Our equity/bond model - This long term reliable investing model provides investors with simple decision making in the markets:

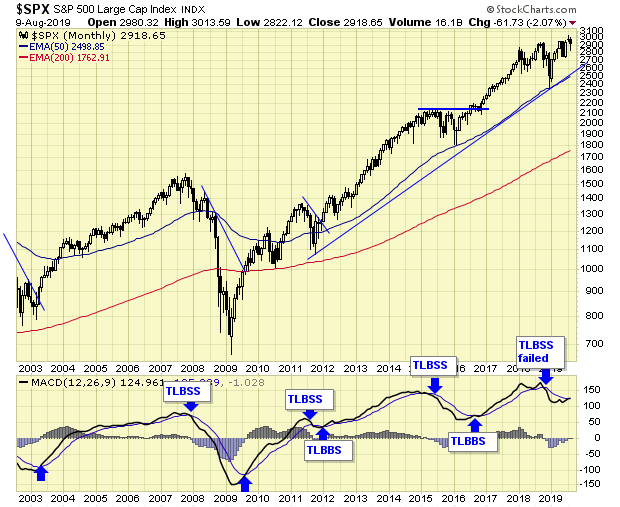

Our benchmark S&P 500 is on a buy signal.

Oil sector is on a major sell signal.

VIX – volatility index

VIX is up and major indexes are down.

Its been a few years since we looked at this long term chart between the benchmark SP500 and the transportation index. According to the “Dow theory”, the markets are in the process of a major top when there is a divergence between these two indexes.

We have witnessed and charted these divergences over the past twenty years:

2019 - ?

Summary

The long term signal on the broad market is up.

However, the current investing model favors bonds, therefore, investors should continue to overweigh with long bonds or bond ETFs for safety.

The Dow theory suggests that a pullback or even substantial correction can materialize in coming weeks and months. Caution is advised.