had enough and are abandoning emerging markets altogether - even nations that are not commodity exporters. As an example here is the Indian rupee's recent performance:

Emerging market currencies are feeling the pressure across the board as investors pull their capital. The Turkish lira hit the lowest level in 17 months, and the South African rand is down 13% year to date. The rebalancing of capital away from emerging markets is in full swing.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Global Portfolio Rebalancing Hits Emerging Markets

Published 06/01/2013, 05:27 AM

Updated 07/09/2023, 06:31 AM

Global Portfolio Rebalancing Hits Emerging Markets

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.