In an echo of the historical underperformance traditionally experienced by US equity markets in September, the ninth month of the year has not been a good one for crypto markets either. Peak to trough, the S&P 500 underwent a decline greater than 5% in September; meanwhile, crypto’s broad market cap experienced a drop of around 25%.

Bitcoin topped out on Sept. 7 at over $52,000 and has since set two progressively lower highs on the daily and daily timeframe. This price action took the number one cryptocurrency below the 200-day moving average and briefly below the 20-week moving average (currently at around $40,800 and steadily declining).

Unless the final week of September sees a break above $52,000 (which would represent a local higher high), traders hoping for a definitive test and hold of this historically crucial moving average will likely have to wait a little longer.

This is because the bulls turned up early last week to defend the $40,000 level, which has led to a weekly candle with a long lower wick and a closing price at least $3,000 above the current 20-week moving average level.

While the defense of $40,000 is undoubtedly bullish, it leaves the door open for a further retreat re-test of the 20-week moving average in the coming weeks.

Technically, the picture looks somewhat bearish. The longer timeframes all suggest that Bitcoin may have topped in April of this year, with September’s surge to $52,000 now appearing as the next weekly lower high on what could be a series of them on the way down.

The following week or two will also likely lead to the 20-week moving average crossing the 50-week in a downward direction. The last time this occurred was back in February of 2020.

Recent headlines have also imparted a distinct bearish bias on the price. China’s crypto crackdown is gathering momentum, and US regulators are sending mixed signals. Both seem intent on intensifying their scrutiny of the entire crypto space but offer little in the way of definitive guidance as to what the regulatory landscape could look like in the next twelve to eighteen months.

Excluding Bitcoin

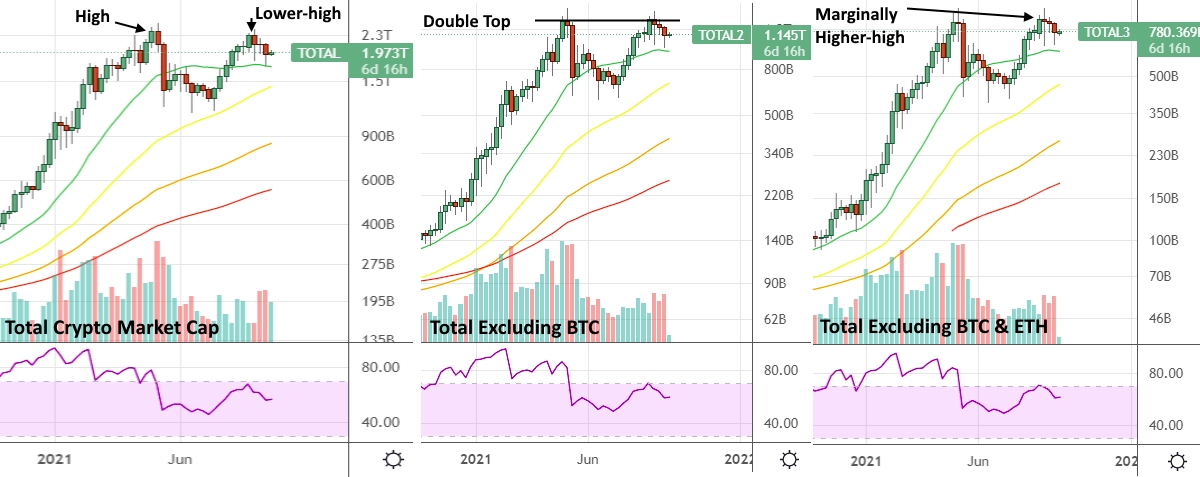

If we exclude Bitcoin’s outsized effect on the market, we receive a slightly different, though equally bearish, picture. Viewing the weekly chart of the entire crypto market cap excluding Bitcoin, we observe a double-top formation instead of April’s all-time high and September’s lower-high as discussed above.

This is due to ether’s outsized influence on this second broad crypto measure when Bitcoin is removed from the picture. Crypto’s market cap, excluding Bitcoin, appears almost identical to the Ethereum chart, which set an all-time weekly high close at $3888 in May and was rejected from this level once again at the end of August. If this does prove to be a double-top formation, we can expect the world’s second-largest crypto to retreat and re-test $1900 from here.

Excluding Bitcoin and Ether

Indeed, the only slightly bullish charts to be found in the space at the moment are in the smaller cap “Altcoins” many of which have gone on to set new record highs in recent weeks despite both Bitcoin and Ether’s failure to do so.

Cardano currently the third-largest cryptocurrency by market cap, has been a notable example of this. It set an all-time weekly high in May at around $2.33 and went on to break above this level in late August, setting a new record weekly high just shy of $3. While this is a good sign.

ADA, Cardano’s native currency, has certainly held up better than many of its rivals during the recent market drawdown. It is not representative of the entire Altcoin space. Viewing crypto’s market cap excluding both Bitcoin and Ether, we see a double-top formation similar to the one observed on ether’s chart and the total market cap excluding Bitcoin.

The third chart below is slightly more bullish than the first or second. It has set a marginally higher high in August over May’s weekly high, but without the convincing bullish momentum to date that would have investors looking at blue skies.

Sentiment and Final Thoughts

Despite all this, sentiment remains bullish in the space, with a general acceptance of the view that the crypto market currently finds itself at the capitulation stage of a mid-cycle correction and that new highs are in store for many crypto assets as we move closer to the end of the year.

However, the chartists among us remain on high alert, as sentiment is usually the last to turn bearish when long-term trends change direction. It’s the main reason that so many investors find themselves holding the bag long after the top in any market arrives. Caution is advised, and last Sunday’s close should not be regarded as a definitive test and hold of the 20-week moving average.

High Risk Investment Warning: Contracts for Difference (‘CFDs’) are complex financial products that are traded on margin. Trading CFDs carries a high degree of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent expert advice if necessary and speculate only with funds that you can afford to lose. Please think carefully whether such trading suits you, taking into consideration all the relevant circumstances as well as your personal resources. We do not recommend clients posting their entire account balance to meet margin requirements. Clients can minimise their level of exposure by requesting a change in leverage limit. For more information please refer to HYCM’s Risk Disclosure.