• Greece votes “No” Greece voted decisively to say “no” in its referendum on Sunday. Now the politicians will have to start working to figure out exactly what the Greeks said “no” to, because it certainly wasn’t clear from the ballots. Moreover, even if the Greeks have said “no” to a bailout package that is no longer an offer, what about the voters in the other 18 Eurozone countries? What’s their view on how much money they should give Greece? We’ll have to see what they think, too.

•The short answer: Greece tries to negotiate, it gets nowhere, the banking system remains frozen, Greece is either forced to capitulate or leaves the Eurozone Briefly, here’s what I think will happen. Greek PM Tsipras has said he will try to use the results of the referendum to strengthen his hand in negotiations with the institutions, so I expect to see him try to restart talks. Unfortunately, Greece’s economic condition has deteriorated since the last offer, so the institutions can only make a more stringent offer now – which, of course, the Greek government cannot possibly accept following the referendum. Meanwhile, the ECB is likely to keep its aid to the Greek banking system frozen, which will keep the banks closed. The government will have to choose how to keep the banking system going: either a bail-in of depositors or reinstitute the drachma. It could issue a scrip to pay its bills, which would probably be seen as a precursor to leaving the euro. Any of these alternatives are likely to upset the Greeks even more. All the while, time is ticking down to July 20th, when the country has to pay EUR 3.5bn to the ECB or the ECB withdraws its aid and the Greek banking system collapses. If the vote had been less of a majority for the “no” side, then I would’ve expected a realignment in Greek politics and a change of government in order to renegotiate a bailout package. But under the current circumstances, that becomes much harder. I think the odds are that we are headed towards Greece leaving the Eurozone, even if that isn’t what either side wants, because the referendum has limited the Greek government’s room for compromise.

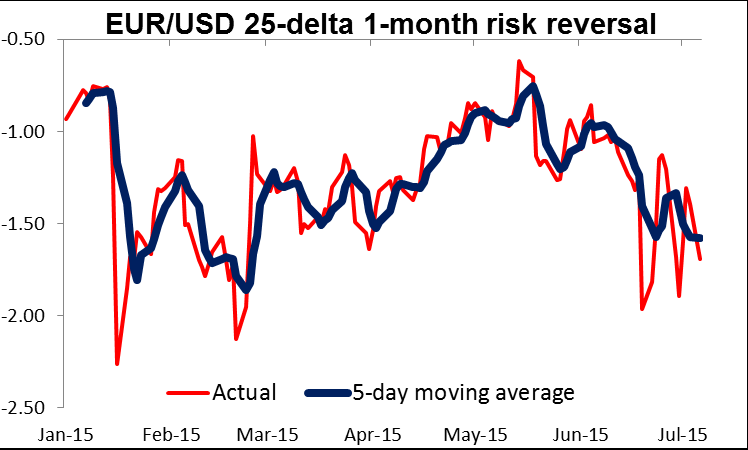

•Market impact is yet to come EUR/USD opened with a gap lower, but in doing so, is just back to almost exactly where it was a week ago after the referendum was first announced – not much change. The rate too remained well above the support zone of 1.0820/1.0950, at around the middle of the 1.0820-1.1275 range that it’s largely been trading in since early June. We would have needed to see a break of at least 1.0950 to draw people in, and 1.0820 to convince investors that we would challenge the previous low of around 1.0500. However, people apparently don’t see much likelihood of that any time soon. The one-month risk reversals moved lower, but nothing special. It looks to me like people do not really believe a Grexit is likely or even possible at this late stage. Either that, or they think that it doesn’t matter– that the possibility has been talked about for so long and everyone is so well prepared that it wouldn’t really matter. I’m not so sure.

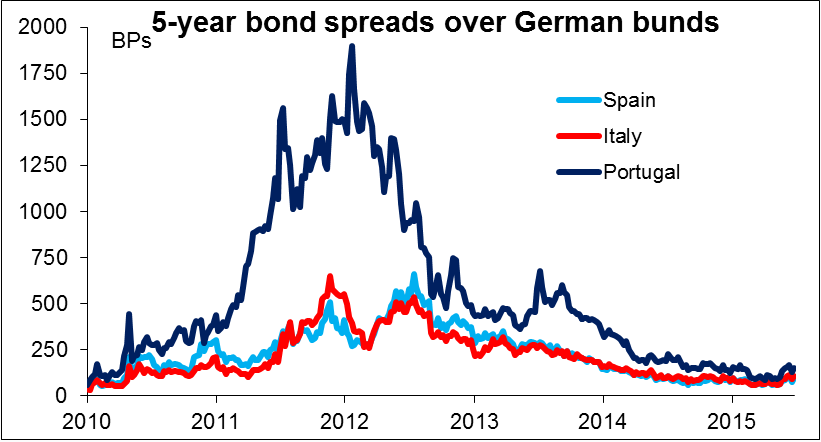

• It’s true that Europe is much better prepared, and also the ECB has in effect made another one of their “do whatever is necessary” pledges about containing contagion. However, there are two risks that are too big even for the ECB: 1) If there is a bail-in in Greece, will depositors in other countries fear the same thing? How will people in Spain and Portugal respond? If they or the Italians start moving money out of the banks, then it could be more than the ECB could deal with. 2) Hedging investments. If European investors in Portugal and Spain etc. start to think about the risk of holding those countries’ assets and start hedging their currency risk – currency risk that didn’t exist before – then the ECB could be overwhelmed. It remains to be seen. I admit that currently, the market in those countries’ bonds reflects little risk, as shown by the extremely narrow spread over German Bunds. But that could also be because of the ECB’s promised purchases of those countries’ bonds.

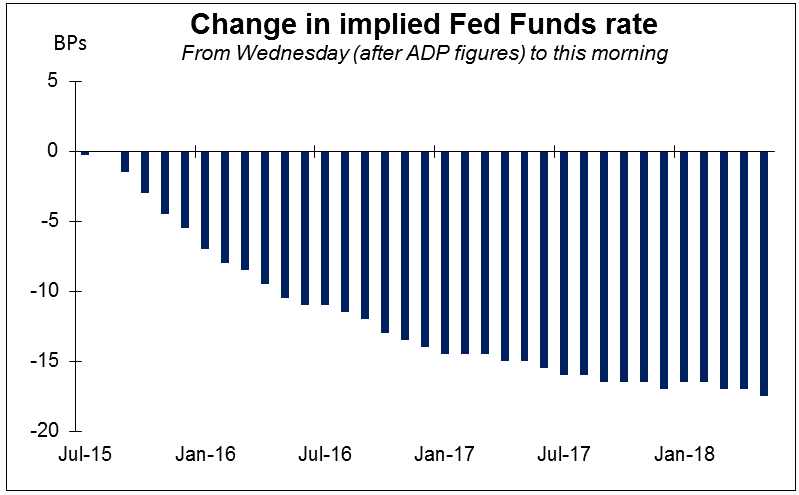

Impact could be reflected outside EUR/USD One of the reasons why EUR/USD has been so stable may be because the market is thinking one step ahead: what does a possible Grexit imply for the Fed? The answer is that it could delay a Fed move (although the Fed is the central bank of the United States, not the Eurozone, and therefore in theory should not take its possible impact on world financial conditions into consideration when it makes its decision). Fed funds rate expectations at the long end of the market have come down an amazing 17 bps since the better-than-expected ADP report on Wednesday. This is one reason probably why EUR/USD has so far held its recent range despite the news.

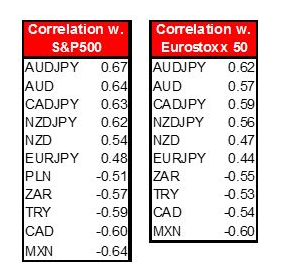

Instead, the major impact is likely to be on other currencies and on equities. If the Fed is worried about the global impact of European monetary turmoil, then maybe other economic actors who are sensitive to risk will be, too. That means less money going into emerging markets and less money going into stock markets, particularly the markets that are more highly geared to economic growth. As a result, the commodity currencies, particularly the beleaguered AUD, and several EM currencies, notably MXN, TRY and ZAR, are likely to suffer. As for the euro, the tables suggests that EUR/JPY is probably more sensitive to risk than EUR/USD, which didn’t make the cut. That’s because of the safe-haven characteristics of the yen in such cases (as we saw this morning, when JPY was one of the few currencies to gain vs USD). EUR/CHF did not make the cut either because these correlations are over the last 10 years and therefore include the period of the EUR/CHF floor. CHF also runs more risk of intervention now than JPY does. It was noticeable that early this morning, USD/JPY was lower, but USD/CHF was higher. It looks like at this point, EUR/JPY is probably the best G10 pair to play Eurozone risk.

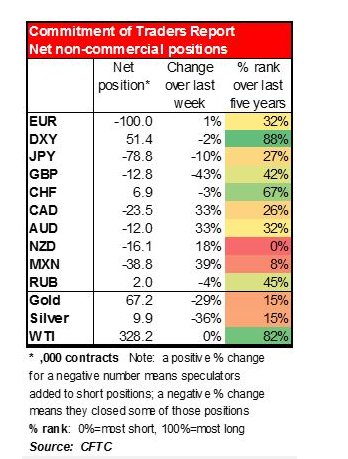

• Looking at last week’s Commitment of Traders (COT) report, EUR shorts were little changed. Speculators still have plenty of room to increase their shorts. Note that speculators are the most short NZD that they’ve been in the last five years and MXN positions are getting down there too. Will they continue to add to these positions? Also, I see plenty of room for speculators to close out stale JPY shorts if risk aversion continues to push the Japanese currency higher.

• The long answer: Here are more detailed reasons why I think the above.

• The Greeks think the referendum was not about leaving the Eurozone The referendum did not mention anything about leaving the Eurozone. Moreover, PM Tsipras specifically said that a “no” vote did not mean leaving the Eurozone. That’s probably a good thing for him because polls have shown overwhelming support in Greece for remaining in the Eurozone – somewhere around 80%. So it remains to be seen why he offered the referendum and why he wanted a “no” vote. Was it, as he said, to improve his bargaining position? If so, it seems only to have backfired – it has totally alienated his counterparts in the other European countries and will make it more difficult to reach an agreement. Or is his purpose really to engineer an exit from the Eurozone and he wants to be able to blame it on the creditors?

• In any event, PM Tsipras has said he will try to restart negotiations with the institutions. The problem, of course, is that the starting point is no longer the same – they are starting without an existing bailout package, following a massive run on the Greek banking system and with tax revenues down sharply. Since Greece’s economic situation has deteriorated, the institutions will have to insist on even more stringent requirements than in the previous offer. Since the Greek public voted to refuse to accept the previous offer, it’s difficult to see how the government can then sign off on a more stringent one. Yet it’s also difficult to see how the institutions can go easier on Greece now that its position has deteriorated further. The Greek government may have painted itself into a corner where the only door leads to Grexit.

• Politicians to debate; likely to leave room for a settlement but no new offer The European politicians have generally stressed that the vote is about whether Greece will remain in the Eurozone. With such a large majority for a “no” vote, Europe may simply decide that the task of keeping Greece within the group is too difficult. Merkel and Hollande agreed that the decision of the Greek people is “to be respected” and called for a Eurozone summit for Tuesday. I expect that they will not say anything to freeze Greece out, because they would probably prefer that the country remain in the Eurozone, but neither can they afford to make a better offer than the one that the Greeks just rejected, for fear of other countries trying the same stunt. So expect something tinged with regret, but breaking no substantial new ground. They may offer humanitarian aid, such as funds to enable the country to import medicine, but that’s about it. “I see no credible basis to help Greece right now, none at all,” said Ingrid Arndt-Brauer, who chairs the finance committee in Germany’s lower house.

• ECB likely to remain on hold while the politicians decide what to do Meanwhile, the ECB is scheduled to meet Monday morning to decide what to do about the Emergency Liquidity Aid (ELA) to Greece. I expect that they will decide to hold the ELA funds steady at their current level, neither decreasing the aid as a penalty for the “no” vote nor increasing it as the banking system so desperately needs. At this point any cutback, increase in the haircut on collateral or the ultimate step of suspending the ELA would effectively bankrupt the banking system and would bring the country much closer to a Eurozone exit. I think the unelected members of the ECB would be loath to take such a momentous step. It’s one thing for them to rescue a country when the politicians can’t agree, but to assume responsibility for a country leaving the Eurozone would be too undemocratic even for Europe.

• Nonetheless, without more liquidity from the ECB, the Greek banking system will soon run out of money completely. Already, Greek companies are frozen out of the international money transmission system and cannot transfer money abroad, meaning that they can’t import anything. Soon, the banks won’t even be able to dispense the EUR 60 per day that Greeks have been allowed to withdraw. Once that happens, Greece will have three options: 1) a “bail-in,” as happened in Cyprus, in which banks seize part of the uninsured deposits to shore up their balance sheets, or 2) keep the banks closed and have the government issue a scrip with which to pay its bills. That scrip would be nominally convertible to euros once the banks reopen, but in practice would probably trade at a discount, as people would assume it to be the predecessor of a new drachma. Or 3) they simply return to the drachma right away and use the new money to recapitalize the banks. Either way, a Grexit seems the logical conclusion.

•Political realignment might’ve been possible, but it would be difficult now I had thought that under pressure from the banking crisis, enough Greek politicians might switch sides to make it possible to realign the government and force new negotiations. However, with the voters approving of SYRIZA’s tactics, that way of resolving the problem is probably closed off. That too points towards Grexit.

•Is there a deal already? In a little-noticed interview Friday with RTE Radio, Greek Finance Minister Varoufakis said a deal between Athens and its creditors is “more or less done,” regardless of the outcome of the vote. However, Eurogroup chairman Jeroen Dijsselbloem said the claim was “completely false.”

• Today’s data: Investors will get plenty of time to think about Greece this morning, as there’s only data of secondary importance on the agenda.

• During the European day, we get the German factory orders for May.

• From Canada, we get the Ivey PMI for June. Following the rise in the RBC manufacturing PMI on Thursday, we could see a positive surprise in the Ivey figure as well. Nevertheless, the decline in oil prices in the last few weeks is likely to keep CAD under selling pressure.

• In the US, we get the labor market conditions index for June. Although not a major market mover, the LMCI index is likely to show the broader US labor conditions and whether the Fed is on track to achieve its maximum employment mandate.

• As for the speakers, BoJ Governor Haruhiko Kuroda speaks.

• Rest of the week: On Tuesday, the main event will be the Reserve Bank of Australia policy meeting. At their last meeting, the Bank kept its cash rate unchanged and maintained a neutral bias as far as their future stance. The forecast is for the Bank to remain on hold, and the focus will turn to the statement accompanying the decision for any hints regarding the future path of the rate.

• As for indicators, the UK industrial production for May is coming out. Following the disappointment in the manufacturing PMI, expectations for a broad rebound in the nation’s growth in Q2 has lessened a bit. However, the rise in the construction and service-sector PMIs eased some of those concerns and kept the rebound scenario alive. The forecast is for the monthly industrial production figure to fall, a turnaround from the previous month, while the annual rate is expected to accelerate. Overall, a strong positive surprise in industrial production is needed to keep the scenario for a rebound in Q2 alive and keep the UK on a recovery path.

• On Wednesday, the minutes of the June FOMC meeting are to be released. At this meeting, the most important outcome was the distribution of the “dot plot.” Fed officials lowered their interest rate forecasts, which turned out to be more dovish than expected, and seem to be fairly split between one and two hikes this year. This is definitely less clear than the previous FOMC forecast, where the Committee was projecting two rate hikes this year. If the meeting minutes show that the first rate hike could occur in September, the USD could regain its strength.

• On Thursday, we get China’s CPI and PPI data for June. The forecast is for the CPI rate to rise to +1.3% yoy from +1.2% yoy, while the PPI rate is anticipated to fall at the same pace as in the month before. The PBoC eased further last week by cutting rates for the fourth time since November and cutting the reserve requirement ratio (RRR) to support the weakening economy, after recent indicators suggested a further slowdown in Q2. The recent sell-off of the country’s stocks could also prompt the Bank to act to ensure financial stability. As the country’s growth continues to slow, Australia and New Zealand, whose economies are heavily dependent on exports to China, could see their currencies weaken further.

• The Bank of England holds its policy meeting. There’s little chance of a change in policy, hence the impact on the market is likely to be minimal, as usual. The minutes of the meeting, however, should make interesting reading when they are released on 22nd of July, as members who previously voted for a rate hike have adopted a more hawkish tone recently, following the upside surprise on April wage data.

• Finally on Friday, we get Norway’s CPI and Canada’s unemployment rate, both for June.

The Market

EUR/USD gaps down as Greeks vote “no”

• EUR/USD gapped down on Monday after Greeks decided to reject the terms of their bailout deal. However, the rate started recovering some of its losses after it hit support fractionally above the 1.0965 (S2) line. Now, EUR/USD is trading slightly above the 1.1030 (S1) barrier and I would expect it to continue higher, perhaps for a test at the resistance line of 1.1115 (R1). However, I still believe that the short-term outlook is somewhat negative and therefore, I would treat any further advances as corrective moves before the bears take control again. A clear move below 1.0965 (S2) would confirm a forthcoming lower low on the 4-hour chart, and perhaps open the way for the 1.0900 (S3) territory. In the bigger picture, I would maintain my neutral stance. I believe that a move above the psychological zone of 1.1500 is the move that could carry larger bullish implications, while a break below 1.0800 is needed to confirm a forthcoming lower low on the daily chart and perhaps turn the overall bias back to the downside.

• Support: 1.1030 (S1), 1.0965 (S2), 1.0900 (S3)

• Resistance: 1.1115 (R1), 1.1175 (R2), 1.1240 (R3)

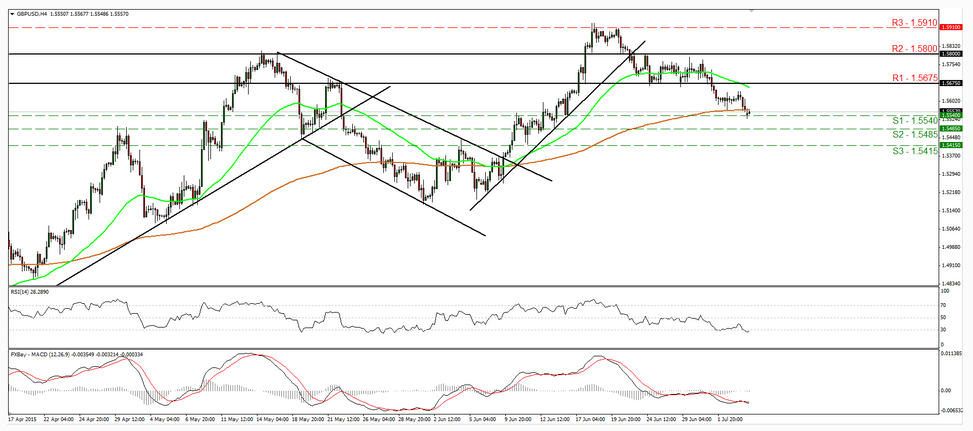

GBP/USD find support at 1.5540

• GBP/USD traded lower on Friday and today during the Asian morning, it hit support at 1.5540 (S1). After the downside exit of the short-term range that had been containing the price action from the 23rd of June until the 1st of July, the short-term outlook has turned negative. I believe that a move below 1.5540 (S1) is likely to initially target our next support at 1.5485 (S2), marked by the low of the 15th of June. Switching to the daily chart, I see that the recent decline confirmed the negative divergence between our daily oscillators and the price action. Moreover, the 14-day RSI has fallen below its 50 line, while the daily MACD, although positive, stands below its trigger line and points north. These signs support the case that we are likely to see cable trading lower in the short run. However, the rate is still trading above the 80-day exponential moving average, and there is still the possibility for a higher low. As a result, I would consider the overall picture to be somewhat positive and I would treat any further short-term declines as a corrective phase.

• Support: 1.5540 (S1), 1.5485 (S2), 1.5415 (S3)

• Resistance: 1.5675 (R1), 1.5800 (R2), 1.5910 (R3)

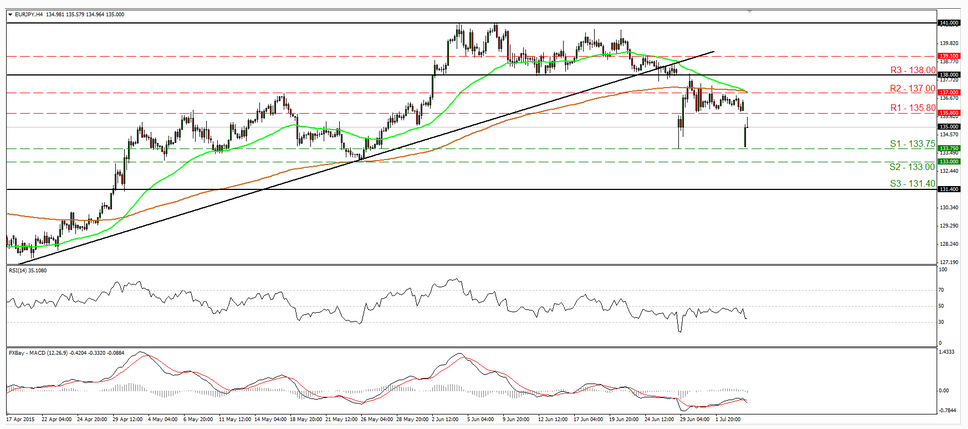

EUR/JPY gaps down but finds support near 133.75

• EUR/JPY gapped down as well after Greece’s “no” vote. Nevertheless, it rebounded significantly after it triggered some buy orders marginally above the 133.75 (S1) support line. I believe that the short-term outlook of the pair is still to the downside and thus, I would expect the bears to eventually take charge again and go for another test at the 133.75 (S1) area. Our short-term oscillators support the notion. The RSI fell after it hit resistance slightly below its 50 line, while the MACD, already negative, has topped and fallen below its trigger line. On the daily chart, I see that the 133.75 (S1) support area stands pretty close to the 50% retracement level of the 14th of April – 4th of June advance. I would like to see a daily close below that area before I assume that the medium-term picture has turned negative as well.

• Support: 133.75 (S1), 133.00 (S2), 131.40 (S3)

• Resistance: 135.80 (R1), 137.00 (R2), 138.00 (R3)

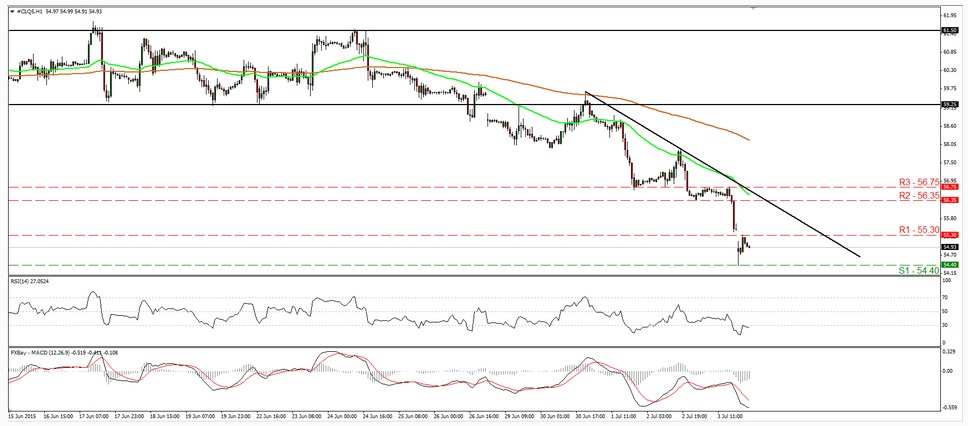

WTI continues its tumble and hits support at 54.40

• WTI continued its tumble on Friday, falling below the support (now turned into resistance) barrier of 56.35 (R2). On Monday, the price gapped down, but after hitting support at 54.40 (S1), it rebounded somewhat to hit resistance at 55.30 (R1). After the downside exit of a sideways range on the 26th of June, WTI has been printing lower peaks and lower troughs and this keeps the short-term outlook negative in my view. I would expect a break below the support obstacle of 54.40 (S1) to set the stage for extensions towards our next support at 53.30 (S2), defined by the low of the 13th of April. On the daily chart, the break back below the psychological area of 55.00 has turned the longer-term picture negative as well. Our daily oscillators corroborate my stance. The 14-day RSI continued sliding and is now headed towards its 30 line, while the MACD lies below both its signal and zero lines, pointing south.

• Support: 54.40 (S1), 53.30 (S2), 51.75 (S3)

• Resistance: 55.30 (R1) 56.35 (R2), 56.75 (R3)

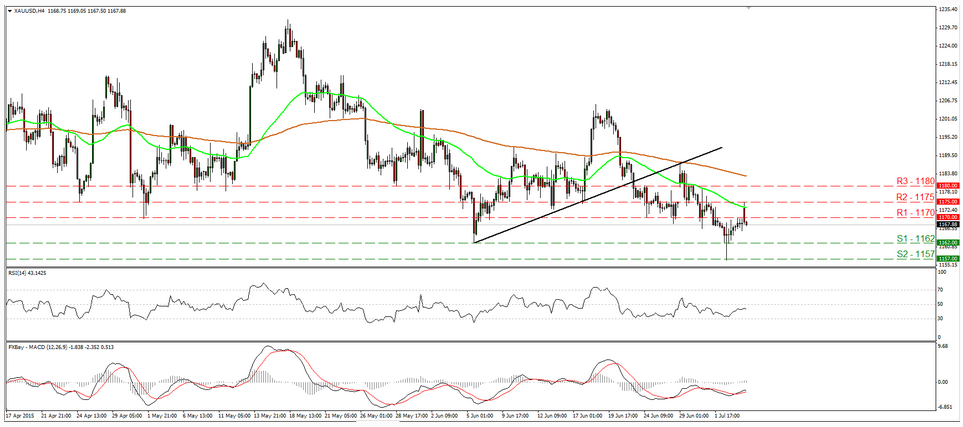

Gold hits resistance near 1175 and tumbles

• Gold gapped up on Monday, but gave back all its gains after hitting resistance marginally below the 1175 (R2) hurdle. The precious metal is now trading below 1170 (S1) and I would expect it to continue lower to initially challenge the 1162 (S1) barrier. A break below that line could pave the way for another test of 1157 (S2). Taking a look at our short-term oscillators, I see that the RSI, already below its 50 line, has turned down, while the MACD, already negative, shows signs of topping and could fall below its trigger line soon. On the daily chart, the move below the 1162 (S1) level on the 2nd of July confirmed a lower low on the daily chart and kept the overall outlook of gold cautiously negative.

• Support: 1162 (S1), 1157 (S2), 1153 (S3)

• Resistance: 1170 (R1), 1175 (R2), 1180 (R3)

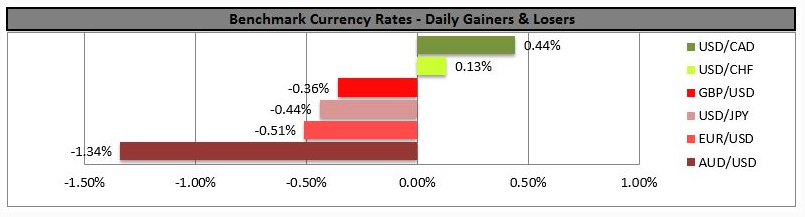

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

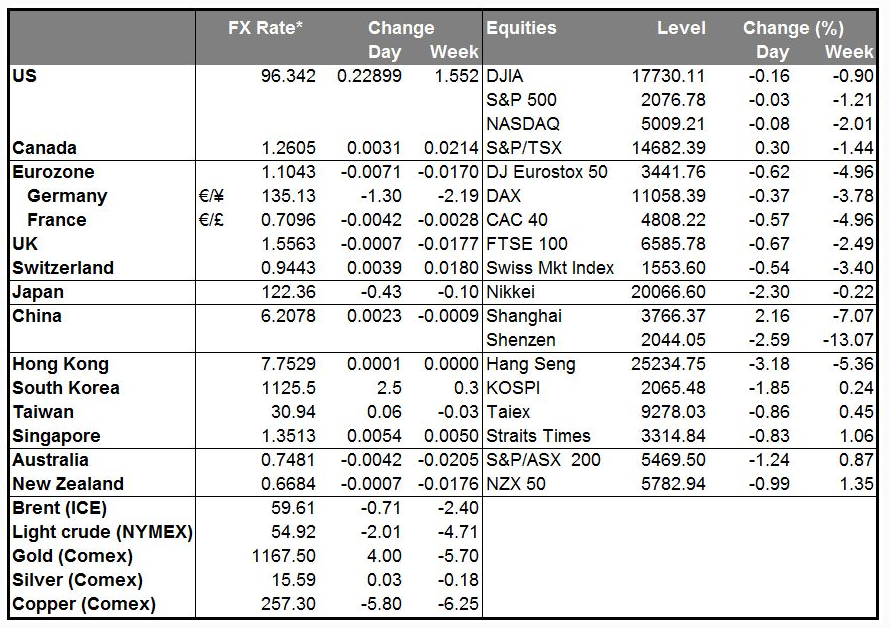

MARKETS SUMMARY