The U.S. Bureau of Labor Statistics released its June Consumer Price Index report on Wednesday, July 13. In the report, it indicated that CPI rose 1.3% for the month and on a seasonally adjusted basis it rose 9.1% year over year, weighing on investors’ resolve.

Earlier in Lipper’s fund-flows week, some pundits had hoped that with the recent decline in front-month crude oil prices the Fed would take a less aggressive path to its interest-rate hike plans and monetary policy normalization.

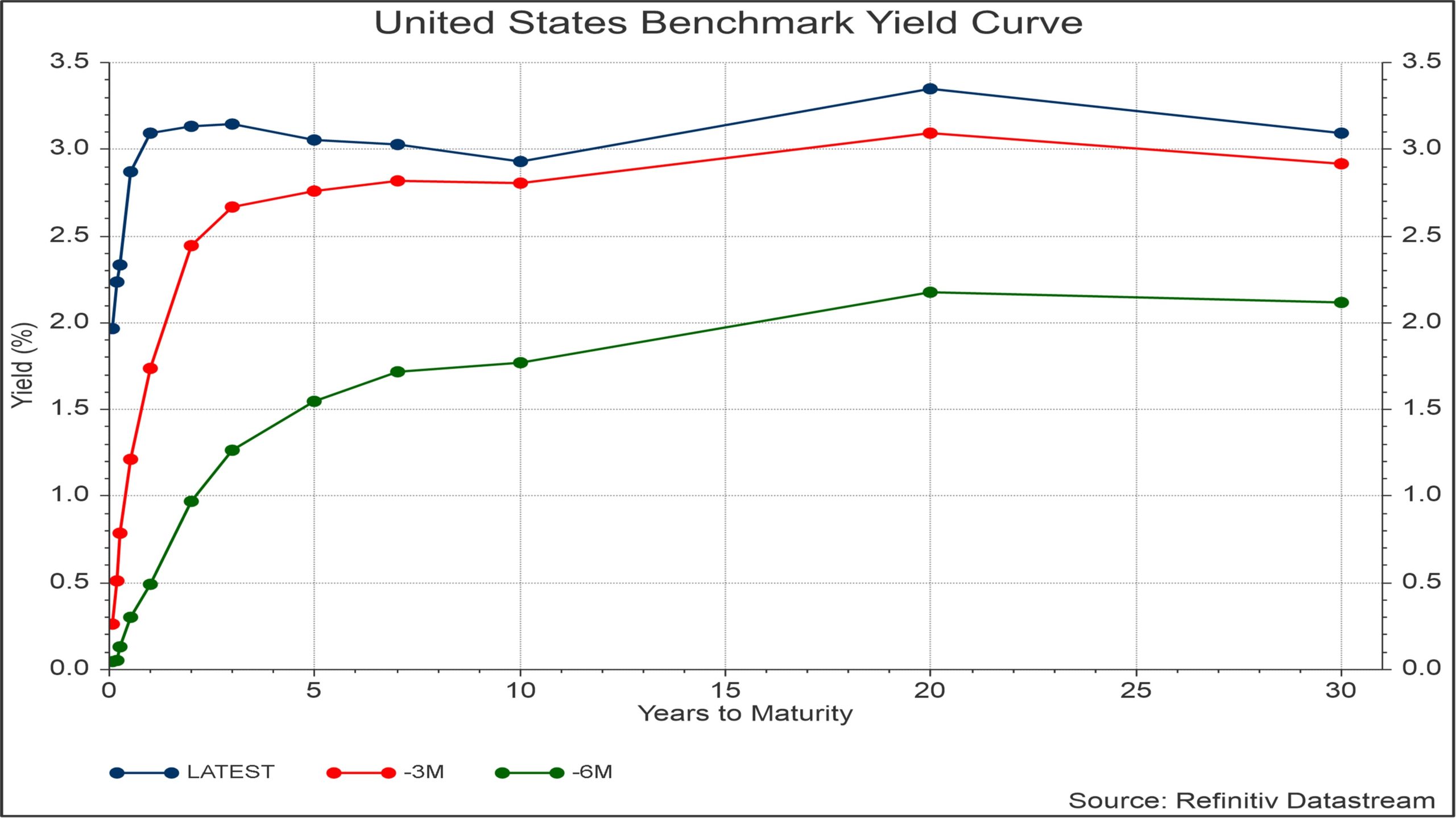

However, after the June CPI report was released, the CME FedWatch Tool showed a greater than 80% probability that the U.S. Federal Reserve would hike its key lending rate by 100 basis points (bps) during its meeting this month. The 10-year Treasury yield declined five bps to 2.91% and the 10-2 Year Treasury Yield Spread inverted further (22 bps—its largest since at least January 22, 2007), with the 2-year Treasury yield closing the day out at 3.13%—putting recessionary fears back on the table.

For the Refinitiv Lipper fund-flows week ended July 13, 2022, investors were overall net purchasers of fund assets (including those of conventional funds and ETFs) for the second consecutive week, injecting a net $8.1 billion. However, the headline numbers are a bit misleading. The lion’s share of the net new money was earmarked for conservative and short-term assets. Fund investors were net purchasers of money market funds (+$9.4 billion), taxable bond funds (+$1.6 billion), and tax-exempt fixed income funds (+$210 million) but were net redeemers of equity funds (-$3.1 billion) for the week.

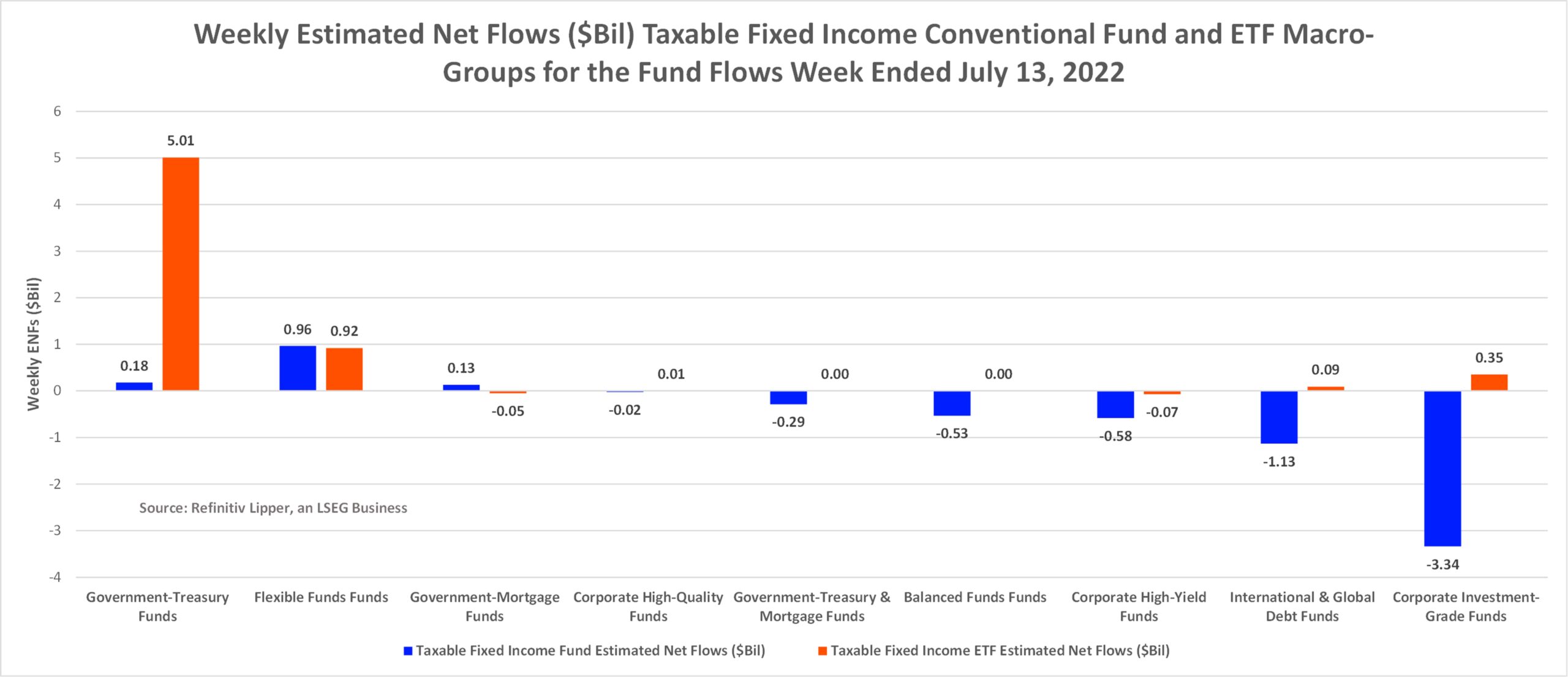

As might be expected given the likelihood of the Fed hiking its key lending rate another 75-100 bps on July 27, on the taxable fixed income side investors were in a risk-off mode, padding the coffers of safe-haven macro-groups, with government-Treasury funds and ETFs (+$5.2 billion) taking in the largest draw of net new money for the fund-flows week followed by flexible funds (+$1.9 billion) and government-mortgage funds (+$77 million).

The General U.S. Treasury Funds (+$3.8 billion, including ETFs) classification took in the largest draw of net new money, followed by Short U.S. Treasury Funds (+$1.1 billion), Corporate Debt BBB-Rated Funds (+$1.1 billion), and Multi-Sector Income Funds (+$992 million), while the Loan Participation Funds classification (-$1.2 billion) experienced the largest net outflows in the taxable fixed income universe.

For the fund-flows week, iShares 10-20 Year Treasury Bond ETF (TLH, +$1.7 billion) took in the largest amount of investor assets of all individual taxable fixed income funds and ETFs. TLH was followed by American Funds Multi-Sector Income Fund, R6 Share Class (RMDUX, +$1.3 billion) and iShares iBoxx $ Investment Grade Corporate Debt ETF (LQD, +$1.2 billion).

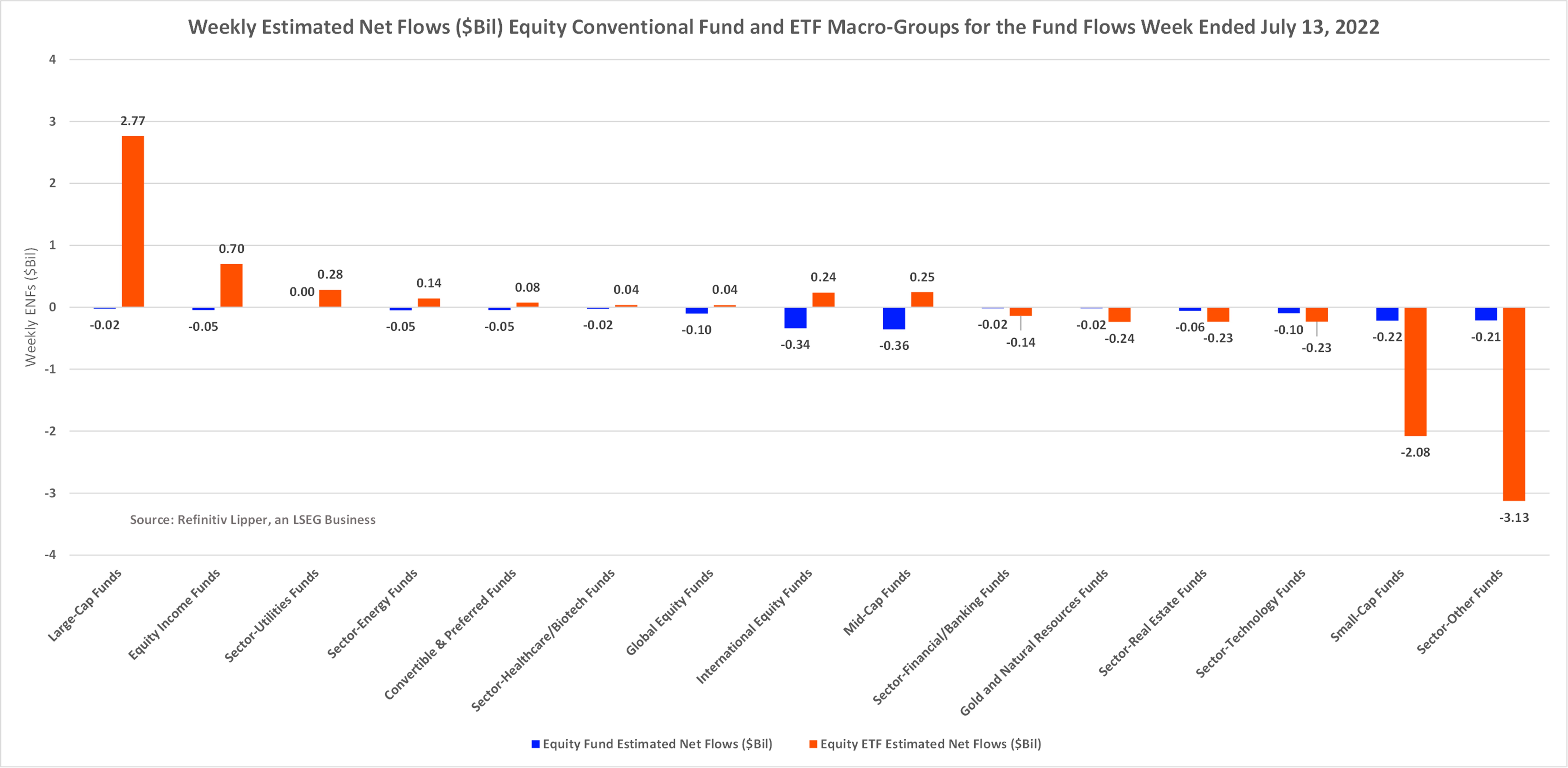

And while investors have been net redeemers of equity funds and ETFs, withdrawing money from the asset class in each of the last five weeks, the large-cap funds macro-group (including ETFs) was the primary attractor of investors’ assets, taking in a net $2.7 billion for the most recent flows week, followed by equity income funds (+$656 million) and sector-utilities funds (+$284 million). Meanwhile, investors fled the commodities-heavy, sector-other funds macro-group (-$3.3 billion) and small-cap funds (-$2.3 billion) for the week.

This was very much in line with the trends we saw in the second quarter, where the top attractors of investors’ assets were government Treasury funds (+$37.4 billion, including ETFs), equity income funds (+$25.1 billion), and large-cap funds (+$18.0 billion).

At the equity classification level, the S&P 500 Index Funds (+$1.4 billion, including ETFs) classification took in the largest draw of net new money during the week, followed by Dedicated Short Bias Funds (+$1.1 billion), Large-Cap Growth Funds (+$957 million), and Multi-Cap Value Funds (+$796 millions). At the bottom of the barrel, we saw Small-Cap Core Funds (-$1.8 billion, including ETFs) suffering the largest net redemptions in the equity universe, bettered by Commodities General Funds (-$833 million), Consumer Services Funds (-$711 million), and Commodities Precious Metals Funds (-$654 million).

Invesco QQQ Trust 1 (QQQ, +$1.7 billion) took in the largest draw of net new money in the equity universe for the most recent fund flows week, followed by iShares Core S&P 500 (IVV, +$952 million) and T. Rowe Price U.S. Large-Cap Core Fund, Z Share Class (TRZLX, +$706 million).

The next two weeks should provide investors with a bit more clarity and direction as we get into the meat of the second quarter corporate earnings season and after the Federal Open Market Committee meeting ends. Until then, volatility will be ever present and stories about recessionary concerns will be the headlines of mainstream media.