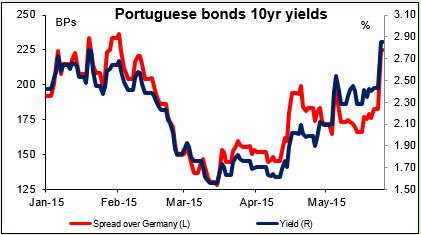

Portuguese bonds show contagion risk from Greece There’s a lot of talk nowadays that the EU could afford to let Greece leave the euro without worrying too much about the impact elsewhere. Don’t believe it! As I mentioned yesterday, the anti-austerity parties won big in the Spanish municipal elections on Sunday, plus the Greek Interior Minister Sunday said that the country didn’t have the money to meet pension and wage bills in June and also make required payments to the IMF. Result: almost all the major Eurozone stock markets that were open yesterday were lower (France, Spain, Italy, Portugal, Netherlands, Belgium, Greece – Germany was closed) and 10-year Portuguese government bond yields jumped 43 bps to 2.86% -- a huge move! Portuguese 10-year yields are now higher than they were before the ECB announced its QE program in January. The US stock market wasn’t open, but S&P 500 futures were lower.

Things look grim for EUR right now. It’s questionable whether Greece can make the EUR 308mn payment due to the IMF on June 5th, followed by another large payment on June 12. In total it has to pay EUR 1.6bn to the IMF in June. It will be touch-and-go whether it can make these payments. But rather than making concessions, Greek Finance Minister Varoufakis yesterday blamed creditors’ insistence on more austerity for the impasse on aid. There is talk in the market that Greece could potentially "bundle" all its principal repayments to the IMF that are due in June into a single payment to be made later in the month. This could buy Greece a few extra weeks for negotiations. However, that would probably be taken as a very risky move that could further increase pressure on its banks. It would not be well received by the markets.

Payments to the IMF are not the same as payments on bonds. If Greece can’t pay the IMF, it still might not be declared “in default.” However, the ECB might decide that the Greek banking system – which holds a lot of Greek government bonds as assets -- was no longer solvent and therefore not eligible for ECB aid. That could result in anything from a very short deadline to reach agreement and therefore restore solvency, as happened with Cyprus, or they simply stop aid immediately. That would probably result in a bank holiday followed by capital controls and…who knows what else.

China is in a world of its own Meanwhile, things in the Chinese stock market go from good to better. Shanghai stocks are up 1.6% today at the time of writing and Shenzhen stocks up 2.8%. The Shandong Shihua Shenghua Group Co Sunday said the online part of its IPO was 826x oversubscribed. Is that a world record?

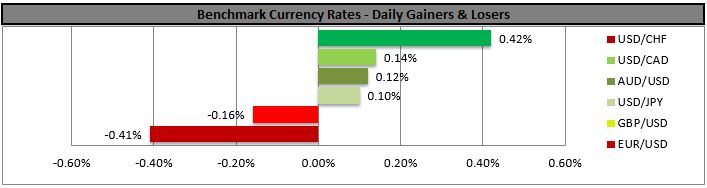

New Zealand trade surplus falls New Zealand’s trade surplus for April was expected to fall sharply and indeed it did, although not quite as much as expected. Both exports and imports were lower than expected. NZD and AUD were the only G10 currencies to gain against the dollar over the last 24 hours, probably because of the continued rally in Chinese stocks. While I don’t trust the Chinese stock market rally, which is fueled by margin buying, I think that while it continues, AUD and NZD may well be underpinned.

Hawkish Mester Cleveland Fed President Mester said “the time is near” for the Fed to raise rates. “In my mind every meeting is on the table,” she said, including June. While Mester is not currently a voting member of the FOMC, her statements nonetheless show me that some members of the Committee are much more hawkish than the market is discounting. I think the risk of an early tightening is higher than people expect and the possibility of an early surprise should support the dollar.

Today’s highlights: During the European day, we have no major releases from the Eurozone or the UK.

From Sweden, we get the PPI for April. Following the dip of the CPI back to deflation, another sign of weakness in prices could prompt the Bank to increase its bond-purchasing program. This could keep SEK under selling pressure.

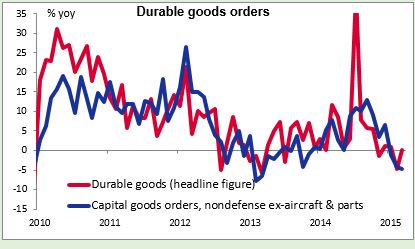

We have a busy day in the US. Durable goods orders for April are expected to fall, a turnaround from the previous month, while durable goods excluding transportation equipment are estimated to have risen at the same pace as in March (on a month-on-month basis). The focus is usually on the core figure, where a positive surprise could suggest the possible start of a turnaround in business investment that would be bullish for the dollar. New home sales for April and FHFA housing price index for March are also due out. Following the better-than-expected housing starts and building permits last Tuesday, if the new home sales show a firming housing sector, this could strengthen USD. Finally, the Conference Board leading index, Richmond Fed manufacturing activity index, preliminary Markit (NASDAQ:MRKT) service-sector PMI and Dallas Fed manufacturing index, all for May, and S & P/Case-Shiller house price index for March are also due out. Overall, positive US data surprises are now required for the USD to remain supported.

As for the speakers, Fed Vice Chairman Stanley Fischer speaks on Global Economic Developments. He spoke on Monday as well and said nothing particularly new, just emphasized that the decision on whether to raise rates would be determined by the data.

The Market

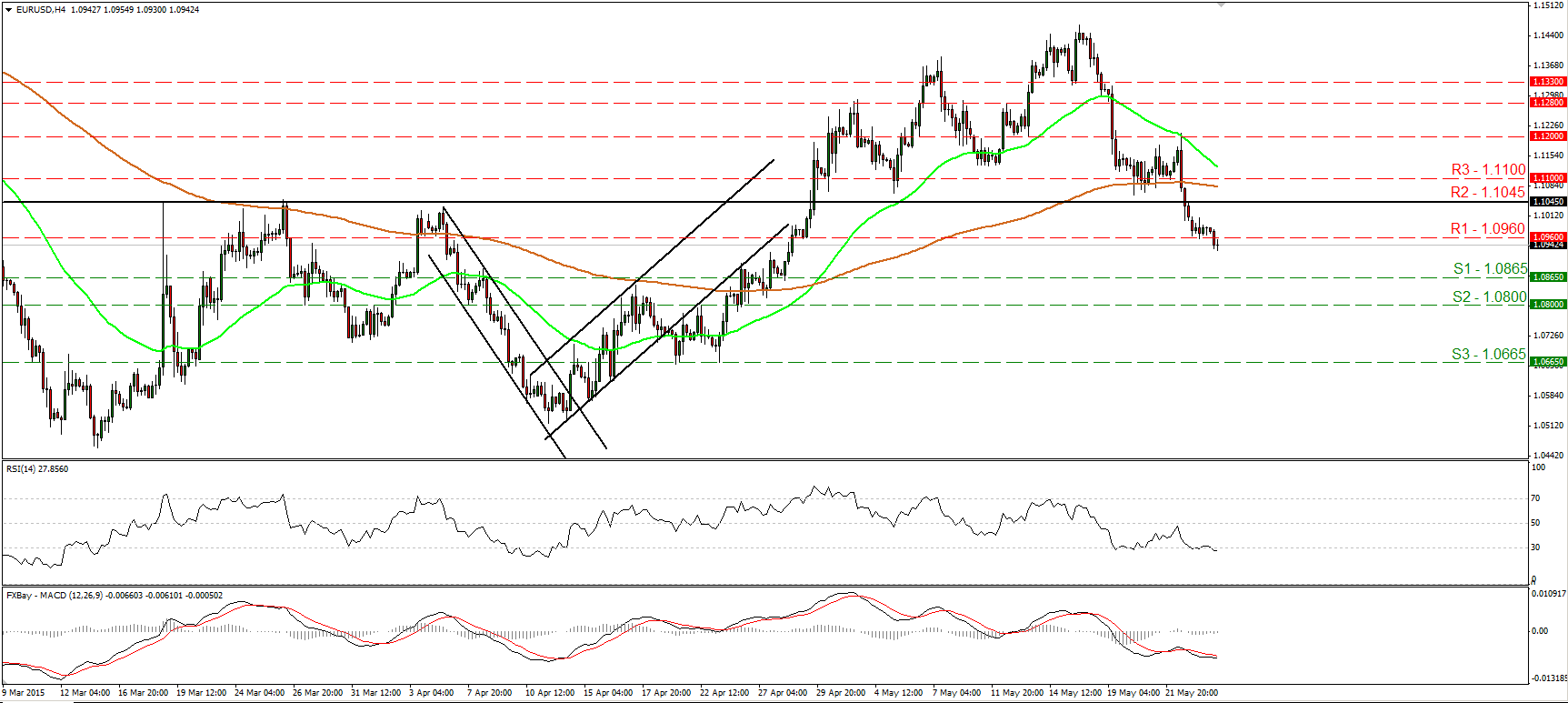

EUR/USD continues its tumble

EUR/USD continued declining on Monday, falling below the support (now turned into resistance) barrier of 1.0960 (R1). The short-term outlook remains negative, and as a result, I would expect the bears to take advantage of the break and drive the battle towards the 1.0865 (S1) support barrier. Both our short-term oscillators detect negative momentum and amplify the case for further declines. The RSI fell below its 30 line, while the MACD stays below both its zero and signal lines. On the daily chart, the move below the 1.1045 (R1) barrier increases the likelihood that the 13th of April – 15th of May recovery was just a corrective move and that the prior downtrend could now be resuming.

• Support: 1.0865 (S1), 1.0800 (S2), 1.0665 (S3).

• Resistance: 1.0960 (R1), 1.1045 (R2), 1.1100 (R3).

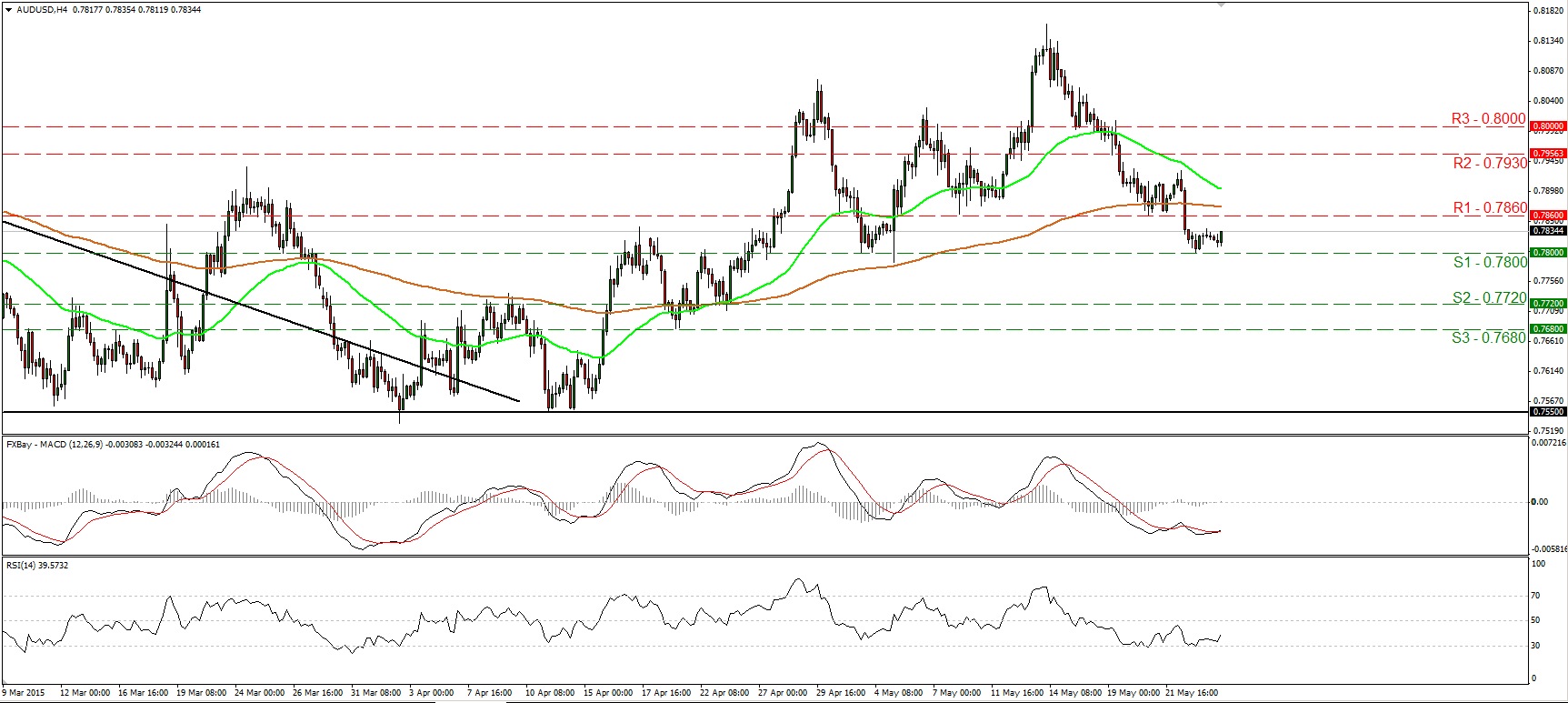

AUD/USD hits support at 0.7800

AUD/USD traded quietly yesterday, after hitting support at 0.7800 (S1). The price structure on the 4-hour chart suggests a short-term downtrend; hence, I would expect a clear and decisive dip below 0.7800 (S1) to open the way for our next support territory of 0.7720 (S2). Nevertheless, taking a look at our short-term oscillators, I would be careful of a minor corrective bounce before the bears prevail again. The RSI hit support at its 30 line and edged higher, while the MACD has bottomed and poked its nose above its trigger line. As for the bigger picture, on the 19th of May the rate fell below the uptrend line taken from the low of the 14th of April. This confirmed the negative divergence between the 14-day RSI and the price action and supports that the recovery of the 14th of April until the 14th of May was just a corrective phase of the prior longer-term downtrend.

• Support: 0.7800 (S1) 0.7720 (S2), 0.7680 (S3).

• Resistance: 0.7860 (R1), 0.7930 (R2), 0.8000 (R3).

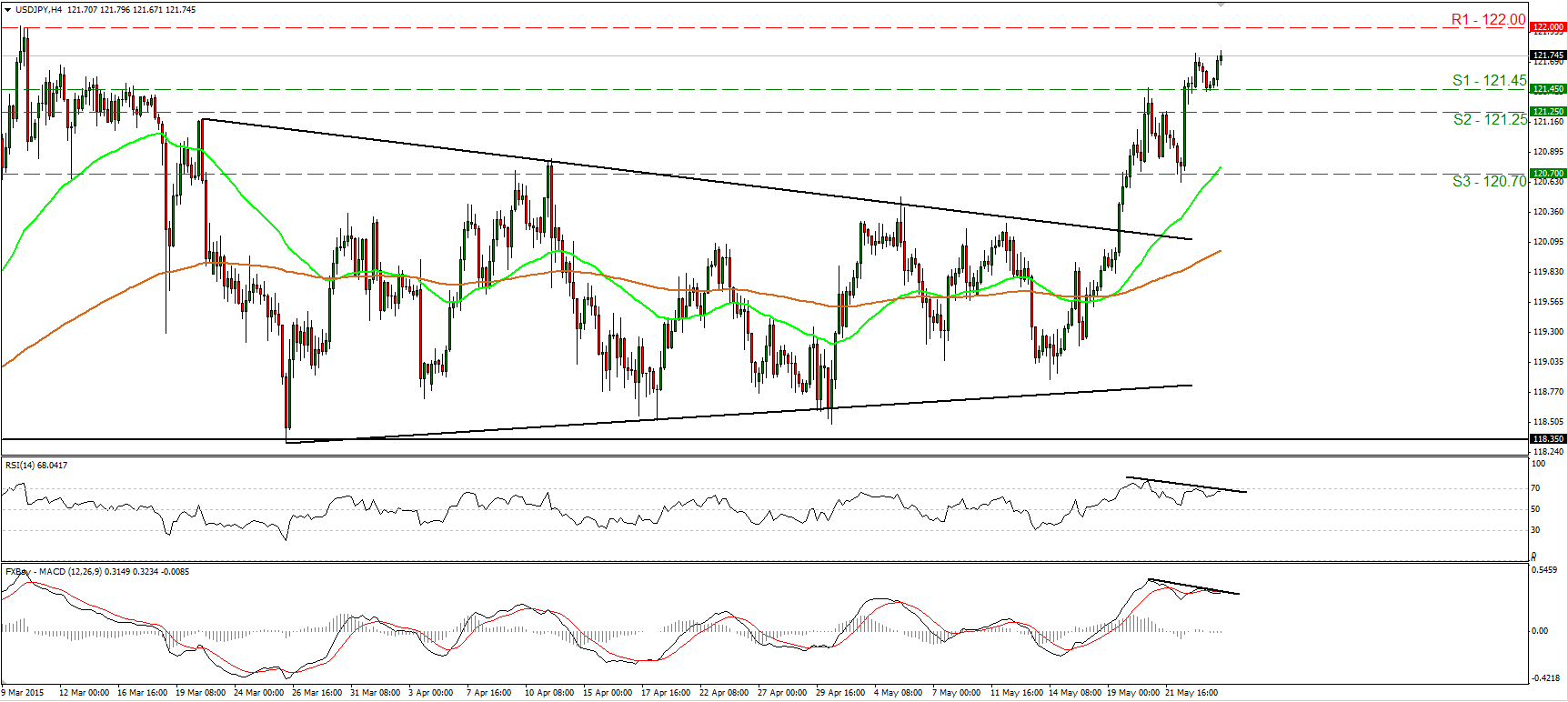

USD/JPY continued higher

USD/JPY rebounded from 121.45 (S1) to continue its near-term surge. I would now expect the pair to challenge the 122.00 (R1) key resistance territory, defined by the peak of the 10th of March. A break through that could have larger bullish implications and perhaps open the way for the 124.00 (R2) territory, marked by the highs of June 2006. However, looking at our oscillators, I see negative divergence between both of them and the price action. Therefore, after it hits 122.00 (R1), the rate could correct lower before the bulls seize control again. On the daily chart, the rate is trading above the 50-day moving average and well above the 200-day one. This keeps the overall trend of USD/JPY to the upside. However, a clear close above 122.00 (R3) is needed to confirm a forthcoming higher high on the daily chart and signal the resumption of that trend.

• Support: 121.45 (S1), 121.25 (S2), 120.70 (S3).

• Resistance: 122.00 (R1), 124.00 (R2), 125.00 (R3).

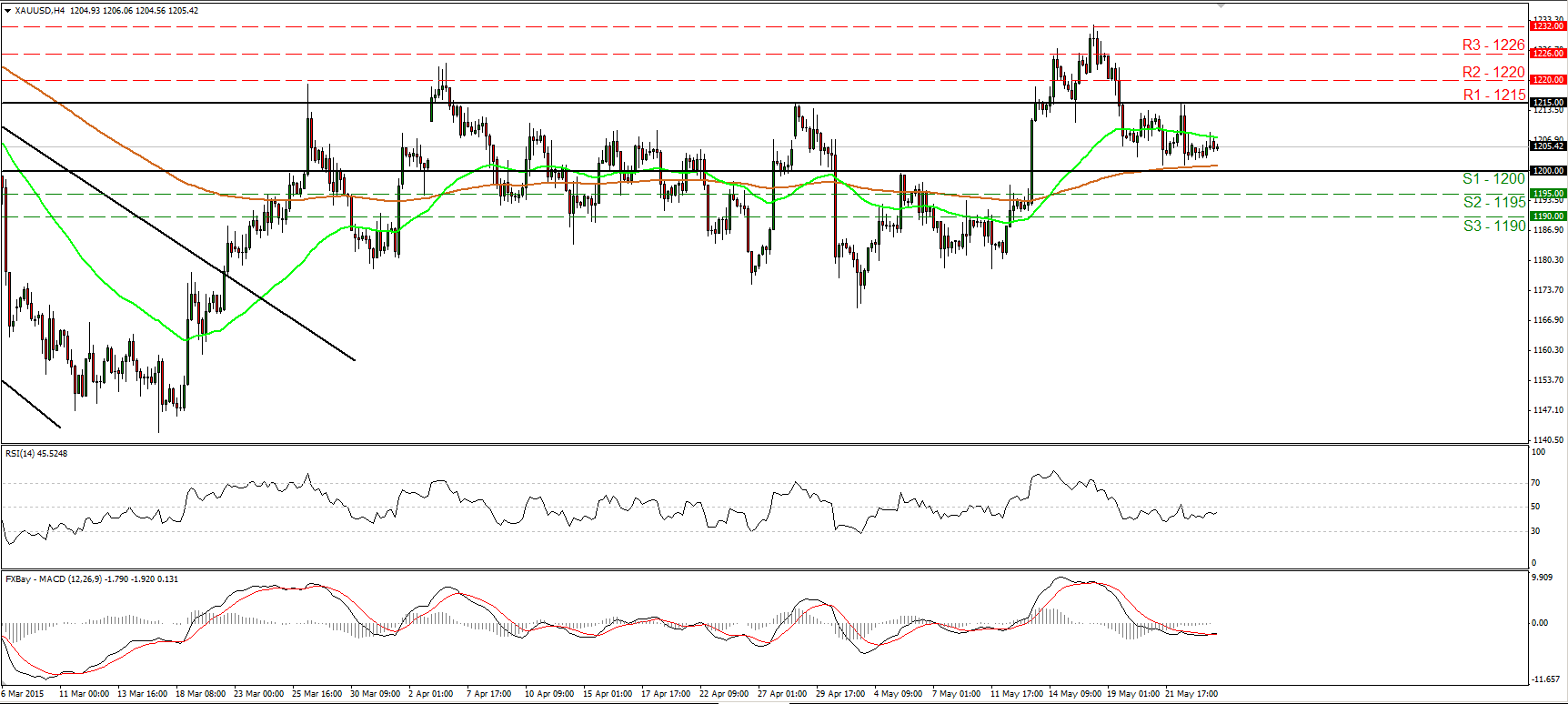

Gold continues sideways

Gold traded in a consolidative manner on Monday, staying between the resistance of 1215 (R1) and the psychological support barrier of 1200 (S1). The metal has been oscillating between these two hurdles since the 19th of May. Therefore, I would keep my flat stance as far as the short-term bias is concerned. On the daily chart, on May 18th gold failed to close above 1226 (R3). I believe that a decisive close above that barrier is needed to turn the medium-term outlook to the upside. For now, I will hold a neutral stance as far as the overall picture of the yellow metal is concerned as well. This is also supported by our daily oscillators. The 14-day RSI is back near its 50 line and points sideways, while the MACD, although positive, has topped and could fall back below its trigger line.

• Support: 1200 (S1), 1195 (S2), 1190 (S3).

• Resistance: 1215 (R1), 1220 (R2), 1226 (R3).

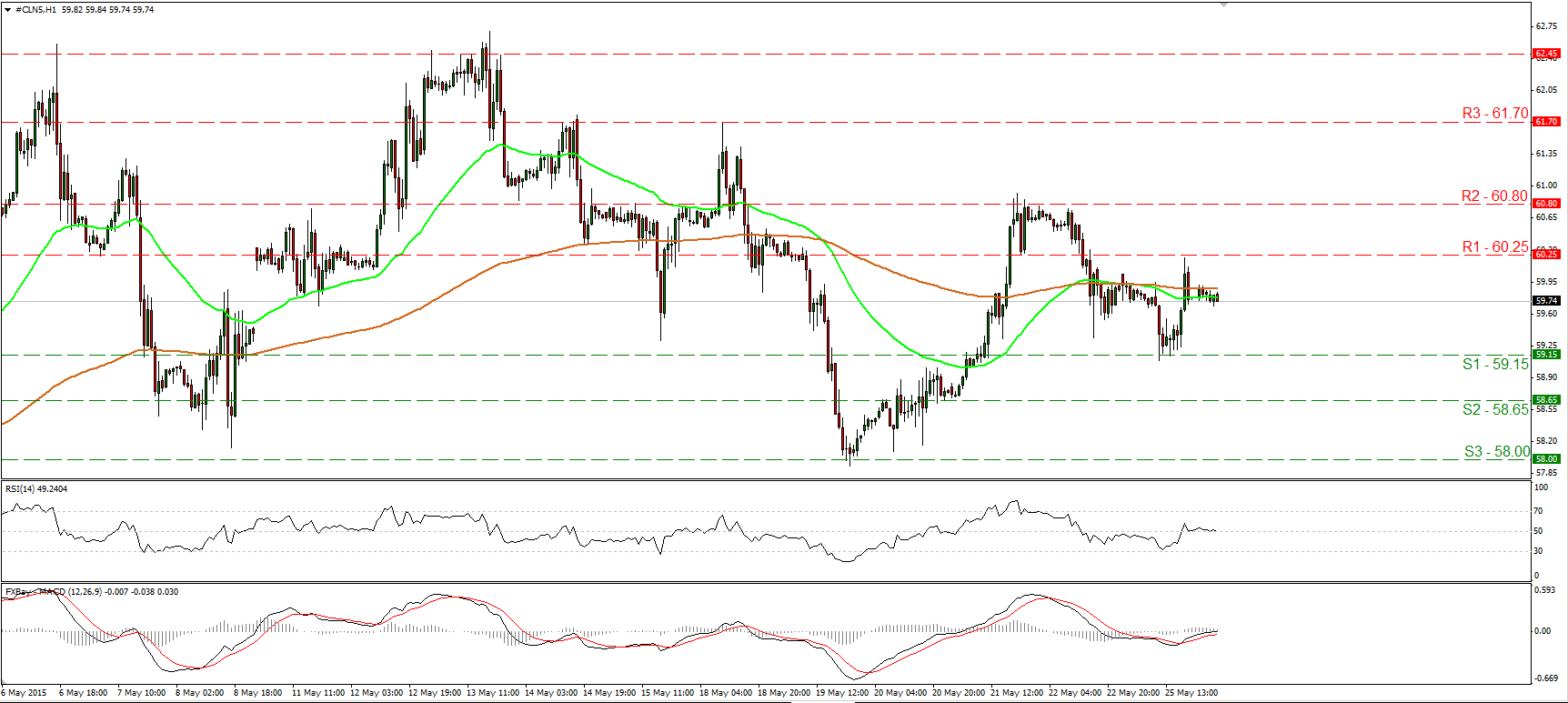

WTI hits resistance at 60.25

WTI traded higher on Monday after finding solid support at around 59.15 (S1), but hit resistance near 60.25 (R1) and then retreated. Although the rebound painted a higher low on the 1-hour chart, we need a move above 60.80 (R2) to have a forthcoming higher high and a positive near-term outlook. As a result, I would adopt a neutral stance for now. My choice is also supported by our technical indicators. Both the 50- and the 200-hour moving averages point sideways, while both our hourly oscillators stand near their equilibrium lines, pointing east as well. As for the broader trend, the break above 55.00 on the 14th of April signaled the completion of a double bottom formation, something that could carry larger bullish implications in the not-too-distant future. Therefore, I would treat any declines that stay limited above 55.00 as a corrective phase.

• Support: 59.15 (S1), 58.65 (S2), 58.00 (S3).

• Resistance: 60.25 (R1) 60.80 (R2), 61.70 (R3) .