The Coca-Cola Company (NYSE:KO) has a possibility to take over the renowned energy drink maker Monster Beverage Corp. (NASDAQ:MNST) , according to founder of The Street, Jim Cramer. Meanwhile, Monster Beverage’s shares scaled a new 52-week high of $56.44 on Aug 31, finally ending the day’s trading a tad lower at $55.82.

Coca-Cola had already acquired a 16.7% stake in Monster Beverage on Jun 12, 2015. Hence, according to Cramer, Monster Beverage is a possible buyout choice for Coca-Cola as the company has also been focusing on portfolio expansion in order to gain a competitive edge in the U.S. beverage space.

Furthermore, Coca-Cola’s new CEO, James Quincey is known for his motivation in expanding the company’s brand through acquisitions.

In the U.S. beverage space, Coca-Cola along with other major soft drink makers like Pepsico, Inc. (NYSE:PEP) and Dr Pepper Snapple Group, Inc. (NYSE:DPS) have been facing carbonated soft drinks (CSD) category headwinds for some time now.

Cross-category competition and growing health and wellness consciousness have resulted in a drastic shift in consumer demand toward healthier beverages like energy drinks, tea juices and flavored waters. Consumer’s watchfulness over the use of artificial sweeteners and high sugar content has dented sales for companies belonging to the beverage industry.

In fact, Coca-Cola’s second-quarter 2017 revenues declined 16% year over year to $9.7 billion, marking the ninth consecutive quarterly decline in revenues.

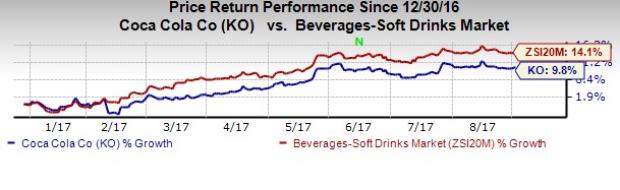

Year to date, shares of Coca-Cola have underperformed the industry. The company’s shares have rallied 9.8% as compared with the industry’s 14.1% gain. Notably, new taxes levied on sugar-sweetened beverages and growing regulatory pressure are affecting CSD sales for Coca-Cola. In order to navigate such challenges, it is necessary for the company to diversify its portfolio by tacking on other healthier energy drink makers like Monster Beverage.

Notably, new taxes levied on sugar-sweetened beverages and growing regulatory pressure are affecting CSD sales for Coca-Cola. In order to navigate such challenges, it is necessary for the company to diversify its portfolio by tacking on other healthier energy drink makers like Monster Beverage.

Monster Beverage drinks are healthier options and keeps up with changing consumer preferences. New innovative mutant soft drink, known as “super soda,” has considerably drove revenues and profits in the last quarter from the year-ago quarter for Monster Beverage.

However, Coca-Cola’s strategic efforts in enhancing its portfolio as a total beverage company are encouraging. Takeover of Monster Beverage can therefore prove beneficial in terms of revenue growth for this Zacks Rank #3 (Hold) company. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Coca-Cola Company (The) (KO): Free Stock Analysis Report

Dr Pepper Snapple Group, Inc (DPS): Free Stock Analysis Report

Pepsico, Inc. (PEP): Free Stock Analysis Report

Monster Beverage Corporation (MNST): Free Stock Analysis Report

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is Coca-Cola Mulling Over The Buyout Of Monster Beverage?

Published 08/31/2017, 09:44 PM

Updated 07/09/2023, 06:31 AM

Is Coca-Cola Mulling Over The Buyout Of Monster Beverage?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.