This post was written exclusively for Investing.com

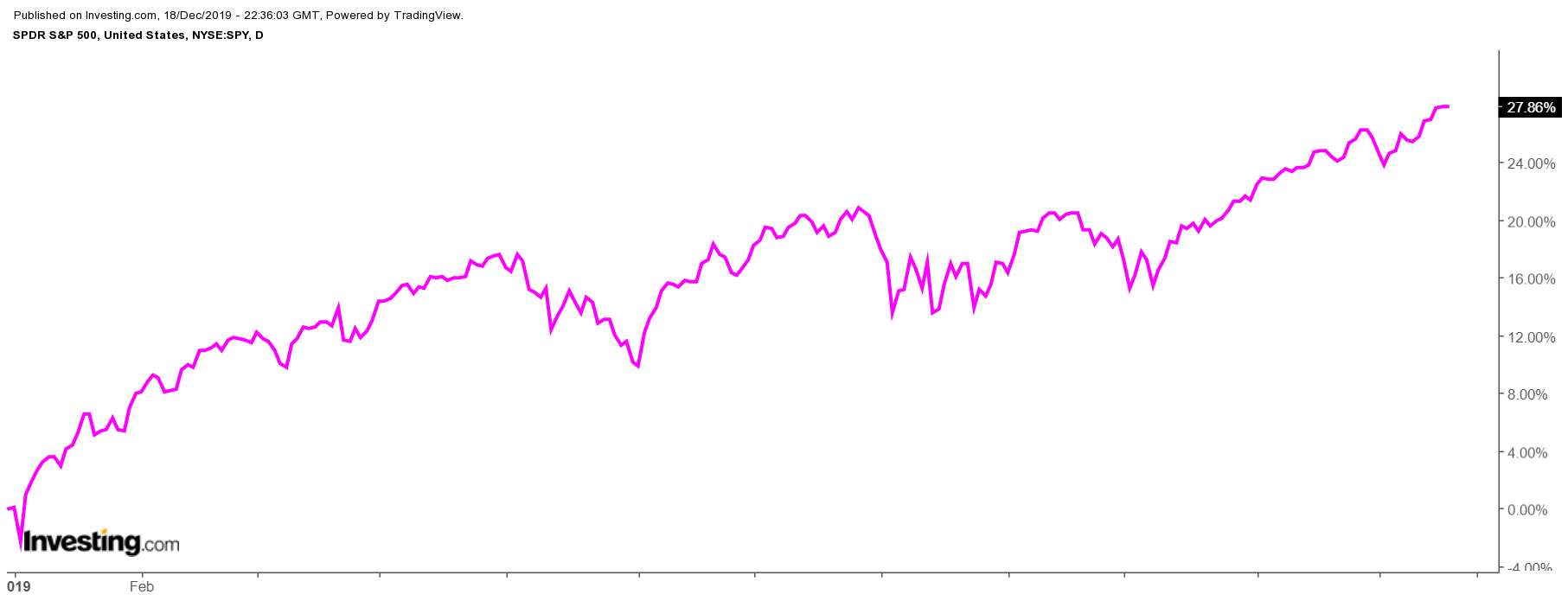

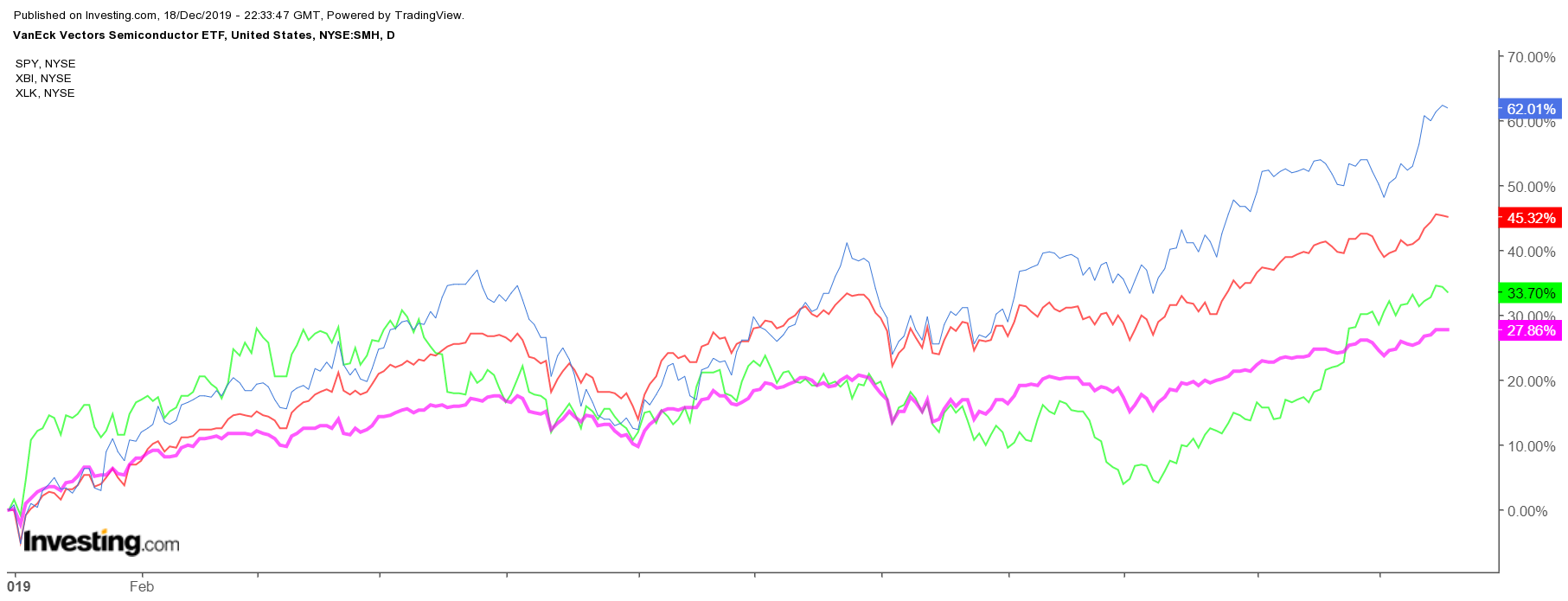

2019 has undoubtedly been a year for risk-taking, and who can blame investors. Interest rates have plunged on global growth fears, and markets have rallied sharply off their 2018 lows. It made sectors like Semiconductors, Technology, and Biotech soar, as investors quickly refocused their positioning from risk-off in 2018 to risk-on.

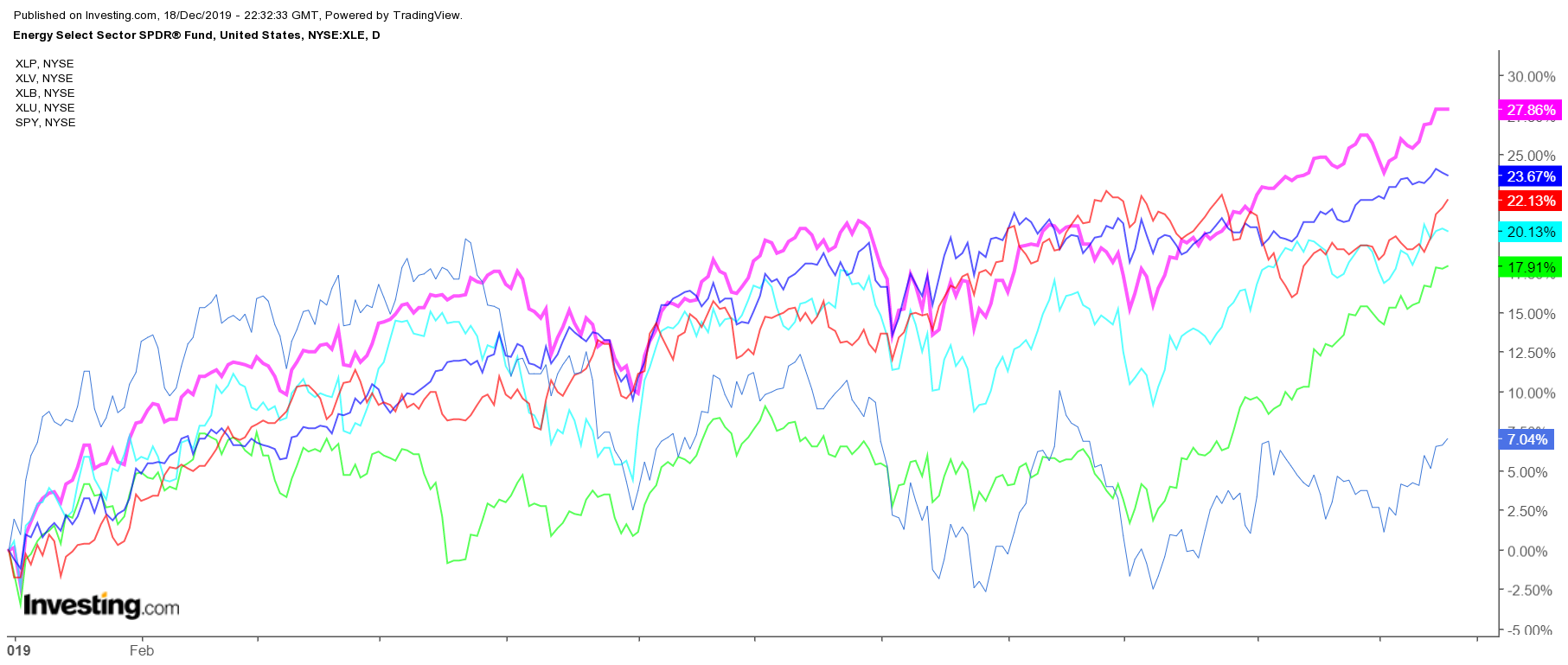

It also meant that any defensive sector or sectors that had to do with the prospects of global growth sank to the bottom of the list, badly underperforming the S&P 500. But now as 2019 wraps-up and a new year, and for that matter, a new decade begins, one must wonder if the strengths of 2019 will continue.

Taking on Risk

Using the ETF proxies through Dec. 18, the semiconductor sector has had the best year as measured by the VanEck Vectors Semiconductor ETF (NYSE:SMH) rising by a jaw-dropping 62%. Additionally, the Technology sector as a whole had a healthy 2019 with the Technology Select Sector SPDR ETF (NYSE:XLK) increasing by almost 46%. That was followed by a surging biotech sector as measured by SPDR S&P Biotech ETF (NYSE:XBI), which has risen by nearly 34%. The significant gains can be compared to the S&P 500 SPDR ETF's (NYSE:SPY) increase of about 28%.

The semiconductor, technology and biotech sectors represent some of the riskiest parts of the equity market, made up of companies with fast-growing revenue and earnings. Meanwhile, valuations and earnings multiples in these groups can at times be very lofty when compared to the broader S&P 500. Inherently, these sectors tend to carry more risk.

Additionally, these three sectors were among the worst-performing in 2018. From their 2018 highs, the Biotech XBI dropped by 29%, the Semiconductor SMH fell by almost 23%, and the Technology XLK declined by more than 18%. Again, during a time of a catastrophe, the risky sectors of the market were being dumped.

Defensive and Global Growth Sectors Underperform

But this year's robust performance of the risky sectors of the market came at the expense of the less attractive areas and those groups that are more defensive in nature. Energy stocks were the worst-performing group as measured by the Energy Select Sector SPDR (NYSE:XLE), which increased by roughly 7%. Followed by the Health Care SPDR (NYSE:XLV), which climbed almost 18%, and the Materials Select Sector SPDR (NYSE:XLB) rising approximately 20%. Performing only slightly better were the Utilities Select Sector SPDR ETF (NYSE:XLU) and Consumer Staples Select Sector SPDR ETF (NYSE:XLP), which rose by around 22% and 23%, respectively.

Investors were clearly in no mood to own any commodity-related sectors tied to a strong U.S. dollar or that relied on global growth. Despite the XLE ETF falling about 27% in 2018 from its highs, and the XLB ETF decline of approximately 21%, the two groups couldn’t find a meaningful bounce in 2019, with both still trading well below their 2018 highs. Additionally, the upcoming Presidential election cycle and the talk of Medicare for all led to investors shying away from health care.

Will There Be A 2020 Rotation?

The big question for 2020 is if a risk-on mentality will be able to lead the charge or if investors will be left looking for a new group to flock to. If the economy around the globe does start to improve, energy and materials may be two sectors that could stand to benefit.

As of right now, the question remains open on whether the market will continue to stay in a risk-on mood during 2020, or if investors will shift their attention to some of the underperforming sectors of 2019.

Only time will tell.