Another year has gone by, and you are either richer or poorer, happier or sadder, living life or worried about your future.

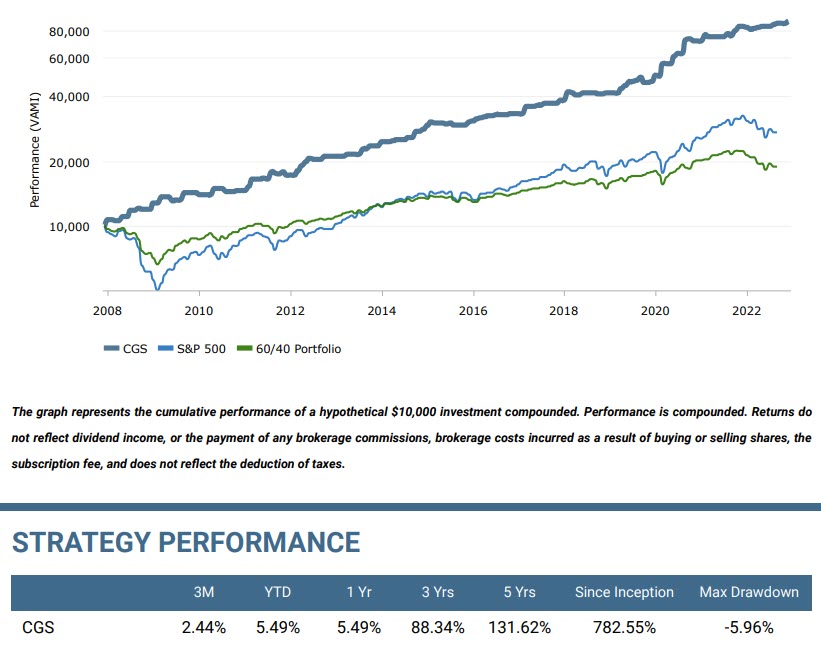

2022 ended up being an alright year for individuals who focused on controlling risk and positions. Investors and I are up over 5% in 2022 using a passive consistent growth strategy. It may not sound like much, but considering the average buy-and-hope portfolio with a 60/40 stock/bond balance which is down -19%, it’s a dramatic difference.

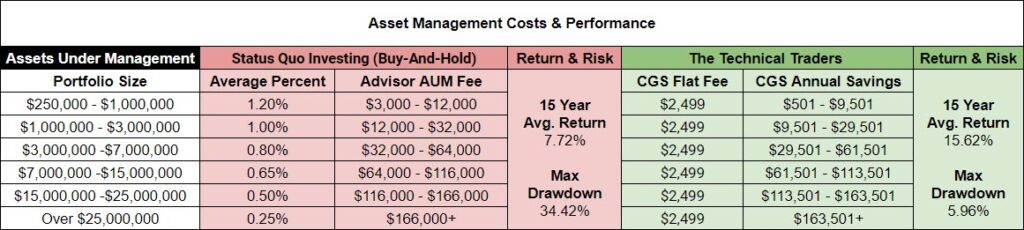

Buy-and-Hope Strategy vs. Consistent Growth Strategy

This table shows how much the old buy-and-hold strategy costs investors. It’s very volatile and unpredictable and will cause many sleepless nights and put a strain on relationships with your spouse at times.

It will delay retirement and can also destroy it, depending on your age. Anyone over the age of 50 should not be using the buy and hold if they want to protect and preserve their wealth and lifestyle. I won’t go into how investors have Stockholm Syndrome because of how the financial system created the Buy-And-Hold strategy and more or less created all the tools and training for advisors to carry it out in order to keep the stock market rising over the long run. It’s not so much the advisors but rather the financial system as a whole.

Just look at the annual costs, returns, and volatility of the two different investment methods to see how much you may be paying for underperformance and the use of a high-risk strategy.

In the past couple of months, I have temporarily turned my focus in my weekly articles to be more about You, the trader, and the investor. In my last post, I shared the brutal truth about how individuals are the root cause for losses, and it’s because they don’t know who they are on a deeper level or where their strengths and weaknesses are for their given personality.

Give Me More Trades, and I Will Show You More Losses

This week I chatted with an individual who said he needed more trades to make money and that holding cash at times is not how money is made. He went on to say that paying for investment signals that held cash does not justify the cost of the subscription and that he must trade more to make money.

If you have been reading my work for a while, then you likely can hear me moaning or see me squirming in my seat with my eyes rolling because people with a mindset like that are destined to fail.

Unfortunately, most traders and investors think they need to trade frequently to make money because they believe that the more trades they make, the more opportunities they will have to profit. This belief can be fueled by the market constantly moving and that traders must always be in the market to capture these movements.

However, this is only sometimes true. Frequent trading can lead to decreased profits or even losses, especially if the trader does not have a clear strategy or plan, which most do not. While trading frequently can lead to increased transaction costs, the real issue is that it leads to emotional trading, where traders make decisions based on their emotions rather than a rational analysis of the market, leading to poor decision-making and further losses.

SPY 30-Minute Regular Trading Hours Chart Example:

The chart below shows my Panic Buying indicator. This red line located at the top of the chart is the FOMO level. When it is above the blue horizontal line, the average trader and investor are buying in fear of missing out on a further move.

What happens is the stock market starts a rally, and everyone quickly jumps on board and chases the price higher. This is when the red indicator line spikes and holds above the thin blue horizontal line. I won’t go into the details, but we can see when traders are doing the same thing, which is a contrarian signal as we know that the price is likely about to reverse and fall.

I also have the other side to this opportunity, which is my Green FOMO indicator, which tells us when everyone is selling, and a reversal and rally is about to start.

My point with this chart and indicator is to show you how the average trader is driven by their emotions. In a downtrend like 2022, when they buy, they are buying at a high. They are like a school of fish or a flock of birds, all doing the same thing simultaneously, and it’s obvious and predictable.

The Reality And What It Means For You

In reality, it is often better for traders to focus on developing a solid trading strategy and plan and then implementing it with self-discipline and patience rather than trying to trade frequently in the hopes of making quick profits.

This way of trading involves taking the time to thoroughly analyze the market, identifying good entry and exit points, and setting clear risk management guidelines to help protect against potential losses. To the active emotional trader without a written detailed strategy, this will naturally feel slow and boring to implement. It may even feel a little more like work vs. the gambling rush you may be secretly addicted to. But, by taking a more measured and disciplined approach to trading, you can increase your chances of success and profitability over the long term.

As I always tell traders, if something feels slow or boring, it means you have a system in place, things figured out, and you are in control.

Sorry You Are Screwed

It does not matter if you are a trader or an investor. If you are not a long-term thinker and planner, willing to sacrifice your short-term emotional trades with no regard for position sizing or risk management, and you lack the self-discipline to wait for high probability trades, take profits, and exit trades not working out – sorry, but you are screwed, and no one can help you but yourself.

Until you decide to treat trading and investing as a business vs. a lottery ticket, you will continue to suffer massive multi-year drawdowns and take 30-75% losses because you love a stock or asset, which by the way, does not love you back. That stock or asset does not care if it ruins your retirement plans.

A great example is Tesla (NASDAQ:TSLA). It’s down over 70% and is the worst-performing stock this year in the S&P 500. Is it a great company? I think so. Is it going to continue to grow and expand? I think so. Do I want to own shares? I do, but why would we hold onto an asset went it’s falling? We know we can always buy it back later at a better price, or worse case, we buy it back at a higher price.

But it’s not like it’s a one-time opportunity to buy the stock. The good news is that we can use technical analysis to know when an asset trend has reversed and exit positions early to lock in gains. Technical analysis is how we generate above-average returns. Just in case you are wondering, my analysis has it falling to $65-69 per share in 2023.